Statoil (U.K.) Limited has awarded a contract to Sentinel Marine Limited to provide a new multi role Emergency Response & Rescue Vessel (ERRV) to support operations on the Mariner field on the UK Continental Shelf (UKCS).

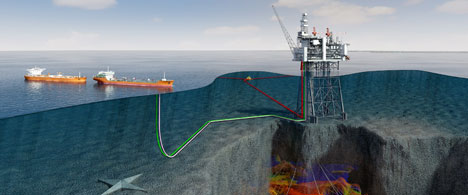

Mariner Sentinel illustration. (Illustration: Sentinel Marine)

Mariner Sentinel illustration. (Illustration: Sentinel Marine)

Sentinel Marine is an Aberdeen-based company, owning and operating offshore support vessels in the oil and gas marine industry. The new 65 meter ship, to be named "Mariner Sentinel", will be custom built for Statoil and provide emergency cover, oil spill response preparedness and tanker assist capabilities for the Mariner field.

The ERRV contract with Sentinel Marine has a fixed duration of five years, commencing in July 2016, and also includes five one-year extension options.

"This is an important contract award in our preparations for safe and efficient operations on Mariner," says Gunnar Breivik, managing director of Statoil Production UK.

"The emergency and rescue vessel plays a key role in our safety and emergency preparedness plan. We are pleased with the flexible and cost-effective solution Sentinel Marine is offering, and we are looking forward to working with them as a partner in the operational phase. "Mariner Sentinel" will carry mechanical oil spill response equipment and contribute to a strengthening of the emergency preparedness capacity also on a regional basis," Breivik says.

The Mariner field, located approximately 150 kilometers east of the Shetland Isles, is currently under development, with production start-up planned for 2017. Hook-up and commissioning is expected to start in 2016.

The Mariner field, located approximately 150 kilometers east of the Shetland Isles, is currently under development, with production start-up planned for 2017. Hook-up and commissioning is expected to start in 2016.

"Mariner Sentinel" is expected to be delivered early in 2017. From the summer of 2016 and until the new vessel is ready for operation, Sentinel Marine will provide another ERRV for emergency cover on Mariner.

Statoil is the operator of the Mariner field with 65.11% equity. Co-venturers are JX Nippon Exploration and Production (U.K.) Limited (28.89%) and Dyas Mariner Ltd. (6%).

Facts:

The Mariner Field is located on the East Shetland Platform of the UK North Sea, approximately 150 kilometers east of the Shetland Isles.

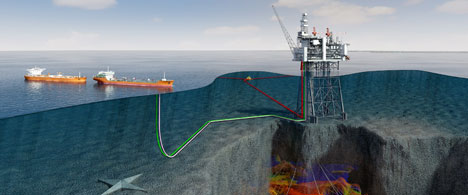

The Mariner heavy oil field consists of two shallow reservoir sections – the deeper, Maureen Formation at 1492 meters and the shallower Heimdal reservoir at 1227 meters.

The development of the Mariner field will contribute more than 250 million barrels reserves with average plateau production of around 55,000 barrels per day.

The field will provide a long-term cash-flow over a 30-year field life. Production is expected to commence in 2017.

The concept chosen includes a production, drilling and quarters (PDQ) platform based on a steel jacket, with a floating storage unit (FSU).

Drilling will be carried out from the PDQ drilling rig, with a jack-up rig assisting for the initial years.

The Mariner field development entails a gross investment of more than USD 7 billion.

Following the final investment decision in December 2012, Statoil in 2013 established an office an Aberdeen.

Statoil's new UKCS operations center is currently under construction on the Prime Four business park at Kingswells west of Aberdeen.

Oceaneering International, Inc

Oceaneering International, Inc The Ceona Amazon will be deployed for the Coelacanth Export Pipelines project with the scope of work encompassing the installation of an oil and a gas export line tying the new Coelacanth Platform into existing pipeline infrastructure. Each 10" line will be approximately 11 miles, totaling 22.6 miles (approximately 36 km). The pipelines will each be terminated by two pipeline end termination (PLETs) structures installed by the Amazon. All work will be undertaken in one single mobilization.

The Ceona Amazon will be deployed for the Coelacanth Export Pipelines project with the scope of work encompassing the installation of an oil and a gas export line tying the new Coelacanth Platform into existing pipeline infrastructure. Each 10" line will be approximately 11 miles, totaling 22.6 miles (approximately 36 km). The pipelines will each be terminated by two pipeline end termination (PLETs) structures installed by the Amazon. All work will be undertaken in one single mobilization. BMT Group Ltd

BMT Group Ltd Governments' responses to low oil prices will have a significant effect on supply dynamics for years to come, depending on whether fiscal regimes are adjusted to provide a landscape in which companies can make big development decisions, says an analyst with research and consulting firm

Governments' responses to low oil prices will have a significant effect on supply dynamics for years to come, depending on whether fiscal regimes are adjusted to provide a landscape in which companies can make big development decisions, says an analyst with research and consulting firm  Maersk Discoverer

Maersk Discoverer

Claxton Engineering Services

Claxton Engineering Services VAALCO Energy, Inc

VAALCO Energy, Inc Mariner Sentinel illustration. (Illustration: Sentinel Marine)

Mariner Sentinel illustration. (Illustration: Sentinel Marine) The Mariner field, located approximately 150 kilometers east of the Shetland Isles, is currently under development, with production start-up planned for 2017. Hook-up and commissioning is expected to start in 2016.

The Mariner field, located approximately 150 kilometers east of the Shetland Isles, is currently under development, with production start-up planned for 2017. Hook-up and commissioning is expected to start in 2016. As part of its mission to serve the public interest as well as the needs of members and clients by promoting offshore safety and security,

As part of its mission to serve the public interest as well as the needs of members and clients by promoting offshore safety and security, Chevron Corporation (NYSE: CVX) executives, at the company's annual security analyst meeting in New York, expressed confidence in the long-term energy business and highlighted its growth outlook through 2017. At the same time, company executives outlined near-term actions to address the recent decline in commodity prices.

Chevron Corporation (NYSE: CVX) executives, at the company's annual security analyst meeting in New York, expressed confidence in the long-term energy business and highlighted its growth outlook through 2017. At the same time, company executives outlined near-term actions to address the recent decline in commodity prices.

The

The