NYC-based PIRA Energy Group reports that the oil export and revenue sharing agreement between the KRG and Baghdad has all but collapsed, but the Kurds are ramping up independent exports. In the U.S., stocks increased this past week marking a new all-time high. In Japan, crude stocks drew strongly, thus reversing the previous week’s rise. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group reports that the oil export and revenue sharing agreement between the KRG and Baghdad has all but collapsed, but the Kurds are ramping up independent exports. In the U.S., stocks increased this past week marking a new all-time high. In Japan, crude stocks drew strongly, thus reversing the previous week’s rise. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

Oil Market Ignores Overall Stock Build, Focusing on Large Cushing Draw

Total commercial U.S. stocks increased this past week, marking a new all-time high. Higher crude runs drove a crude stock draw, but those higher crude runs and sharply weaker product demand drove a product stock build. Wednesday’s WTI rally was most likely driven by the largest Cushing stock draw of the year. In addition, ongoing supply outages in Canada, declining U.S. sweet production, and the pending Line 9 startup have markets less worried about October maintenance-driven containment problems, and more focused on a tightening Midcontinent sweet balance later in the year.

2Q15 Producers Bogged Down, But Year-on-Year Gains Still Being Realized

Hampered by not only the mud season but also plant maintenance and forest fires, 2Q15 Canadian production retreated from the robust volumes witnessed in 1Q15. Despite the sequential decline, PIRA Survey Group companies still managed to achieve growth compared to the same period last year. However, year-on-year growth is not expected to continue into the second half of 2015, with declines forecast to begin in 3Q and enlarging in 4Q.

Eastern Grid/ERCOT Market Forecast

On-peak prices increased from July in the Northeast and Gulf Coast markets but were mostly lower in the Midwest and Southeast. Prices were consistent with weather patterns as Midwest temperatures remained below normal. One additional factor in the Northeast was a rebound in gas prices that boosted eastern NY markets close to prior year levels ($2.40s/MMBtu).

Week-on-Week Losses Persist in Bloated Thermal Coal Market

Despite a modest midweek rally when rising oil prices pushed the market higher, coal prices yet again moved lower last week. FOB Newcastle (Australia) prices again held up relative to API#2 (Northwest Europe) and API#4 (South Africa) across the forward curve, with marginal week-on-week increases for 1Q15 and Cal-18 recorded as well. The market still remains generally oversupplied, as evidenced by the fact that any rally in pricing is generally short-lived, with ample supply chasing limited demand. PIRA believes that coal prices will continue to balances on costs, which will keep the coal market following the trail cut by the oil market. This is not expected to provide much of an uplift over the next 90 days.

European LPG Demand Improving

LPG demand in the UK and France has increased noticeably this year. First half 2015 LPG demand in the UK of 1.399 million MT was 26% stronger than a year ago. Meanwhile, first half 2015 demand in France of 2.053 million MT was 18% higher year-on-year. A combination of lower prices and higher competitiveness vs competing feedstocks is supporting increased use of LPG, particularly in the petrochemicals sector.

Flurry of Activity as Obama Regulatory Window Closing

This summer was busy, led by the final Clean Power Plan, the new/modified unit NSPS rule, and proposed model FIP. President Obama's Methane Strategy was advanced with proposed rules for fracked oil wells and landfills. The controversial Ozone NAAQS, is due Oct. 1, while Renewable Fuel Standards for 2014-16 look to be finalized by their end-November deadlines. Truck emissions standards (beyond 2018) have a planned May 2016 finalization. Information on priority rulemakings will be available with the Fall Regulatory Agenda release.

Ethanol Prices Rise

U.S. ethanol prices moved higher last week, tracking rising corn values. Ethanol is selling at a premium to gasoline in most of the country.

Demand Remains the Question

Seasonal lows are typically put in for corn and beans within the next 6 weeks, with corn doing it last year on October 1st. Our concern this year, if you haven’t figured it out already, is demand. General malaise over most commodities resulting in the single largest week of Index liquidation on record a few weeks ago, along with a strong dollar, low gas prices, and relatively poor exports do not make us over-friendly.3.75 corn or 8.75 beans.

Worries about Emerging Economies (Particularly China) Delay Fed Tightening for Now

In a press conference after this week’s policy meeting, Fed Chair Yellen was explicit about why the central bank stayed put: growth concerns about China and other major emerging economies, and the resultant volatility in global financial markets. The Fed’s stance clouds the monetary policy outlook, since worries about emerging markets will probably not dissipate quickly. In particular, concerns about China are likely to linger, as the country’s latest data releases turned out to be disappointing.

Iraq Oil Monitor, 3Q15

The oil export and revenue sharing agreement between the KRG and Baghdad has all but collapsed, but the Kurds are ramping up independent exports. Multiple attacks on the ~650 MB/D northern export pipeline stopped flows to Turkey for nine days in August, increasing the risks to 750 MB/D of combined Kurdish and NOC production. Southern exports averaged 3 MMB/D from June to August, as the installation of new infrastructure facilitated the segregation of a Basrah Heavy grade. However, capex cuts at major southern fields could endanger additional production growth.

Making Sense of How Dutch Supply Will Be Replaced this Winter

Dutch gas production. We've always called it the invisible hand of the European gas market, but due to current circumstances it's not so invisible anymore and needs to be a focus for the emerging balances. Additional data on storage in Germany and the U.K. shows that each country will head into winter with lower-than-normal storage that will require a stronger pull on prompt supply if the weather turns colder than normal.

The Low Gas Price Effect on India Power Generation

Asian import prices overall have been on a steep downward trajectory since January, yet a corresponding uptick in demand has not been forthcoming to date. This is about to change, at least in one country. In India, a new government program to provide subsidies to power generators to import LNG for use in domestic power plants is now underway and garnering considerable interest.

China Looks to Reduce Industrial While Raising Residential Gas Prices

China’s National Development and Reform Commission (NDRC) could adjust downward non-residential gas prices by CNY0.5-0.6/cm ($2.18-2.62/MMBtu) within one to two months, sources close to the NDRC said. Meanwhile, the NDRC, the country’s top economic planner and price-setter of key commodities as oil and gas, would continue to optimize multi-tier pricing of residential natural gas, and overall prices of residential gas would go up. The adjustment of natural gas prices is based on performance of international oil prices in 2015 and would factor into environmental protection, economic stability, interests of energy companies as well as readjustment of energy structure.

Fuel Pricing Makes French Units More Competitive this Winter

Weather represents a major driver for French pricing during the upcoming months, with this year also featuring dry hydro conditions. The latest RTE monthly bulletin confirms that hydro output has plummeted to minimum levels in history, especially as a result of the July heat wave. However, other factors will be countering the likely lack of water in the upcoming months, with increasing wind capacity and plenty of cheaper fuel options likely keeping French power prices in check.

Stress Rises on Friday Selloff

On a weekly average basis, the S&P 500 gained for the third straight week, but Friday-to-Friday was little changed due to the selloff at end-week. Volatility also fell on a weekly average basis but rose on Friday’s selloff. High yield credit (HYG) and emerging market credit improved modestly for the week. Overall, commodities declined, but ex-energy was higher. The Cleveland Fed released their inflation estimates for September which were higher on all maturities.

Ethanol Inventories Fall

U.S. ethanol stocks dropped last week to the lowest level of 2015. Ethanol-blended gasoline manufacture fell to a 15-week low 8,788 MB/D as the peak driving season came to a close.

Shaky Soybeans

The soybean market feels like it’s holding on by its fingertips. Last night saw another test of the $8.65 area, a place that’s been tested a half-dozen times in the last month. If you throw out the spike lows of $8.55 on August 24th (Chinese equity collapse) and $8.5325 on September 11th (WASDE), you have what looks like a pretty good base, inferring to many that demand is strong between $8.65 and $8.75, something PIRA has commented on quite often of late.

Japanese Crude Stocks Draw Strongly, thus Reversing Previous Rise

Crude runs eased, but crude imports dropped sharply and crude stocks corrected back down following the surge of the previous week. Finished product stocks built despite modest draws on gasoline, gasoil, jet, and fuel oil. Kerosene demand eased and the stock build rate accelerated from 84 MB/D to 108 MB/D. The indicative refining margin remains good and cracks this past week again firmed.

Fast-Falling Power Loads to Accelerate Storage Builds

Thursday’s reported build served as a continuation of trends seen in recent EIA weekly releases — namely strong gas-fired electrical generation (EG) alleviating fears of storage congestion as the heating season approaches. Our projected end-October storage carry has hovered between 3.90 and 3.95 TCF for some time. While record heat in September has given weather-induced demand a healthy lift and tempered injections, wildcards in October do not take the threat of congestion completely off the table.

Global Equities Mixed

Global equities markets, on average, were modestly changed. In the U.S., the broad market declined due to the sell off on Friday. Utilities moved higher, while banking was the weakest performer. Energy largely matched the U.S. market average performance. Consumers staples and discretionary out performed. Internationally, Latin America posted a decent gain, while Europe and Japan declined, underperforming the average.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

NYC-based

NYC-based  Fugro

Fugro As part of President Obama’s all-of-the-above energy strategy to continue to expand safe and responsible domestic energy production, Bureau of Ocean Energy Management (BOEM) Director Abigail Ross Hopper announced on September 11, that the bureau will offer 40 million acres offshore Louisiana, Mississippi, and Alabama for oil and gas exploration and development in sales that will include all available unleased areas in the Central and Eastern Gulf of Mexico Planning Areas.

As part of President Obama’s all-of-the-above energy strategy to continue to expand safe and responsible domestic energy production, Bureau of Ocean Energy Management (BOEM) Director Abigail Ross Hopper announced on September 11, that the bureau will offer 40 million acres offshore Louisiana, Mississippi, and Alabama for oil and gas exploration and development in sales that will include all available unleased areas in the Central and Eastern Gulf of Mexico Planning Areas. Kvaerner

Kvaerner For much of the period since the year 2000 – characterized by high and rising oil prices, and long-term concerns over global oil supply – decommissioning took a backseat. Asset lives were extended through improved recovery, enhanced maintenance, and, critically, successful divestment. Smaller, more agile operators found success extracting from fields that had ceased to be profitable under original ownership, and with market fundamentals pointing towards continued high prices, many agreed to the transfer of decommissioning liabilities.

For much of the period since the year 2000 – characterized by high and rising oil prices, and long-term concerns over global oil supply – decommissioning took a backseat. Asset lives were extended through improved recovery, enhanced maintenance, and, critically, successful divestment. Smaller, more agile operators found success extracting from fields that had ceased to be profitable under original ownership, and with market fundamentals pointing towards continued high prices, many agreed to the transfer of decommissioning liabilities. Hoover Container Solutions

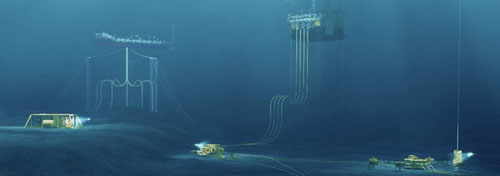

Hoover Container Solutions The project, which could potentially deliver a 40 to 50% cost saving for certification and qualification of subsea composite components, will seek to validate new advanced material models by experimentation, with the main focus on predicting chemical ageing.

The project, which could potentially deliver a 40 to 50% cost saving for certification and qualification of subsea composite components, will seek to validate new advanced material models by experimentation, with the main focus on predicting chemical ageing. Jotun is happy to confirm that “many millions of kilograms” of Jotachar JF750 have already been installed since launch, now protecting key assets. One recent project award will consume over half a million kilograms for a major Middle-East operator choosing Jotachar to protect two large offshore units against a broad range of fire scenarios, including jet fires.

Jotun is happy to confirm that “many millions of kilograms” of Jotachar JF750 have already been installed since launch, now protecting key assets. One recent project award will consume over half a million kilograms for a major Middle-East operator choosing Jotachar to protect two large offshore units against a broad range of fire scenarios, including jet fires. Deep Down, Inc.

Deep Down, Inc.  Wood Group

Wood Group “The main aim of SCR is to reduce the risks from major accident hazards to the health and safety of those employed on offshore installations. It also aims to increase the protection of the marine environment against pollution and ensure the correct mechanisms are in place if such an event were to happen,” described Mackay.

“The main aim of SCR is to reduce the risks from major accident hazards to the health and safety of those employed on offshore installations. It also aims to increase the protection of the marine environment against pollution and ensure the correct mechanisms are in place if such an event were to happen,” described Mackay. The engineering and planning will start immediately with installation being carried out in two phases in 2016 and 2017. Fugro will lay and bury the cables with its construction and installation vessels Fugro Symphony and Fugro Saltire using one of its two Q1400 trenching systems to bury the cables. The array cables will be pulled in and laid between the wind turbines and the offshore substation, where the power is then transmitted onshore.

The engineering and planning will start immediately with installation being carried out in two phases in 2016 and 2017. Fugro will lay and bury the cables with its construction and installation vessels Fugro Symphony and Fugro Saltire using one of its two Q1400 trenching systems to bury the cables. The array cables will be pulled in and laid between the wind turbines and the offshore substation, where the power is then transmitted onshore. Chris Echols, (photo) Vice President of Ashtead Technology in Houston said: “With increasing scrutiny on service and costs across our industry, this certification now independently verifies and certifies our commitment to the highest safety and quality standards within the sector.

Chris Echols, (photo) Vice President of Ashtead Technology in Houston said: “With increasing scrutiny on service and costs across our industry, this certification now independently verifies and certifies our commitment to the highest safety and quality standards within the sector. Anadarko Petroleum Corporation

Anadarko Petroleum Corporation Bibby Sapphire in port during mobilization

Bibby Sapphire in port during mobilization  Craig International’s research has revealed that typically oil company buyers spend 85% of their time on managing only 15% of their spend. This small percentage of overall spend is largely related to oilfield consumables including chemicals, oils and paints, pipe and fittings, tools, electrical and welfare items and services such as travel and accommodation, project management, data management and processing, hospitality, facilities management and general repair and maintenance.

Craig International’s research has revealed that typically oil company buyers spend 85% of their time on managing only 15% of their spend. This small percentage of overall spend is largely related to oilfield consumables including chemicals, oils and paints, pipe and fittings, tools, electrical and welfare items and services such as travel and accommodation, project management, data management and processing, hospitality, facilities management and general repair and maintenance.