NYC-based PIRA Energy Group believes that Brent crude prices continue to struggle and will remain weak in 1Q16. In the U.S., a surprising U.S. crude stock build leaves overall inventories flat. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group believes that Brent crude prices continue to struggle and will remain weak in 1Q16. In the U.S., a surprising U.S. crude stock build leaves overall inventories flat. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

European Oil Market Forecast

Brent crude prices continue to struggle and will remain weak in 1Q16 with Iran’s return, refinery maintenance, and an ongoing stock overhang of nearly 500 million barrels above normal levels. Demand growth and slowly declining non-OPEC crude production will stabilize stocks in 2016 but not substantively reduce them until 2017. Gasoline cracks will stay unusually firm for the winter due to relatively tight inventory coverage which will persist into next year. That will underpin a strong 2016 gasoline season. Naphtha cracks will tag along for the ride at least in the first quarter. For middle distillates, stocks are very high and will stay well above average next year, capping distillate cracks.

Late Month NYMEX Rally “Rescues” Henry Hub Cash Prices

Notwithstanding the holiday-impaired liquidity in the futures and cash markets, the long-awaited arrival of more seasonable weather that also impaired production, prompted an outsized ~70¢ rebound in the NYMEX nearby futures contract that resulted in a HH Bidweek price of ~$2.37. Amidst the two-way volatility affecting Henry Hub (HH) this month, basis differentials were often distorted, especially out West where weather conditions happened to also be relatively cold in contrast to the rest of the county.

Western Grid Market Forecast

Despite a strong finish tied to cold weather and soaring gas prices late in the month, December spot on-peak energy prices are expected to average flat to slightly below November levels. Eastern U.S. weather was much warmer than normal and with gas storage already at high levels, gas prices plunged below $2/MMBtu. In the Northwest, the return to a more typical seasonal runoff pattern is expected to support heat rates in the mid-high 9,000s during Jan/Feb. Southwest heat rates have been revised down in response to somewhat improved California runoff prospects, the likelihood of incremental energy from the Northwest and weak December results. A tightening gas market during 2H16 and 2017 combined with higher renewable generation associated with tax credit extensions will maintain downward pressure on heat rates through 2017.

2016 Offers Little Hope of a Recovery in Coal Pricing

Coal prices remained on a downward trajectory this month, with weaker oil prices and a stronger U.S. dollar pushing the curve lower. While there have been some signs that fundamentals are recalibrating (weaker Russian exports, promises of supply cuts in Australia, and the reduction of the import tariff in China), PIRA continues to assert that there is limited upside for pricing over the next year. Substantially milder than normal weather in Europe and continued year-on-year declines in imports from China and India will weigh on balances and pricing over the short-term.

Tighter PJM REC Markets Now, But More Supply after 2018

The slowdown of growth in qualified renewable capacity and generation together with rising requirements will support PJM RECs in the near to midterm. The extension of the PTC/ITC boosts incentives for new renewable build, which along with major transmission projects will flood the market with supply, driving down REC prices after 2018. Post- 2020 carbon policies will offer additional incentives, so REC price support would need to come from tighter RPS policy requirements.

U.S. Ethanol-blended Gasoline Manufacture Soared to a Two-month High

The week ending December 25, ethanol inventories declined for only the second time in nine weeks. Ethanol output rose 19 MB/D from the prior week to 992 MB/D.

New Year, Same Story

Ags are suffering from a bit of a New Year’s hangover with HRW making new contract lows overnight, despite the flooding and unfavorable Midwest weather of late, while SRW sits within 5 cents of its contract low, March corn within just a few cents, and soybeans tread water.

Global Equities

Global equities were modestly lower on the week. In the U.S., the best performers were consumer discretionary and utilities. Energy and materials were the laggards. Internationally, only Japan moved higher on the week, with EEM, China, and BRICs all underperforming. For 2015, the global market fell 3.8%, with Asia outperforming, and down only 1%. Europe was near the global average, down 3.9%, while the Americas were down 5% and weighted down by poor performance in Brazil, Canada, Mexico, and Argentina. The U.S. market eased only 1.8%.

Surprising U.S. Crude Stock Build Leaves Overall Inventories Flat

With a rebound in crude imports and domestic crude supplied, crude stocks posted an unexpected build, and finished the last full week of the year about 102 million barrels higher than last year. The three light product stocks built, while the rest of the product barrel had a large draw, keeping the overall commercial stock profile flat. The impact of the Christmas and New Year’s holiday period should be felt primarily in data for the week ending January 1, with weaker gasoline and distillate demand. Crude runs moved up this week, and we expect them to move up again for the week of January 1, but then begin to fall, as refinery maintenance picks up during January.

Japan EG Losses Set to Accelerate on Eve of New Australia/ US Contracts

The imminent restart of two large scale nuclear reactors at Japan’s Kansai Takahama facility sends further shivers through Asian LNG markets and will serve to weaken the current spot price floor, which already is at 18 month lows.

Hydro Shortfall Limits Winter Downside

German exports surged to a new maximum of 9.3 GWs on average during December. We expect German exports to stay strong toward the Alpine region for the balance of the winter, given the sizable hydro deficit. France remains more exposed to bearish gas prices, but hydro/weather risks could still be countering this bearish impact – at least for 1Q 2016. We expect a further narrowing of the France-Germany spreads in 2Q and 3Q 2016.

Slight Ease on Financial Stress

On the holiday shortened week, financial stresses appear to have eased a bit. The S&P 500 closed higher on a weekly average basis, while high yield debt (HYG) and emerging market debt (EMB) indices also improved slightly. However, the S&P 500 was fractionally lower for the year. Total commodities posted another modest gain for the week and non-energy now appears rather flat for the past several weeks. The U.S. dollar looks mixed, and the U.S. 2-year yield continues to trend higher as the markets digest the higher Fed target interest rates.

U.S. Ethanol Prices Followed a “V-Shape” Pattern

U.S. ethanol prices fall early during the week ending December 25 before rebounding. Manufacturing margins worsened as average product prices declined more than corn costs.

E-Commerce Impact on U.S. Gasoline and On-Highway Diesel Demand

E-Commerce has been gaining market share from brick and mortar stores. We present evidence that as these on-line retailers grow and set up distribution centers closer to their end users, short haul truck distances traveled to deliver their clients' merchandise decline. The logistical efficiencies achieved may reach as far as long haul traffic with the combined effect implying reduced diesel consumption over earlier retail practices. By contrast, gasoline demand appears to be unaffected by E-Commerce.

Gas Flash Weekly

Thursday’s EIA reported 58 BCF storage draw was slightly on the lower end of an exceptionally wide outlook ranging from the high-teens to high-70s BCF. Yet, this week’s draw was strong in comparison to the prior-week and year-ago draws. The response of the newly minted February contract was initially muted following a pre-release rally, which had raised the price to ~$2.31 from yesterday’s $2.21 settlement. As forecasts for cooler weather persisted, the nearby contract settled at ~$2.34/MMBtu. This Gas Flash Weekly includes an update to our 2016 full-year price forecast.

U.S. October 2015 DOE Monthly Revisions: Demand and Stocks

DOE released its final monthly October 2015 (PSM) U.S. oil supply/demand data today. October 2015 demand came in at 19.35 MMB/D, which is 134 MB/D higher than what PIRA had carried in its monthly balances. Compared to the DOE weeklies, total demand was lowered 284 MB/D. Even so, all of the major products were revised higher, while “other” was lowered. October 2015 versus October 2014 (PSA) demand declined 341 MB/D, or 1.7%. Kero-jet was the strongest performer, +7.1% (+105 MB/D) versus year-ago. Gasoline also outperformed the barrel average by gaining 102 MB/D, or 1.1%, but distillate was down over 6%. Compared to the weekly preliminary data, DOE raised commercial stocks 11.1 MMBbls, with products being raised 7.9 MMBbls.

Upward Revisions to Oklahoma Production and Record Crude Stocks in October PSM

The crude balances in the October 2015 PSM had upward revisions to Oklahoma production even as current production trends downward. October 2015 monthly crude stocks set a new record high.

Seven Issues Driving European Gas Fundamentals in 2016

Seven key issues will drive European gas fundamentals in 2016. At the top of the list will be coal-gas switching economics, along with the evolving role of European gas storage as a global force for balancing. Critical decisions made by Russian gas exporters will have the potential to impact gas prices from the Utica Basin to Tokyo Bay. The direct interaction between Russia pipeline gas and U.S. LNG in Europe will be met by a market that will struggle to grow beyond a correction for weather and the initial stages of recovery for gas use in the power sector.

Saudi Arabia Raises Domestic Fuel Prices

Saudi Arabia has just enacted an increase in domestic fuel prices, which will cover gasoline, diesel, and kerosene, potentially along with other fuels. Even with the increase, Saudi will still have among the lowest domestic fuel prices in the world. Heavy state subsidies in a time of falling oil revenues have put an increased burden on its fiscal balances. According to the IMF, the Saudi government net fiscal balance has gone from a surplus of 5.8% of GDP in 2013 to a 21.6% deficit of GDP in 2015. The Saudi currency has been pegged against the dollar since 1987 at 3.75 SAR/USD. Recent appreciation on a trade-weighted basis might argue for a devaluation versus the peg, but the negative implications would be significant, and as a policy option, appropriately rejected.

Saudi Arabia Increase Methane and Ethane Prices

On Monday, officials said the government ran a record deficit of nearly 367 billion Saudi riyals ($98 billion) this year, or about 15% of gross domestic product, as low oil prices depressed revenue, pushing it to cut planned spending by 14% in 2016 amid expectations that income from oil sales will remain under pressure. Shortly after unveiling the budget for 2016, Saudi Arabia increased domestic fuel prices in a move that suggests that the government is willing to adopt some difficult measures as it deals with cheap oil. Gas prices for local power generation increased on Tuesday and ethane, the main feedstock for petrochemicals, rose more than 100%.

December Weather: The U.S., Europe and Japan Warm

December was 25% warmer than the 10-year normal for the three major OECD markets with a loss of 1203MB/D of oil-heat demand versus normal. The markets were 28% warmer on a 30-year-normal basis.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

With this new global framework agreement in place, Norwegian oil services company

With this new global framework agreement in place, Norwegian oil services company  Inge Alme, Sales Director at Lloyd’s Register said: “Aker Solutions’ efforts in efficiency stewardship are testament to their commercial and environmental commitment. They are demonstrating yet again that their efficiency programs are designed and implemented with high accuracy, completeness and transparency.”

Inge Alme, Sales Director at Lloyd’s Register said: “Aker Solutions’ efforts in efficiency stewardship are testament to their commercial and environmental commitment. They are demonstrating yet again that their efficiency programs are designed and implemented with high accuracy, completeness and transparency.” Marred by corruption and market turmoil, Petrobras, the operator of key pre-salt projects for Brazil’s oil production over the next five years, is one of many Brazilian oil and gas companies facing a difficult financial future in the short term, according to an analyst with research and consulting firm

Marred by corruption and market turmoil, Petrobras, the operator of key pre-salt projects for Brazil’s oil production over the next five years, is one of many Brazilian oil and gas companies facing a difficult financial future in the short term, according to an analyst with research and consulting firm

Maintenance work on the Norne FPSO. (Photo: Rune Solheim)

Maintenance work on the Norne FPSO. (Photo: Rune Solheim)  Forum AMC wins multi-million dollars worth of new orders for its industry-leading rotational torque unit.

Forum AMC wins multi-million dollars worth of new orders for its industry-leading rotational torque unit. NYC-based

NYC-based  The companies will through a joint work group identify opportunities where they can create value for customers by combining

The companies will through a joint work group identify opportunities where they can create value for customers by combining  "We will team up with Saipem on targeted projects, providing integrated solutions that will enable our clients to make the most of their upstream investments, reduce development time and lower operating costs," said Luis Araujo, chief executive officer at Aker Solutions.

"We will team up with Saipem on targeted projects, providing integrated solutions that will enable our clients to make the most of their upstream investments, reduce development time and lower operating costs," said Luis Araujo, chief executive officer at Aker Solutions. Wood Group

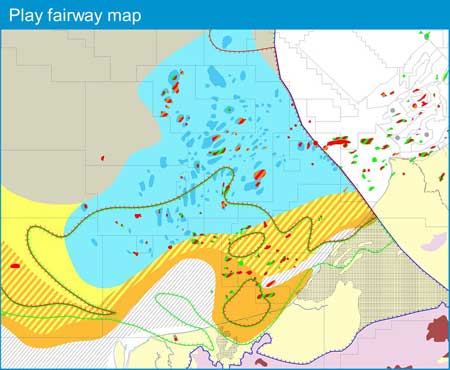

Wood Group Example play fairway map showing distribution of fields, reservoir, seal and source kitchens linked to the play. Tellus provides rapid evaluation of proven and potential play elements, concepts and risks for over 2400 plays in 430 basins worldwide.

Example play fairway map showing distribution of fields, reservoir, seal and source kitchens linked to the play. Tellus provides rapid evaluation of proven and potential play elements, concepts and risks for over 2400 plays in 430 basins worldwide. 2015 was a tough year. Spending and headcounts have been slashed across the industry and the spectre of bankruptcy is an all too common concern. Recent trends in commodity prices have not helped. Late December saw Moody’s downgrade its price forecast for 2016 by 17% and a further dip in the price of oil – Brent falling to the lowest level since 2004. Producers have continued to produce and new Iranian output may result in even more oversupply. By all accounts, 2016 is shaping up to be just as challenging as 2015. Where does this uncertainty leave the industry and what lies ahead?

2015 was a tough year. Spending and headcounts have been slashed across the industry and the spectre of bankruptcy is an all too common concern. Recent trends in commodity prices have not helped. Late December saw Moody’s downgrade its price forecast for 2016 by 17% and a further dip in the price of oil – Brent falling to the lowest level since 2004. Producers have continued to produce and new Iranian output may result in even more oversupply. By all accounts, 2016 is shaping up to be just as challenging as 2015. Where does this uncertainty leave the industry and what lies ahead?

The 23,000-ton spar has been moored by nine Series III Ballgrab ball and taper mooring connectors attached to polyester mooring lines. The connector's male mandrels are manufactured in compliance with American Bureau of Shipping (ABS) 2009 Approval for specialist subsea mooring connectors.

The 23,000-ton spar has been moored by nine Series III Ballgrab ball and taper mooring connectors attached to polyester mooring lines. The connector's male mandrels are manufactured in compliance with American Bureau of Shipping (ABS) 2009 Approval for specialist subsea mooring connectors. M-I SWACO has developed a new technological solution and has now been awarded a contract with

M-I SWACO has developed a new technological solution and has now been awarded a contract with  Subsea 7 S.A.

Subsea 7 S.A. Autonomous Underwater Vehicle Marlin® Mk3 is designed for commercial surveys and inspections

Autonomous Underwater Vehicle Marlin® Mk3 is designed for commercial surveys and inspections The main supplier agreement lasts for six years, with a four-year option for extension. It covers the following licences and installations:

The main supplier agreement lasts for six years, with a four-year option for extension. It covers the following licences and installations: