Industry, government and regulators join the debate at Interspill 2015

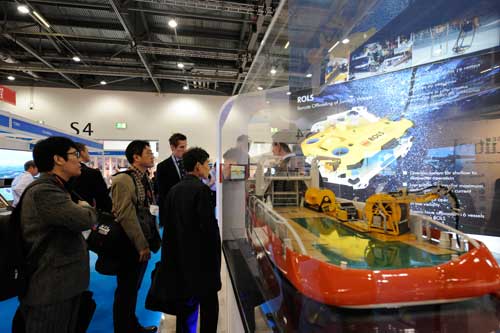

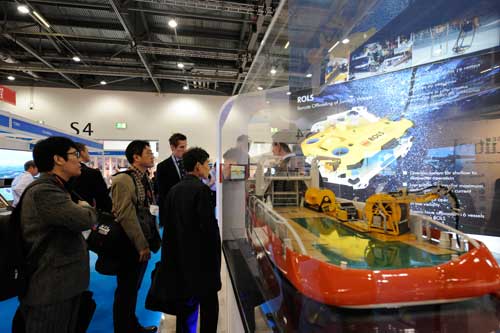

The oil and gas industry is set to discuss the importance of maintaining focus on oil spill response across all sectors at the three day Interspill conference and exhibition in Amsterdam from 24 – 26 March.

The oil and gas industry is set to discuss the importance of maintaining focus on oil spill response across all sectors at the three day Interspill conference and exhibition in Amsterdam from 24 – 26 March.

Rob Cox, technical director at IPIECA and Interspill chairman, believes it is crucial that spill prevention and response remains a high priority even as the many initiatives set up after the 2009/10 offshore incidents are starting to deliver results.

He said: "Significant progress has been made in the aftermath of the Montara and Macondo incidents by the offshore industry but we must not take our eye off the ball; it is vital this work continues. The upstream community is more engaged than ever and legislation is hardening, so we are expecting a lot of debate around articulating the financial impacts of risk to help progress response capability for the offshore sector."

Interspill 2015 brings together industry, academia and government to hear about the latest developments in spill prevention and response. In addition to the conference, the exhibition will showcase the most ground-breaking technologies helping to improve response times and protect the environment. In the biggest exhibition to date, more than 100 exhibitors will demonstrate their latest innovations.

Interspill 2015 brings together industry, academia and government to hear about the latest developments in spill prevention and response. In addition to the conference, the exhibition will showcase the most ground-breaking technologies helping to improve response times and protect the environment. In the biggest exhibition to date, more than 100 exhibitors will demonstrate their latest innovations.

A packed conference program includes sessions on future risk, stakeholder engagement, multi-agency response, emerging technologies, wildlife preparedness and regulation. The opening plenary on current issues and challenges is being chaired by Rob Cox, and includes chairman of host trade association SRGH, Wierd Koops, Brian Sullivan, IPIECA Executive Director, Richard Johnson, Technical Director at ITOPF and Robert Limb, Chief Executive and Director at OSRL.

Other organizations set to present include: ExxonMobil, Shell Exploration & Production, SINTEF, IPIECA, IOGP, IMO, Cedre and SEA Consulting Group.

A first for Interspill is the closing plenary session where members of the International Offshore Petroleum Environmental Regulators Forum (IOPER) will present their principles for offshore oil spill preparedness in an industry-chaired session.

Mr Cox added: "The 1990 Oil Pollution Preparedness, Response and Cooperation Convention tasks industry to work cooperatively with the IMO and its national delegations and the statistics clearly show the success of our joint work with shipping. Now an opportunity exists for us to work together with international regulators to help improve global oil pollution prevention and preparedness in the offshore sector. We anticipate this will be of great interest to operators and the wider industry keen to hear about how the IOPER principles could drive regional and local regulation in practice."

Under the theme of 'working together' the conference aims to not only reflect on past events, but consider the likely future issues for oil and chemical spill prevention, response and restoration.

In addition to the conference programme, spill industry seminars and scientific workshops are being held on the exhibition floor and are free to attend.

The spill industry seminars feature presentations from leading manufacturers and other organisations, highlighting the latest developments.

The science workshops, led by Cedre will include sessions on dispersant breakthroughs, bioremediation, HNS pollution and spill impact assessment. In particular, the workshop on dispersant breakthroughs will take place on Tuesday at 1.30pm and focuses on chemical dispersion of oil in arctic areas, deep sea and tropical regions. Presenters include Tom Coolbaugh, distinguished scientific associate at ExxonMobil, Per Daling, senior research scientist at SINTEF and Francois Merlin, former head of R&D at Cedre.

The well-established program of educational short courses on a variety of spill related topics will run at the venue on Monday 23 March, the day before the conference opening.

Interspill 2015 takes place at Amsterdam RAI Convention Centre. The last event in 2012 in London attracted over 1,300 delegates, visitors and exhibitors from over 70 countries.

Plans for significant further expansion of

Plans for significant further expansion of 2014 saw the submarine fiber optics market surge to its highest demand for new cable since 2007 and the second highest since the early years of the 21st Century, before the market collapsed in late 2001.

2014 saw the submarine fiber optics market surge to its highest demand for new cable since 2007 and the second highest since the early years of the 21st Century, before the market collapsed in late 2001. NYC-based

NYC-based  Aberdeen based,

Aberdeen based,  Dr. Patrick O'Brien, CEO of ITF (photo) said: "There is no doubt of the vital role that technology will play in maximizing reserves and creating cost efficiencies in a low barrel price decline. The Technology Showcase aims to bring to life some of the areas where innovation can make the most dramatic difference from drilling more efficiently to supporting better imaging to target recovery. It's the ideal platform for pin-pointing practical solutions and collaborating to address the ongoing cost pressure challenges."

Dr. Patrick O'Brien, CEO of ITF (photo) said: "There is no doubt of the vital role that technology will play in maximizing reserves and creating cost efficiencies in a low barrel price decline. The Technology Showcase aims to bring to life some of the areas where innovation can make the most dramatic difference from drilling more efficiently to supporting better imaging to target recovery. It's the ideal platform for pin-pointing practical solutions and collaborating to address the ongoing cost pressure challenges."

Harvey Gulf International Marine LLC

Harvey Gulf International Marine LLC The five products tankers brought under Crowley Accord management are the MT Dawn Haridwar, MT Dawn Mansarovar (photo), MT Dawn Mathura, MT Dawn Madurai and MT Portland Pearl. The first four are owned by Arya Tankers and will operate along the Indian Coast, while the fifth is owned by Union Maritime Limited and will operate in the Europe-to-Nigeria trade. Combined, these tankers represent over 130,000 gross tons in the market.

The five products tankers brought under Crowley Accord management are the MT Dawn Haridwar, MT Dawn Mansarovar (photo), MT Dawn Mathura, MT Dawn Madurai and MT Portland Pearl. The first four are owned by Arya Tankers and will operate along the Indian Coast, while the fifth is owned by Union Maritime Limited and will operate in the Europe-to-Nigeria trade. Combined, these tankers represent over 130,000 gross tons in the market. HB Rentals

HB Rentals

Photo: Courtesy of BOEM

Photo: Courtesy of BOEM With submarine pipelines increasing in diameter and extending into deeper waters and more challenging environments, design requirements for concrete weight coating do often not meet current needs. The result is inconsistent safety margins and potentially expensive overdesign and stringent installation requirements.

With submarine pipelines increasing in diameter and extending into deeper waters and more challenging environments, design requirements for concrete weight coating do often not meet current needs. The result is inconsistent safety margins and potentially expensive overdesign and stringent installation requirements.  The oil and gas industry is set to discuss the importance of maintaining focus on oil spill response across all sectors at the three day I

The oil and gas industry is set to discuss the importance of maintaining focus on oil spill response across all sectors at the three day I Interspill 2015 brings together industry, academia and government to hear about the latest developments in spill prevention and response. In addition to the conference, the exhibition will showcase the most ground-breaking technologies helping to improve response times and protect the environment. In the biggest exhibition to date, more than 100 exhibitors will demonstrate their latest innovations.

Interspill 2015 brings together industry, academia and government to hear about the latest developments in spill prevention and response. In addition to the conference, the exhibition will showcase the most ground-breaking technologies helping to improve response times and protect the environment. In the biggest exhibition to date, more than 100 exhibitors will demonstrate their latest innovations.

The offshore oil and natural gas leasing program proposed by the Obama administration puts America's energy competitiveness at risk,

The offshore oil and natural gas leasing program proposed by the Obama administration puts America's energy competitiveness at risk,