Subsea Services/Diving Support: Offshore Seen from Sea Depths

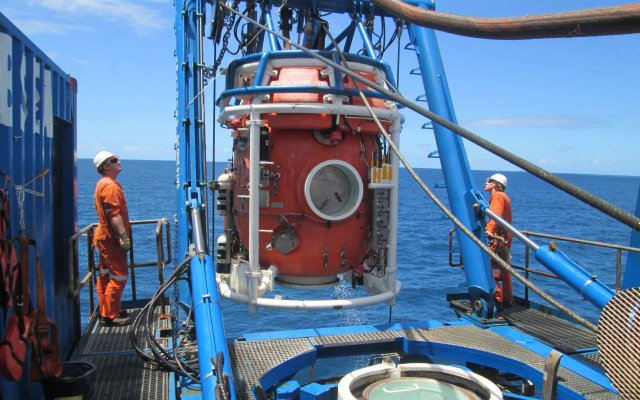

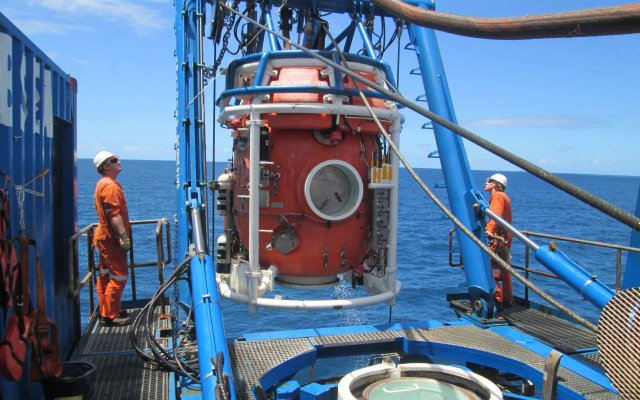

A module containing technicians, and you have to use an airlock to get out of it to work in a challenging environment: an orbiting space station? Not quite, although the living and working conditions are similar... The module is on the deck of the Bourbon Evolution 806, for a new diving support mission off the coast of Saudi Arabia.

A module containing technicians, and you have to use an airlock to get out of it to work in a challenging environment: an orbiting space station? Not quite, although the living and working conditions are similar... The module is on the deck of the Bourbon Evolution 806, for a new diving support mission off the coast of Saudi Arabia.

Subsea construction and maintenance work on oil facilities can be performed by saturation divers working at depths of up to 200 m, operating from an IMR vessel.

The principle: divers are kept at a constant pressure equal to the pressure at the sea bottom (up to 20 bars), enabling them to live and work over a long period - up to 4 weeks in a row - without having to undergo a decompression period with each dive. 3 teams of divers work in shifts at the intervention site, which they get to using a pressurized capsule, or diving bell, that acts as an elevator between the sea bottom and the vessel.

Work at the bottom becomes almost continuous (3 x 6hr shifts) and there is only one single decompression phase at the end of these 4 weeks. This single decompression is longer than usual, since it takes nearly 3 days to bring divers back to atmospheric pressure. Among the missions performed:

Taking measurements prior to interventions,

Connecting pipes,

Cleaning, maintenance, or repair work.

Bourbon Evolution 800, The Safety Advantage

"Diving support differs from other missions because of the human stakes," says Jean-Charles Audouin, Subsea Project Manager. "Divers work under risky conditions, so we need to ensure maximum safety for them. In this context, class 3 dynamic positioning (DP 3) is one of our advantages." Indeed, the Bourbon Evolution 800 series is equipped with DP 3. This system, highly redundant, allows the vessel to maintain its position in the event of a failure, but also in case of a fire or a leak. It's an important guarantee of safety for all types of subsea operations, but even more so when divers' lives may depend on it.

In the worst-case scenario of an evacuation of the vessel, divers can take refuge in a pressurized capsule, called the HRC (Hyperbaric Rescue Craft), which is launched and recovered by a second vessel, the safety vessel, constantly holding in the area to take charge of it within 30 minutes. The capsule will then be brought back to land, to be depressurized safely. .

A Bustling Vessel

During the operation, which can spread out over a period of 2 to 6 months, the vessel becomes a beehive of activity. Nearly a hundred people are working on board. On its own, the station housing the divers is managed by three command posts: one for handling pressurization, another for handling the daily lives of divers, and one for subsea operations.

The 1,000 m2 deck of the Bourbon Evolution 800 is well suited to integrating these systems and makes it possible to maintain clear deck space for storing the parts to be installed. In addition to the diving system, the capsule, and the essential equipment for a subsea intervention, the vessel also houses an ROV on deck. The ROV ensures both the monitoring of the operation and provides assistance to divers during certain tasks. At these depths, nothing can be left to chance...

Quick, Efficient Installation

In the past few months, BOURBON has conducted several such operations in Malaysia, New Caledonia, and China, thus taking advantage of the versatility of its vessels. After the mission is accomplished, the diving system is dismantled and the vessel can be reconfigured for any other subsea operation.

In this market segment, efforts are now being focused on optimizing the mobilization time for the diving system. Halved over the last two operations managed by our vessels – 7 days instead of 15 – Studies are underway to move towards a system similar to plug & play, with a vessel mobilization time reduced to a few days

CGG

CGG  Cal Dive International, Inc

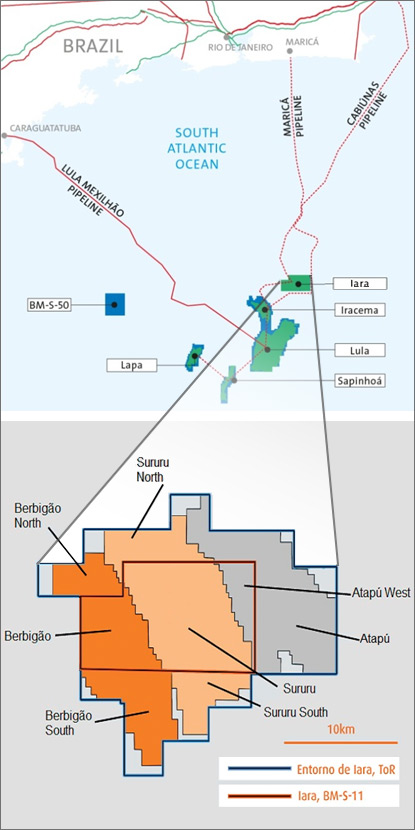

Cal Dive International, Inc Iara and Entorno de Iara areas in the Santos Basin, Brazil

Iara and Entorno de Iara areas in the Santos Basin, Brazil To maintain the continuous availability of its wide range of built-for-stock vessels,

To maintain the continuous availability of its wide range of built-for-stock vessels,  Eni

Eni AVEVA

AVEVA The first new-build semi-submersible drilling rig incorporating

The first new-build semi-submersible drilling rig incorporating EFC's Surface BOP HPU can be supplied modular or as one integrated unit to fit rig requirements.

EFC's Surface BOP HPU can be supplied modular or as one integrated unit to fit rig requirements. As of January 5, 2015,

As of January 5, 2015, McDermott International, Inc

McDermott International, Inc NYC-based

NYC-based  A module containing technicians, and you have to use an airlock to get out of it to work in a challenging environment: an orbiting space station? Not quite, although the living and working conditions are similar... The module is on the deck of the Bourbon Evolution 806, for a new diving support mission off the coast of Saudi Arabia.

A module containing technicians, and you have to use an airlock to get out of it to work in a challenging environment: an orbiting space station? Not quite, although the living and working conditions are similar... The module is on the deck of the Bourbon Evolution 806, for a new diving support mission off the coast of Saudi Arabia. Oceaneering International, Inc

Oceaneering International, Inc