Reflects robust Administration support for science-based decision-making in managing natural resources

Reflects robust Administration support for science-based decision-making in managing natural resources

The President's fiscal year 2016 budget request for the U.S. Geological Survey is $1.2 billion, an increase of nearly $150 million above the FY 2015 enacted level. The FY16 budget reflects the vital role the USGS plays in advancing the President's ongoing commitment to scientific discovery and innovation to support a robust economy, sustainable economic growth, natural resource management, and science-based decision-making for critical societal needs.

The budget request includes increases that ensure the USGS is at the leading edge of earth sciences research. It includes robust funding for science to inform land and resource management decisions, advance a landscape-level understanding of ecosystems, and develop new information and strategies to support communities in responding to climate change, historic drought, water quality issues, and natural hazards. The budget also funds science to support the Nation's energy strategy, to help identify critical mineral resources, and to address the impacts of energy and mineral development on the environment.

"The USGS has a strong 136-year legacy of providing reliable science to decision-makers," said Suzette Kimball, Acting USGS Director. "This budget request recognizes our unique capabilities with multi-disciplinary earth science research and will allow the USGS to meet societal needs for our Nation now and in the future."

Key increases in the FY 2016 Budget are summarized below. For more detailed information on the President's 2016 budget, visit the USGS Budget, Planning, and Integration website.

Meeting Water Challenges in the 21st Century

The FY16 budget provides an increase of $14.5 million above the FY 2015 enacted level for science to support sustainable water management. Meeting the Nation's water resource needs poses increasing challenges for resource managers, who must contend with changes in the frequency and magnitude of floods and droughts. As competition for water resources grows for activities such as farming, energy production, and community water supplies, so does the need for information and tools to aid decision-makers. The budget provides increased funding across several USGS mission areas to support resource managers in understanding and managing competing demands related to water availability and quality and to enable adaptive management of watersheds to support the resilience of the communities and ecosystems that depend on them. This includes a $3.2 million increase for science to understand and respond to drought, a $4 million increase for water use information and research, a $2.5 million increase to study ecological water flows, a $1.3 million increase for stream flow information, and a $1.0 million increase to advance the National Groundwater Monitoring Network.

Powering Our Future and Supporting Sustainable Energy and Mineral Development

The 2016 USGS budget provides $9.6 million in program increases across the energy, minerals and environmental health portfolio for science to support the sustainable development of unconventional oil and gas resources, renewable energy sources such as geothermal, wind, and solar, critical minerals such as rare earth elements, and to address the environmental impacts of uranium mining.

Specifically, the budget includes a program increase of $1 million for mineral resources science to continue life-cycle analysis for critical minerals such as rare earth elements and to develop new science and tools to reduce the impacts of minerals extraction, production, and recycling on the global environment and human health. A life-cycle analysis will trace the flow of critical minerals from generation and occurrence through the consequences of human activity to ultimate disposition and disposal. The Nation faces key economic decisions within each stage of the resource life cycle. Scientific understanding is an essential input to these decisions. The program change will support new workforce capability to address the main thrusts of the President's four working groups in the Office of Science and Technology Policy that are currently focused on critical and strategic materials essential to national security, economic vitality, and environmental protection.

Responding to Natural Hazards

The budget provides an increase of more than $6.6 million above the FY 2015 enacted level for natural hazard science. This includes an increase of $4.9 million to expand the Global Seismic Network used for worldwide earthquake monitoring, tsunami warning, and nuclear treaty verification monitoring and research in partnership with the Department of Energy and the Department of Defense. It also includes a $1.7 million increase to support space weather (solar flare) geomagnetic monitoring. The increase will also support the installation and operation of rapid-deployable streamgages and expand the library of flood-inundation maps to help manage flood response activities. The proposed increase will also support landslide, wildfire, and sinkhole response capabilities as well as provide disaster scenario planning products for emergency managers. Included in the request is funding to build on investments to continue development of an earthquake early warning system, with the goal of implementing a limited public warning system for the U.S. west coast by 2018, as well as continued investments in volcano monitoring networks and science.

Building a Landscape-Level Understanding of Our Resources

The budget includes $15.6 million to expand, enhance, and initiate ecosystem science activities to increase the understanding of the Nation's landscapes and how they work. This includes budget increases of $6.7 million in support of critical landscapes. Specifically it provides a $4.2 million increase for the Arctic, a $1 million increase to study sagebrush landscapes that provide habitat for survival of greater sage-grouse, and a $1.5 million increase that supports science for Puget Sound, Columbia River, and the upper Mississippi River. USGS research will continue to support restoration of other priority ecosystems, such as Chesapeake Bay, Everglades, Great Lakes, California Bay Delta, and the Gulf Coast. The budget request also provides an increase of $2.2 million for research on invasive plants and animals that cause significant economic losses in the U.S. and transmit diseases to wildlife and people, and $1.6 million to study the decline of insects, birds, and mammals that pollinate agricultural and other plants. Finally, the budget increases funding by $5.1 million to support coastal resilience to hazards and adaptation to long-term change from sea-level rise and coastal erosion.

Foundations for Land Management

The President's budget request includes an increase of $37.8 million to provide data and tools to help land and resource managers make informed decisions across the landscape and provide data and information to the public for use in a wide variety of applications. The budgets of USGS and NASA provide complementary funding to sustain the Landsat data stream, which is critical to understanding global landscapes. An increase of $24.3 million in the USGS budget supports the ground system portion of the Sustained Land Imaging Program, including funding for ground systems development for a Thermal Instrument Free Flyer, Landsat 9 (a rebuild of Landsat 8), and to receive data from internal partners. The increase also will enhance the accessibility and usability of data. Specifically, the budget includes a $4 million increase for Landsat science products for climate and resource assessments.

The budget provides increases for other foundational data and tools needed to support landscape-level understanding. For example, an increase of $3.7 million will expand three-dimensional elevation data collection using ifsar (interferometric synthetic aperture radar) for Alaska and lidar (light detection and ranging) elsewhere in the U.S. in response to growing needs for high-quality, high-resolution elevation data to improve aviation safety, to understand and mitigate the effects of coastal erosion, storms, and other hazards, and to support many other critical activities. A $1.8 million increase will enhance understanding of the benefits of the Nation's ecosystem services, and a $1.1 million increase for the Big Earth Data Initiative will make high-value data sets easier to discover, access and use. The accessibility and usability of these data are critical for land management, hazard mitigation, and building a landscape-level understanding of our resources.

Supporting Community Resilience in the Face of a Changing Climate

The USGS plays an important role in conducting research and developing information and tools to support communities in understanding, preparing for, and responding to the impacts of global change. The budget includes an increase of $32 million above the FY 2015 enacted level for science to support climate resilience and adaptation. Climate change requires the Nation to prepare for more intense drought, heatwaves, wildfire, flooding, and sea level rise. These challenges are already impacting infrastructure, food and water supplies, and physical safety in communities across the Nation.

Understanding potential impacts to communities, ecosystems, water, plant and animal species, and other resources is crucial to federal, state, tribal, local, and international partners as they develop adaptive and resilient strategies in response to climate change. The budget includes a $6.8 million increase in science for adaptation and resilience planning, an increase of $2.3 million for the USGS to provide interagency coordination of regional climate science activities across the Nation, an increase of $8.7 million to support biological carbon sequestration, and an increase of $11 million for the USGS to support the community resilience toolkit, which is a web-based clearinghouse of data, tools, shared applications, and best practices for resource managers, decision-makers, and the public.

BG Group

BG Group A thirty day public consultation on plans to commence decommissioning of the Brent oil and gas field in the North Sea will begin week commencing Monday February 16. The field has produced around 10% of all UK North Sea oil and gas and generated more than £20 billion of tax revenue for the UK since production began in 1976.

A thirty day public consultation on plans to commence decommissioning of the Brent oil and gas field in the North Sea will begin week commencing Monday February 16. The field has produced around 10% of all UK North Sea oil and gas and generated more than £20 billion of tax revenue for the UK since production began in 1976. Shell Photographic Services, Shell International Ltd

Shell Photographic Services, Shell International Ltd NYC-based

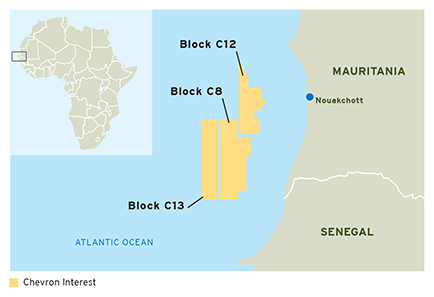

NYC-based  Chevron Corporation

Chevron Corporation  Reflects robust Administration support for science-based decision-making in managing natural resources

Reflects robust Administration support for science-based decision-making in managing natural resources As a result of a £300,000 investment in its ground breaking armoured cabling line earlier this year,

As a result of a £300,000 investment in its ground breaking armoured cabling line earlier this year,

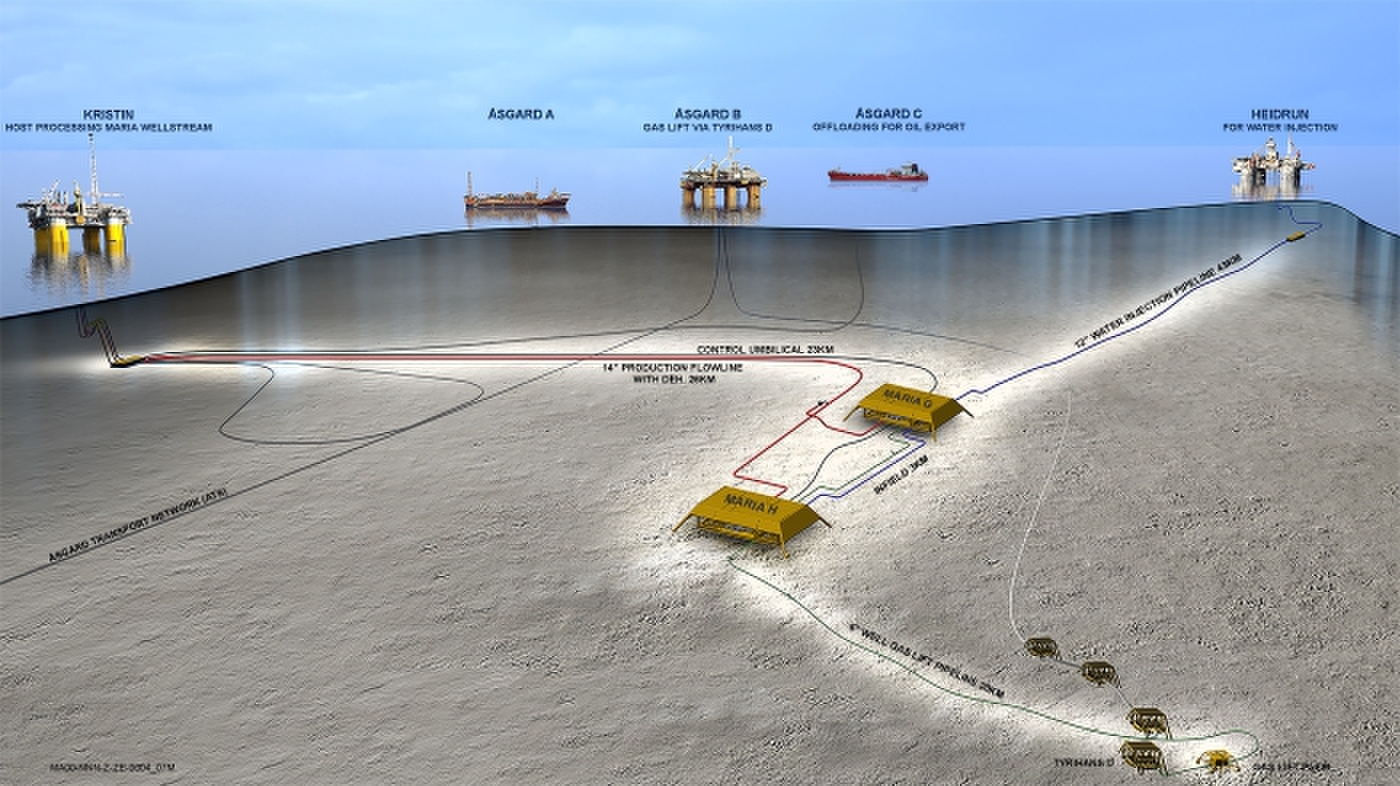

The contract is expected to run until the end of 2018, with a value of potential 30 million NOK (US$ 3.95 million).

The contract is expected to run until the end of 2018, with a value of potential 30 million NOK (US$ 3.95 million). Aberdeen head-quartered

Aberdeen head-quartered  For the fifth consecutive year,

For the fifth consecutive year,  President Obama's fiscal year 2016 budget request for the Bureau of Safety and Environmental Enforcement (BSEE) is $204.7 million, providing robust support that will enable BSEE to keep pace with industry activity and the technology developments that are helping to drive deepwater oil and gas development on the U.S. Outer Continental Shelf.

President Obama's fiscal year 2016 budget request for the Bureau of Safety and Environmental Enforcement (BSEE) is $204.7 million, providing robust support that will enable BSEE to keep pace with industry activity and the technology developments that are helping to drive deepwater oil and gas development on the U.S. Outer Continental Shelf. Sætre has been acting as president and CEO since October, and assumes the role with immediate effect. He has 35 years of experience from

Sætre has been acting as president and CEO since October, and assumes the role with immediate effect. He has 35 years of experience from