NOIA President Randall Luthi(photo) issued the following statement in response to President Obama's 2015 State of the Union Address:2015 State of the Union Address:

NOIA President Randall Luthi(photo) issued the following statement in response to President Obama's 2015 State of the Union Address:2015 State of the Union Address:

"While the President highlighted America's energy renaissance in his address to Congress tonight, he failed to note that the increase in the supply of American-made energy is occurring on state and private lands, not the federal lands under his control. The President was certainly right about one thing: low energy costs and gas prices have given American families and small businesses relief and have contributed to the recovering economy; however, the increased supply of oil and natural gas and lower energy costs have occurred in spite of, not because of, the Administration's energy policies.

"The President and his Administration have a prime opportunity in the coming months to take positive action to support a true all-of-the-above energy strategy that strengthens America's economy, creates thousands of new jobs, and enhances our energy and national security. This opportunity lies within the next 5-Year Outer Continental Shelf (OCS) leasing program. More than 85 percent of the OCS remains shuttered to exploration and development, including the entire Atlantic Coast, Pacific Coast, and the Eastern Gulf of Mexico. Changing the current policy to one that would open new areas of the OCS would be a positive step in the right direction toward a truly all-of-the-above energy approach that recognizes the opportunity in developing all offshore energy resources, including oil, natural gas and wind. In fact, another good American story is the progress toward harnessing the potential of offshore wind power, particularly in the Atlantic. NOIA supports all offshore energy sources, but it only makes sense for the Administration to devote similar efforts toward moving forward on offshore oil and natural gas leasing in new areas as well.

"Other nations, including Canada, Cuba, Mexico, Norway, Greenland, Brazil and Ghana, have recognized these opportunities and are exploring new offshore areas. A recent study shows that by opening the Atlantic, Pacific, and Eastern Gulf of Mexico, America could, by 2035, create more than 838,000 jobs annually, spur nearly $449 billion in new private sector spending, generate more than $200 billion in new revenue for the government, contribute more than $70 billion per year to the U.S. economy, and add more than 3.5 million barrels of oil equivalent per day to domestic energy production.

"As the President knows, this issue is not a partisan one. Congressional Democrats and Republicans and the vast majority of the American public have stated their support for the safe exploration and production of America's offshore energy resources. We have an opportunity to leave future generations with a stronger economy and strengthened national and energy security for decades to come, and NOIA urges the President to help put America on this course by putting forward a 5-year OCS leasing program that opens new offshore areas for energy exploration and development."

ABOUT NOIA

NOIA is the only national trade association representing all segments of the offshore industry with an interest in the exploration and production of both traditional and renewable energy resources on the nation's outer continental shelf. NOIA's mission is to secure reliable access and a fair regulatory and economic environment for the companies that develop the nation's valuable offshore energy resources in an environmentally responsible manner. The NOIA membership comprises more than 325 companies engaged in business activities ranging from producing to drilling, engineering to marine and air transport, offshore construction to equipment manufacture and supply, telecommunications to finance and insurance, and renewable energy.

With Mexican oil open to private investment for the first time, the country's initial bidding round is expected to remain competitive despite low oil prices, delays and a number of uncertainties, according to research and consulting firm

With Mexican oil open to private investment for the first time, the country's initial bidding round is expected to remain competitive despite low oil prices, delays and a number of uncertainties, according to research and consulting firm  The photo shows a typical mobilization of an 11.4 m reel. This is a contract lift carried out under strict supervision, and as such there would be a lift plan in place prior to the start of the lift operation. In addition, there would be a method statement prepared, a risk assessment and tool box talk, which would be signed by all participants in the activity.

The photo shows a typical mobilization of an 11.4 m reel. This is a contract lift carried out under strict supervision, and as such there would be a lift plan in place prior to the start of the lift operation. In addition, there would be a method statement prepared, a risk assessment and tool box talk, which would be signed by all participants in the activity.

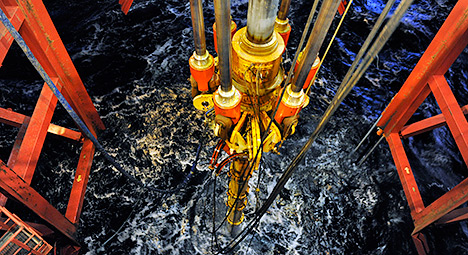

Photo courtesy: Anadarko

Photo courtesy: Anadarko the past 12 years,

the past 12 years,

he world's largest ship and offshore classification society

he world's largest ship and offshore classification society At the end of last year,

At the end of last year,  GAC

GAC Deep Casing Tools

Deep Casing Tools In the Awards in Predefined Areas 2014,

In the Awards in Predefined Areas 2014,  Claxton,

Claxton, PIRA Energy Group

PIRA Energy Group On behalf of the Johan Sverdrup partnership

On behalf of the Johan Sverdrup partnership  • The samples obtained in the exploratory survey known as Sandia confirmed the existence of gas, although without the necessary volume nor quality to consider future extraction.

• The samples obtained in the exploratory survey known as Sandia confirmed the existence of gas, although without the necessary volume nor quality to consider future extraction. The MacArtney Group

The MacArtney Group