BOURBON celebrates delivery of the 500th vessel, placing the group at the head of the world's largest fleet of vessels operated1 for the offshore marine services industry

BOURBON celebrates delivery of the 500th vessel, placing the group at the head of the world's largest fleet of vessels operated1 for the offshore marine services industry

BOURBON announces the entry into service of the 500th vessel - the Bourbon Evolution 806, the 6th vessel of the 1st series of IMR2 vessels for the offshore industry. BOURBON thus ranks among the world's leading groups for the offshore marine services industry.

This delivery validates BOURBON's strategic decision to focus on achieving economies of scale through standardization and construction in series, thus offering its customers a reliable innovative fleet with optimized service quality: ""We are delighted with the delivery of this 500th vessel, which reflects our commitment to provide the means to continue our development and to best serve the needs of our clients. We are now realizing the fruits of seeds sown over several years when we invested in a series of standardized vessels to achieve a global leadership position in our market."" asserts Gael Bodénès, Chief Operating Officer.

With a fleet of 500 vessels averaging 6.3 years of age, BOURBON operates worldwide with over 11,000 employees providing local services through 28 operating affiliates who ensure commercial and contractual relationships, as well as local technical support on-site, close to operations. By year-end 2015, the delivery of the 34 vessels under construction will make the fleet even larger and better able to serve the most demanding customers.

BOURBON'S standardization policy is best illustrated by the success of its series of vessels:

The Bourbon Liberty series: By the end of 2014, the fleet will include 111 next-generation Bourbon Liberty vessels offering high standards of quality and performance. They have a prove client track record, thanks to their embedded technologies such as the class 2 dynamic

positioning system, backup equipment, cargo capacity and the optimization of fuel consumption.

The Bourbon Evolution 800 series: With the delivery of the 500th vessel, BOURBON currently has 6 Bourbon Evolution vessels in operation (and 4 more under construction) in this 1st series of IMR vessels positioned within the deepwater offshore market. With a class 3 dynamic positioning system, these highly reliable vessels have outstanding maneuverability and their backup equipment guarantees optimum safety.

The seismic support vessel series: BOURBON has pioneered the 1st series of 6 seismic support vessels, custom designed for CGG that allows the provisioning of fuel, equipment and personnel to seismic vessels ensuring the safety of their operations. 4 vessels are already fully operational.

The Bourbon Explorer 500 series: This is a new series of 20 PSV vessels launched in 2014, 4 of which are already in operation. Their cargo capacity is a real added value, as they have been optimized to supply modern drilling equipment with a large carrying capacity of slurry (drilling lubricant) of 1,500 m3. They can also carry up to 50 people, offering the customer additional accommodation capacity on the oil fields.

As part of its growth strategy, BOURBON not only focuses on construction in series, but also on centralizing maintenance and personnel's training via a structured industrial organization.

As part of its growth strategy, BOURBON not only focuses on construction in series, but also on centralizing maintenance and personnel's training via a structured industrial organization.

BOURBON Repair Centers: Pooling the fleet's technical support, carried out by the Group at the local level makes it possible to provide all subsidiaries with the necessary technical specialists and parts inventories, with 6 BOURBON Repair Centers deployed close to their operations.

Standard exchange: Thanks to its Plug & Play standard exchange system BOURBON is able to replace all of its propulsion units with new or reconditioned components, thus eliminating the need for the vessel to remain in the repair center. Standard replacements reduce repair time to the strict minimum.

BOURBON Training Centers: BOURBON's 15 Training Centers contribute to standardizing the company's worldwide training efforts for all crews. As the fleet becomes more and more standardized, specific training programs have been put together to perfectly meet the safety requirements and the quality of service provided to the customer.

The vessels standardization policy and centralization of maintenance allow BOURBON teams to ensure customers operational continuity as well as achieving high levels of technical availability of 94.5% in 2013.

1 Vessels owned or on bareboat charter

2 Inspection, Maintenance and Repair of subsea infrastructure

Oseberg Øst. (Photo: Øyvind Hagen)

Oseberg Øst. (Photo: Øyvind Hagen) Myanmar's Deputy Minister for the Ministry of Energy, His Excellency, U Aung Htoo, was guest of honor at the inauguration ceremony for CGG's new Myanmar subsuface imaging center.

Myanmar's Deputy Minister for the Ministry of Energy, His Excellency, U Aung Htoo, was guest of honor at the inauguration ceremony for CGG's new Myanmar subsuface imaging center.

BP

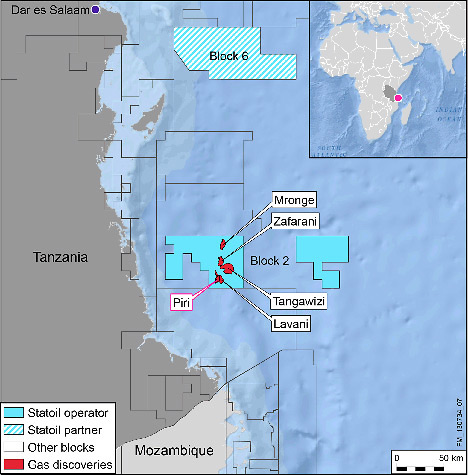

BP The discovery in the Piri prospect is

The discovery in the Piri prospect is

CSA Ocean Sciences Inc. (CSA

CSA Ocean Sciences Inc. (CSA GE Oil & Gas

GE Oil & Gas

Roxtec UK managing director Graham O'Hare (photo) said the firm's deck seals are being used on the hull and top sides of the project and also in the living quarters.

Roxtec UK managing director Graham O'Hare (photo) said the firm's deck seals are being used on the hull and top sides of the project and also in the living quarters. YC-based

YC-based  Secretary of the Interior Sally Jewell and Acting Director of the Bureau of Ocean Energy Management (BOEM) Walter Cruickshank have announced the first step in a robust public engagement process to develop the next schedule of potential offshore oil and gas lease sales.

Secretary of the Interior Sally Jewell and Acting Director of the Bureau of Ocean Energy Management (BOEM) Walter Cruickshank have announced the first step in a robust public engagement process to develop the next schedule of potential offshore oil and gas lease sales. Caterpillar Marine

Caterpillar Marine BOURBON

BOURBON Royal Dutch Shell plc

Royal Dutch Shell plc Adding to its fleet of 37 conventional and ASD vessels,

Adding to its fleet of 37 conventional and ASD vessels,