World Oil Market Forecast

World Oil Market Forecast

Financial market turmoil is undermining global economic growth and reducing the demand for inventory which is especially negative for oil prices given over 300 million barrels of surplus inventory. This surplus is hardly eroded in 4Q15 making prices vulnerable to weakness if financial turmoil worsens. The lower prices are now, the stronger they will be later. Global light product demand has been strong and will remain so. Refining margins will continue to decline as gasoline cracks come off further and distillate stocks continue to build. Supply disruptions have ticked higher and significant political risks to supply remain.

Production Growth and Storage Limit Near-Term Price Upside

Since last month’s forecast, Henry Hub (HH) gas prices have taken a sizable hit reflecting the continuing storage surplus coupled with anticipated 4Q production growth led by Appalachia. Sagging prices come despite a late July/early August heat wave and lackluster production which helped boost gas-fired electricity generation (EG), narrowing the storage surplus somewhat faster than earlier expected. Yet, the market’s tepid response to those bullish weather episodes called attention to heightening concerns over bearish gas balances in the months ahead.

PJM 2018/2019 Capacity Auction: Results and Future Implications

PJM’s 2018/19 Base Residual Auction cleared the Capacity Performance product at $164/MW-day for the PJM RTO. This clear was over the high end of PIRA’s forecast range of ($130-$160/MW-day). However, EMAAC and ComEd areas cleared close to their offer caps as per our expectations. A total of about 13 GW of capacity was offered but not cleared in this auction. Despite the higher capacity price clear for the ComEd LDA, Exelon’s Quad Cities nuclear units did not clear in the auction. The inability of a large portion of DR to participate as a CP product implies significant upside to PJM RTO capacity prices when the share of CP resources required increase in the near future.

Downside Risks Outweigh Upside in Freight Market Outlook

The usual autumn pickup in Cape freight rates came earlier this year. The question is whether we are likely to see a second rebound as happened in late 2014. On the supply side, Australian iron ore exports are picking up and Brazil has the potential to boost exports after an expected dip last month. On the demand side, China’s steel production has slowed and there are currently some government imposed temporary mill shutdowns around Beijing. As of now, it looks like Cape rates will continue to slide in the short term.

Strong Demand at California/Quebec Carbon Auction

The Vintage-2015 allowance auction showed strong bidding interest supportive of the secondary market pricing gains that we expect in our forecast. As anticipated, the Vintage-2018 allowance auction was fully subscribed with a particularly strong coverage ratio, clearing well above the floor price.

Wide Range of Possible RGGI Auction Outcomes

Market prices have moved above the $6 trigger for the Cost Containment Reserve. The upcoming auction has potential for significant additional supply to enter the market. Unlike in California, there is plenty of demand for more allowances. While 1H15 emissions are down 8.5% year-on-year, total 2015 emissions are expected to be in line with 2014 levels. Coordinated procurement of large-scale hydro, renewables and transmission suggest a more sustained push to lower long term emissions.

U.S. Ethanol Prices Lower

U.S. ethanol prices edged down the week ending August 21, pressured by plunging oil prices. Manufacturing economics improved slightly due to lower corn costs, breaking a two-week slide.

U.S Ethanol Prices Decline

U.S. ethanol output dropped to a 15-week low 952 MB/D the week ending August 21 as some plants cut back production due to poor margins. Stocks increased slightly for the second consecutive week, building by 67 thousand barrels to 18.63 million barrels.

Japanese Crude Runs Ease, Holiday Impacts Fade

Crude runs eased back from peak levels and crude imports remained sufficiently high to build stocks slightly. Gasoline demand eased back following the holiday, which built stocks. Gasoil demand conversely rebounded, with lower yield and higher exports, so to draw stocks. Kerosene demand jumped a bit and moderated the seasonal stock building. The indicative refining margin remains acceptable, with lower gasoline, naphtha, and fuel oil cracks being mostly offset by higher middle distillate cracks.

U.S. Coal Stockpile Estimates

Power sector coal stocks drew modestly in August as mild weather conditions across the Midwest and Northern Plains was offset by continued weak coal supply. PIRA estimates U.S. electric power sector coal stocks will reach 157 MMst as of the end of this month, or 81 days of forward demand based on our forecast of Sep/Oct average coal burn (vs. 57 days one year ago).

Asia Demand Weakness No Guarantee for Low Spot Prices

The inefficient mechanisms that pervade LNG pricing, particularly in Asia, were once again highlighted in July. At this point, the fragmented nature of pricing should not come as a surprise given the even odder behavior of demand. The outlook on the demand front is simply not good, which will do little to boost future support for Asian prices, oil prices notwithstanding, particularly as overall global supply increases are inevitable.

U.S. Commercial Stocks Again Reach New Record Level, In Spite of Crude Draw

In spite of a larger than expected crude stock draw, total commercial stocks built a combined 2.9 million barrels this week, to a new record high level. With a smaller overall build last year, the year-on-year excess widened. Commercial stocks began to grow quickly the first week of September last year, and that is likely when we will see the surplus decline.

Producing Region (PR) Storage Congestion Getting Harder to Avoid

Thursday’s market miss and the expected rapidly increasing storage builds as the shoulder season starts to get underway highlight both a seasonal denouement of summer peak electric generation cooling demand, as well as the lack of any significant heating demand coming back into play until October.

3 Major OECD Crude Stocks Build in October But Then Continue Downward Trend

While Thursday’s crude market certainly reversed trend, the crude price sell-off over the last few weeks has obscured an important fundamental view: we expect crude stocks in the 3 Major OECD regions to continue cleaning up through the end of the year, although October will see stocks build because of refinery maintenance.

Bulgarian Gas Price Likely To Be Reduced

Natural gas prices in Bulgaria are expected to be cut by 13.65% as of next quarter. Chairperson of Bulgaria’s Energy and Water Regulatory Commission (EWRC) Ivan Ivanov announced the news speaking with journalists. “I believe that the natural gas price will be a total of 30% cheaper for the year. The initial reports of Bulgargaz show that the natural gas price for the next quarter should be 13.65% cheaper,” he said.

PIRA Urges Caution Regarding Expected Crude Production Revisions from the EIA’s Producer Survey

Since the collapse in crude prices some months ago, markets have been focused on the timing and magnitude of the peak in U.S. crude production, and its subsequent drop. On Monday, August 31, the EIA is scheduled to publish both the June 2015 Petroleum Supply Monthly, and the 2014 Petroleum Supply Annual. Traders and analysts have been focused on what the EIA, using their Form 914 for the first time, will do to recent reported crude production data. Even though PIRA and others have noted we think the EIA has overstating Texas production so far during 2015, we urge caution is assuming the new crude producer survey will revise down 2015 crude production.

German Power Sinking Into Unchartered Waters

In Germany, fundamental support to the front (September) and winter months prices will come from stabilizing power demand and stronger exports, especially as the Alpine region is seeing drier conditions this year. However, with no signs of major capacity closures, no clear anchor is in place for German deferred prices, which is to say that the back of the curve will sink further into unchartered waters. With the recent declines in French forward prices, cost recovery for the operational nuclear fleet starts being problematic, which is to say that French prices may be closer to a bottom.

Ample Supply Supports Demand Growth and Injection Gains

LNG did not flow to Europe in the volumes we expected during the third quarter, with only Qatar really pushing cargos into its own terminals. It is an important lesson for the future; global length does not necessarily mean that Europe will be a dumping ground for LNG in the years ahead, although the emergence of U.S. export volumes could change the equation. Well-priced pipeline supplies from contract sources have stepped in front of LNG to boost storage injections and meet incremental demand.

Financial Market Turbulence Is Not Yet Over in All Likelihood

A large part of the recent financial market stress was caused by growth worries about emerging markets. It is therefore crucial to track the performance of these economies, though timely information is hard to come by. Available indicators are still painting a negative picture of the emerging world. For developed economies, the key risk going forward is financial market contagion from emerging economies. Historical experiences provide very limited guidance on this subject. But the likelihood is that policymakers in the U.S. and Europe are taking this threat seriously.

Market Falls, Then Rallies

The S&P 500 and other key market indicators dropped drastically on a weekly average basis. They generally fell as the week started, but they recovered towards the end of the week and ended higher Friday-to-Friday. The dollar continues to strengthen against Asian currencies, the Russian ruble and many of the fragile emerging market economies. Commodities generally fell. US Baa corporate bond yields jumped significantly higher this week. Policy interest rates in China fell again from 4.85% to 4.60%.

Seaborne Coal Market Edges Higher amid Surge in Oil Pricing

Coal prices rebounded last week, carried higher by the sizeable recovery in equity and oil prices on Thursday and Friday following a collapse early in the week. In the prompt market, FOB Newcastle (Australia) prices strengthened the most, while gains for API#2 (Northwest Europe) and API#4 (South Africa) measured about half as strong. Further along the curve, API#2 and API#4 fared better than FOB Newcastle. The market remains in search for clear direction, and at the moment it appears as if pricing will follow the lead of oil, which is not expected to be supportive of a structural rebalancing in pricing until mid-2016.

U.S. LPG Prices Firm Ahead of Seasonal Demand

U.S. LPG prices ripped higher on Friday with crude prices. September propane futures jumped 9% higher to 41.6¢/gal and butane gained 2.4¢ to 54.2¢/gal. LPG prices, in anticipation of higher seasonal demand in the months to come, have outperformed vs crude oil thus far in August. Propane prices have gained 8.5%, and butane 2.5%, vs. a 4% decrease in crude prices. Ethane prices fell to 18.9¢/gal, sliding with natural gas, but remained above gas on a Btu basis. Ethane prices, after trading at a discount to gas for a year or so, are now approaching levels necessary to economically incentivize incremental production.

Corn Crop Maturing Fast

The end of meteorological summer brings a choice for many eastern Belt farmers; go to the Farm Progress Show in Decatur, Illinois which starts tomorrow, or start harvesting corn that turned very quickly over the last week or so.

Frustration Starting to Build

Unfortunately, there’s very little to do at these price levels. The market seems somewhat content around $3.75 in corn and above $8.75 in soybeans, while it does appear that wheat sellers are trying to re-establish a decent short position which may be a bad bet.

Global Equities Climb Higher

Global markets gained about 1% on the week following a 6% decline the previous week. In the U.S., energy, retail, and technology showed the strongest gains among the tracking sectors. Utilities and housing posted declines.

Internationally, most of the tracking indices improved with emerging markets and Japan doing the best. BRIC’s and Europe posted fractional declines. The information above is part of PIRA Energy Group's weekly Energy Market Recap- which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

Oil and gas company

Oil and gas company

“Pipeline protection is increasingly important, with the typical incident costing an average of at least $1 million to repair, not counting the incalculable costs of injury, death, or environmental impact,” said Ed Landgraf, director of CAMO. “This AIS-based safety broadcasting system culminates several years of hard work on a solution that enables vessel and pipeline operators to collaborate on protecting mariners from the risk of pipeline strikes. The system makes it easier for mariners to know where and when to take protective measures as they transit or operate near submerged pipelines, and we look forward to a successful roll-out here and in other ports nationwide.”

“Pipeline protection is increasingly important, with the typical incident costing an average of at least $1 million to repair, not counting the incalculable costs of injury, death, or environmental impact,” said Ed Landgraf, director of CAMO. “This AIS-based safety broadcasting system culminates several years of hard work on a solution that enables vessel and pipeline operators to collaborate on protecting mariners from the risk of pipeline strikes. The system makes it easier for mariners to know where and when to take protective measures as they transit or operate near submerged pipelines, and we look forward to a successful roll-out here and in other ports nationwide.” The Coastal and Marine Operators (CAMO) group was developed with a goal to diminish the gap between onshore and offshore spills, releases, and pipeline damage prevention initiatives. A key component of this group’s mission is to educate marine stakeholders and the public about the risks that damage to offshore utilities and pipelines can pose to personal safety and the environment. Although pipeline operators have vigorous inspection and maintenance programs to insure the integrity of their assets, the risk of third-party damage to a pipeline is a continual threat. For more information about CAMO, visit

The Coastal and Marine Operators (CAMO) group was developed with a goal to diminish the gap between onshore and offshore spills, releases, and pipeline damage prevention initiatives. A key component of this group’s mission is to educate marine stakeholders and the public about the risks that damage to offshore utilities and pipelines can pose to personal safety and the environment. Although pipeline operators have vigorous inspection and maintenance programs to insure the integrity of their assets, the risk of third-party damage to a pipeline is a continual threat. For more information about CAMO, visit

Workboats are built for a wide range of purposes. But, they all share the need for trouble-free bushings and bearings. Vesconite offers a line of low-friction, long-lived polymers that thrive in a dirty, marine environment.

Workboats are built for a wide range of purposes. But, they all share the need for trouble-free bushings and bearings. Vesconite offers a line of low-friction, long-lived polymers that thrive in a dirty, marine environment.

World Oil Market Forecast

World Oil Market Forecast

The second concept is for a purpose-built, new bunker barge. Offering greater carrying capacity and improved visibility, the design features a larger LNG tank that is nestled inside of the barge. This new barge will also feature the latest safety features and efficiencies.

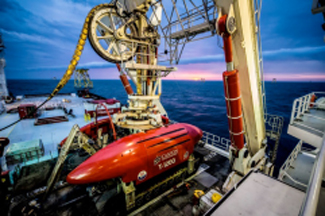

The second concept is for a purpose-built, new bunker barge. Offering greater carrying capacity and improved visibility, the design features a larger LNG tank that is nestled inside of the barge. This new barge will also feature the latest safety features and efficiencies. Helix Energy Solutions Group, Inc. is pleased to announce that Shell, as operator of BC-10, has awarded a contract to Helix’s robotics subsidiary, Canyon Offshore Inc., to trench and bury over 40 kilometers of pipe in 1675 meters of water in the Campos Basin offshore Brazil. The work will be performed at the Shell operated BC-10 field in the fourth quarter of 2015 from the DP III M/V Grand Canyon I utilizing the T-1200 Deepwater Trenching System.

Helix Energy Solutions Group, Inc. is pleased to announce that Shell, as operator of BC-10, has awarded a contract to Helix’s robotics subsidiary, Canyon Offshore Inc., to trench and bury over 40 kilometers of pipe in 1675 meters of water in the Campos Basin offshore Brazil. The work will be performed at the Shell operated BC-10 field in the fourth quarter of 2015 from the DP III M/V Grand Canyon I utilizing the T-1200 Deepwater Trenching System.