Marking the fifth anniversary of the Macondo incident in the Gulf of Mexico, a summary of inquiries into the tragedy flags up key ways to prevent a repeat

Much has been done to reduce the risk of another major incident such as the Macondo tragedy, but more change is needed. This is a key message in a new summary by DNV GL of findings and recommendations by 21 major inquiries into the BP Deepwater Horizon drilling rig explosion and oil spill in the Gulf of Mexico in 2010. The inquiries were conducted by governmental, industry and independent organizations in the US, UK, Norway and the Republic of the Marshall Islands.

“We have carried out this review because no single investigation provides a full overview of the actions recommended to prevent another Macondo,” said Peter Bjerager, director for the Americas, DNV GL - Oil & Gas. “There will doubtless be further investigations, particularly around long-term environmental effects of the spill. The US Chemical Safety Board (CSB) intends to address organizational and human factors. Five years on though, it is timely to review key lessons and recommendations.”

Lessons learned

Lessons learned

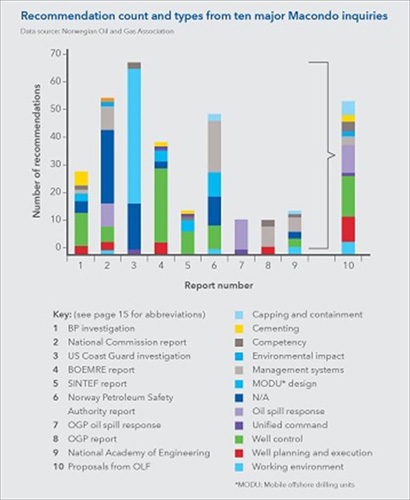

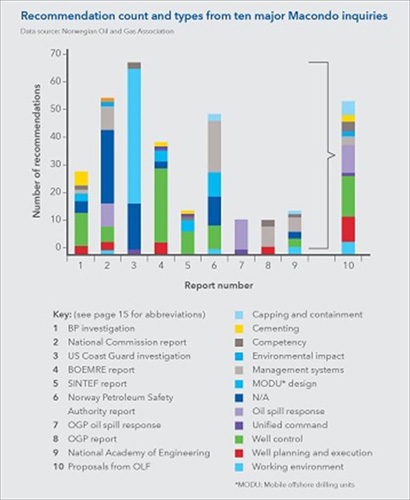

Broad subject headings for the recommendations from all 21 inquiries are summarized in the table to the right. Among technically-focused investigations, the US Justice Department commissioned a DNV GL forensic examination of the Deepwater Horizon rig’s blowout preventer (BOP) recovered from the seafloor. DNV GL made detailed recommendations[1] regarding BOP design and operation issues.

Among the most high profile studies, the US Deepwater Horizon Commission[2] and its chief counsel[3] included lessons learned for industry, government and energy policy. The Commission stressed how culture was a key factor for enhancing safety and discussed issues affecting BP, its contractors, and the industry in the Gulf of Mexico generally. The organization and response by US federal and state agencies, and the cooperation of BP and the whole industry, was commended by the national incident commander, Admiral Thad Allen.

In other nations, the Norwegian Oil and Gas Association (formerly OLF), led an inquiry for which DNV GL reviewed regulatory differences between the US and Norway. This concluded that the Norwegian Continental Shelf had robust legislation and safe operations.[4] It made 45 recommendations for improvements to prevention, intervention and response, and summarized those related to well control and response issues.

In the UK, the Health and Safety Laboratory (HSL) studied fire and explosion issues related to Macondo. HSL relied on key investigations elsewhere, mainly in the US, and found that recommendations from these generally matched those for offshore UK.[5]

The legacy

DNV GL’s summary of inquiries flags the legacy of reforms to reduce risk and improve occupational and process safety. “Many key recommendations have been adopted in one form or another,” Bjerager said. He cited the emergence of two new US regulatory entities: the Bureau of Safety and Environmental Enforcement (BSEE) and the Bureau of Ocean Energy Management (BOEM). This has separated safety oversight from resource management. “The set-up now emphasizes goal-based safety and includes increased numbers of inspectors to boost presence offshore in both safety and environment.”

BSEE has issued new requirements for: drilling safety; BOP recertification; negative pressure tests; professional engineer sign-off on casing and cement; and for a compulsory estimate of worst-case blowout events.

The American Petroleum Institute (API) and the International Association of Drilling Contractors have worked on an interface requirement between rig lessees and drilling contractors. Several new API standards are available. SEMS I & II have been implemented with the new Center for Offshore Safety defining the protocols and approving third-party audit service providers.

BSEE has provided guidance on safety culture, and is working with another US federal agency to implement a confidential reporting system for offshore incidents and near misses. The Bureau has also established the Ocean Energy Safety Institute within Texas A&M University. This will research longer-term issues such as risk, reliability data, and the best available and safest technologies.

The US Coast Guard service has issued guidance on additional fire and explosion assessments that it would like to see introduced, and has highlighted safety culture issues. Two response consortia have been established in Houston (MWCC and Helix). The International Association of Oil and Gas Producers (formerly OGP) has set up consortia at four international locations to provide emergency response support. API and the Norwegian Technology Centre, which develops NORSOK standards, have updated standards for drilling and well control, and have made their safety standards freely available. “Detailed assessments of fire and explosion lessons from Macondo have been made and are finding their way into designs,” Bjerager added.

CSB investigated the BOP failure after DNV GL’s forensic examination. It concluded that regulations should be updated to identify critical parts of safety equipment and ensure that these all operate reliably. The co-chairs of the Deepwater Horizon Commission maintain the oscaction.org website to monitor progress on implementation of its recommendations, and issue annual progress reports. “Generally it concludes that industry and the executive branch of the US government have done a good job implementing recommendations, but US Congress lags behind,” said Bjerager.

Global response

There has been change elsewhere. The European Union (EU) is adopting a safety-case approach similar to that of the UK, for all EU offshore developments. Australia has expanded coverage of its regulator, the National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA), to address drilling and environmental impacts because of Montara and Macondo, and to move closer to the goal of having a single offshore regulator.

“The UK and Norway believe their goal-setting approaches were not challenged by Macondo, but that many detailed aspects of drilling safety needed enhancement. The UK Health and Safety Executive (HSE), Norway’s Petroleum Safety Authority and the International Association of Oil and Gas Producers are working on these issues,” Bjerager said. “Still, some important recommendations for the US regulatory system have yet to be adopted. The US appears not ready to adopt mandatory risk assessment with a risk target nor, at least as a partial step, to nominate safety-critical items with defined performance standards.” Download the report at: www.dnvgl.com/macondo.

A surge in crude tanker vessel capacity over the next two years will lead to a fall in ship-owner earnings from current highs, according to the latest edition of the Tanker Forecaster, published by global shipping consultancy Drewry.

A surge in crude tanker vessel capacity over the next two years will lead to a fall in ship-owner earnings from current highs, according to the latest edition of the Tanker Forecaster, published by global shipping consultancy Drewry. Bill is an experienced Operations Manager with over 25 years in manufacturing, logistics, engineering, strategic and quality systems roles. He has delivered site start-ups, set strategies and led major change projects in telecoms, IT, construction and process industries. Bill Strahan has also developed individuals and teams to succeed both in periods of growth and cost reduction.

Bill is an experienced Operations Manager with over 25 years in manufacturing, logistics, engineering, strategic and quality systems roles. He has delivered site start-ups, set strategies and led major change projects in telecoms, IT, construction and process industries. Bill Strahan has also developed individuals and teams to succeed both in periods of growth and cost reduction. Lessons learned

Lessons learned NYC-based

NYC-based  Bill Smart (photo) has joined the

Bill Smart (photo) has joined the

Today’s oil and gas environment has been impacted by a myriad of issues including restrained capital spending, curtailed investment and employment cuts for struggling companies across the supply chain. Recovery from current market conditions is expected to be slow, with oil prices likely not to return to pre-crash levels in the near term. However, such conditions are likely to prove beneficial for those private equity firms and strategic investors prepared to take a long-term view of the current downturn.

Today’s oil and gas environment has been impacted by a myriad of issues including restrained capital spending, curtailed investment and employment cuts for struggling companies across the supply chain. Recovery from current market conditions is expected to be slow, with oil prices likely not to return to pre-crash levels in the near term. However, such conditions are likely to prove beneficial for those private equity firms and strategic investors prepared to take a long-term view of the current downturn. Within the past six months, the company has employed eight new personnel for its UK base, namely three engineers, a production scheduler, QHSE manager, administrative assistant and trainee produce, assembly and test technician as well as a new MD, Paul Betteridge (photo).

Within the past six months, the company has employed eight new personnel for its UK base, namely three engineers, a production scheduler, QHSE manager, administrative assistant and trainee produce, assembly and test technician as well as a new MD, Paul Betteridge (photo). The company hooked up the 80,000 bbl/d spar to three mooring lines in Green Canyon block 860, offshore Louisiana, at a water depth of 5,300 ft (1600 m). The project’s original contractor then resumed the job and completed the remaining six mooring lines along with the completion of the spar installation.

The company hooked up the 80,000 bbl/d spar to three mooring lines in Green Canyon block 860, offshore Louisiana, at a water depth of 5,300 ft (1600 m). The project’s original contractor then resumed the job and completed the remaining six mooring lines along with the completion of the spar installation.