NYC-based PIRA Energy Group reported that the price of WTI dropped in December to the lowest monthly average since 2004. In the U.S., a large holiday week U.S. commercial stock build mirrors last year. In Japan, crude runs are at a new post-turnaround high while demands are impacted by the holiday. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group reported that the price of WTI dropped in December to the lowest monthly average since 2004. In the U.S., a large holiday week U.S. commercial stock build mirrors last year. In Japan, crude runs are at a new post-turnaround high while demands are impacted by the holiday. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

North American Midcontinent Oil Forecast

The price of WTI dropped $5.55/Bbl in December, averaging $37.25 — the lowest monthly average since 2004. Crude prices were continuing to drop in early January, in anticipation of more stock builds in the first quarter. Crude stocks rose in Cushing and in Western Canada, but generally fell in other regions — particularly in Texas, where ad valorem tax laws encourage minimizing year-end inventories.

Cold Spell Provokes Stronger Demand, Freezes Production

Thursday’s unexpectedly strong 117 BCF reported storage draw gave extra impetus to the already in place bullish price momentum underpinned by two important fundamental shifts since late December — colder weather and structurally weaker production relative to previous estimates. In sum, these developments provide justification for the dramatic upswing in Henry Hub (HH) cash prices after declining to a low of $1.54 over the extended Christmas holiday, as well as the former NYMEX weakness.

Spanish Flows Swing, Coal Dispatching Set to Decline in 2016

The Spanish market has seen increased price volatility so far this year, with lower day-ahead prices resulting in larger flows toward France. Spain has exported an average of over 400 MWs to France so far in 2016, which compares to imports averaging 2.2 GWs during December 2015. The outcome over the past few days has been led by exceptionally strong wind output (11.6 GWs in January to date) and extremely warmer-than-normal weather, as Spanish demand plummeted by over 6% year-on-year. Higher Spanish exports to France are contributing to undermine French prices, also lowering French imports from Germany.

Coal Fades Again; India Not Providing Uplift

The coal market experienced a modest rally midweek despite the notable decline in oil prices and the major selloff in Chinese equities, perhaps due to the wet weather in Australia and as market participants returned to activity in the New Year. However, the noted factors and continued unsupportive fundamentals were too much of a bearish influence on pricing for the market to end in positive territory for the most part last week. Fueled by weaker dry bulk freight rates, prompt pricing for API#4 (South Africa) and FOB Newcastle (Australia) moved up slightly W/W while API#2 (Northwest Europe) declined. Beyond 1Q16, all three forward curves declined, particularly the long-dated deferred prices, exacerbating the backwardation in the market.

Freight Market Outlook

OPEC continues to keep the taps open to force higher cost production from the market and there is no indication of any change in policy. This has helped the tanker sector in a number of ways. From August 2014, when the Saudis first indicated their intent to defend market share, bunker prices have fallen by 70% to the lowest level in more than 12 years, adding $30,000/day to vessel earnings for a typical VLCC. Higher OPEC production and expanding waterborne trade have added substantially to vessel demand, but a bloated supply chain has also contributed immensely. High inventories have caused excess port time and discharge delays, especially in China. While long-term floating storage is still not attractive, unintended floating storage is widespread as charterers knowing that discharge delays are inevitable on arrival are slowing vessels down on their laden legs, reducing fleet efficiency.

LPG Tanker Rates Swoon on Weaker Shipping Fundamentals

Spot VLGC freight rates have plunged to the lowest level since early 2014. Decreasing U.S. LPG export growth, a rapidly growing tanker fleet, and the fast approaching opening of the expanded Panama Canal will continue to plague rates throughout 2016. Rates fell to $52/MT on the benchmark Ras Tanura – Chiba, Japan route, an 18% decrease from the week earlier and a remarkable 62% lower than last year’s July high.

U.S. Ethanol Manufacturing Margins Rise

Most U.S. ethanol prices were steady in light trading during the final week of 2015. After declining for four straight weeks, manufacturing margins improved as corn costs moved lower.

It’s Go Time

Tuesday’s WASDE and QSR are two of the most critical reports of the year and will set the tone for 2016. While PIRA believes that next week’s reports will be bearish, we are also extremely cognizant of the short Non-Commercial positions going into the reports.

Global Equities Begin the Year Broadly Lower

Global equity markets began the year broadly lower for all of our tracking indices. In the U.S. the utility tracking index, largely a defensive play, was the best performer, down 0.8%. Banking, housing, and materials were almost 10% lower. Internationally, Japan faired the best but still declined about 5%. China was down over 10%.

Libya: ISIS Attacks Highlight Ongoing Risk; Expect to See More

ISIS militants launched a two-pronged attack on Libya’s largest oil export facilities early last week. Suicide bombers struck Es Sider (export capacity 340 MB/D), and an assault at Ras Lanuf (220 MB/D) left an oil storage tank holding 400,000 barrels ablaze. A storage tank at Es Sider was also hit. Neither attack will have an immediate impact on Libyan oil supply, as the terminals have been shut for over a year. But the development highlights the ongoing risk of a growing ISIS presence in Libya. We expect to see more attacks in the near future, which could do further damage to oil infrastructure, disrupt already-minimal oil supplies, or prevent any improvement in output. It may also exacerbate the security vacuum in Libya, igniting broader fighting between the two rival governments in the country. The lack of territorial gains by ISIS in other parts of the world (Iraq, Syria) may encourage more ISIS activity in Libya.

Large Holiday Week U.S. Commercial Stock Build Mirrors Last Year

Total commercial stocks built 7.3 million barrels this week, narrowing the surplus to 163.5 million barrels, or 14.2%. Crude stocks drew 5.1 million barrels this week, versus 3.1 million barrels last year; the four major refined products built 15.9 million barrels this year, versus a whopping 18.6 million barrels last year; and all other product stocks drew 3.5 million barrels versus drawing 5.7 million barrels last year. At 1,312.6 million barrels, total commercial stocks set a new weekly record. We think uncertainty in holiday week data (this year and last), along with a loss in trucking activity, and possibly minimal drawdowns from flooded PADD II terminals, contributed to this year’s large refined product stock build. Last year, the largest product build was in distillate, while this year, it was in gasoline, impacting demand growth rates.

Relocated Louisiana Methanol Plant Now Up and Running

The Methanex Corporation announced that on December 27, 2015, the company successfully produced the first methanol from its newly completed one million ton Geismar 2 methanol plant in Geismar, Louisiana. The plant was relocated from the company's production site in Punta Arenas, Chile. The total combined cost for the completion of the two Geismar plants is approximately $1.4 billion.

U.S. Coal Market Forecast

Record warmth in December drove natural gas pricing and coal burns lower, driving coal stocks to a record level for the month of December. With gas forwards in the $2.30/MMBtu range and coal stocks at limit levels, we foresee deep cuts in coal production. We have cut our outlook by 60 MMst since last month. This will likely push some producers into bankruptcy.

Financial Stress Builds

Financial stresses are building with financial markets starting the year with increased volatility and a definitive move to the downside. The ripples are being felt globally. The S&P 500 closed the week down 6%. Surprisingly, high yield debt (HYG) and emerging market debt (EMB) indices improved slightly again on a weekly average basis, but that will not hold up if markets remain under pressure.

Inventories Rise to an Eight-Year High

U.S. ethanol-blended gasoline manufacture plummeted to a two-year low. Due to the large decrease in demand and high output, ethanol inventories increased for the eighth time in 10 weeks, rising to an eight-month high.

Major Reports Ahead

As harvest was ending two to three months ago, prompt corn was trading around $3.75, soybeans were holding on around $9.00, and wheat was a $5.00+ commodity. The corn and soybean markets seemed to be taking the annual harvest pressure in stride at the time, with many looking forward to the possibility of a year-end rally as seen in 2014, or at least some stability going into the new calendar year as seen in 2013. Neither of those occurred, but there may be some light at the end of the tunnel.

Japanese Crude Runs at New Post-Turnaround High, Demands Impacted by the Holiday

Crude runs rose to a post-turnaround high, while crude stocks increased to just short of 100 MMBbls and then fell back slightly. Gasoline demand was helped by the holiday and stocks drew both weeks. Gasoil demand, after posting a gain, plunged with the New Year and stocks built. Kerosene stocks continued to draw seasonally. Refining margins remain strong, though distillate cracks continue under noticeable pressure but are offset by very strong gasoline and naphtha cracks.

Should Ukraine Be an Ongoing Concern?

Colder temperatures are finally returning to Europe after an incredibly warm 4Q 2015. Storages are being used as they should and demand numbers are starting to rise quickly. PIRA estimates residential and commercial demand figures will rise by 18% in Germany and 12% in the U.K. Looking farther east we can see that temperatures have already hit deep winter lows and storage draws have already shot up.

Healthy U.S. Job Growth Bodes Well for Outlook, but Weak ISM Is Source of Concern

The latest U.S. payroll data surpassed all expectations, and the pace of job growth accelerated significantly during the fourth quarter. Wage growth, however, remained tame. The ISM manufacturing index was disappointing, but the likelihood for now is that manufacturing’s difficulties will not spill over into other sectors. This week’s developments in China weighed on financial market confidence globally. Confusion over the country’s currency policy proved especially damaging.

Forward Brent Structure to Remain Under More Contango Pressure than Currently

While February-March Brent futures prices are under $0.40/Bbl contango, forwards like March-April and beyond are trading around $0.90/Bbl contango. This is very much related to misalignment between the futures contract and the forward BFOE market. This will change for the March and subsequent futures contracts, which will go off the board 15 days earlier than has been the case. Thus, unlike previous months, the whole March North Sea program will underlie the March futures contract, compared to just half earlier. In a contango market, having half the program go physical before expiration leaves the higher priced second half of the program to drive valuation of futures expiration, thereby directionally narrowing the contango. With the whole March program underlying futures expiration, almost double the volume previously, the contango will naturally be wider. Thus, March-April contango is already double that of February-March.

China Balancing Role in 2016: Positive, Negative or Neutral?

Long in the works, China announced a new financing source for Russian LNG supply at Yamal despite a recent stall in its actual LNG buying.

Aramco Pricing Adjustments for February — Maintaining Competitiveness

Saudi Arabia's formula prices for February were just released. The adjustments made to differentials against its key regional benchmarks were within market expectations and do not suggest a shift in Saudi export pricing policy. Pricing policy continues to be one of maintaining competitiveness, volumes, and liftings. Northwest European pricing was made more generous, Asia tightened in alignment with market circumstances and expectations, and U.S. prices left unchanged for all but the lightest grade, Saudi Extra Light. Pricing for delivery into the ports of the Mediterranean Sea was left mostly unchanged.

Mississippi River Flooding Is Not a Major Concern for Product Supply

There are fears that recent flooding along the Mississippi River will drive up gasoline prices out of concern that refineries either will shut or slow production as the flood waters head downriver. PIRA believes that those concerns are overblown. The last major flood along the Mississippi River occurred in April and May 2011. There was only one flood-related refinery outage then. The Krotz Springs refinery was idled when the Morganza Spillway was opened to relieve flood pressure on the Mississippi River.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

Wood Group has been awarded a new contract by PetroRio to deliver services to the Polvo A platform, in the southern Campos basin, approximately 100 kilometers off the coast of Rio de Janeiro. Integrated operations and maintenance services will be provided by Wood Group PSN under the two year contract, which is effective immediately.

Wood Group has been awarded a new contract by PetroRio to deliver services to the Polvo A platform, in the southern Campos basin, approximately 100 kilometers off the coast of Rio de Janeiro. Integrated operations and maintenance services will be provided by Wood Group PSN under the two year contract, which is effective immediately. Greene’s Energy Group, LLC (GEG)

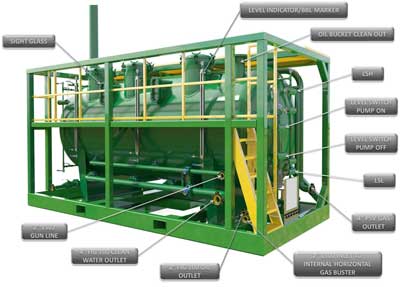

Greene’s Energy Group, LLC (GEG) Aquatic's offshore team using harnesses and ladders to assemble modular reel drive system

Aquatic's offshore team using harnesses and ladders to assemble modular reel drive system

The Mexican Navy (Secretaria de Marina - SEMAR) and Dutch shipbuilder

The Mexican Navy (Secretaria de Marina - SEMAR) and Dutch shipbuilder  With recoverable oil reserve estimates of approximately 750 and 600 million barrels (mmbbl) in Uganda and Kenya respectively, and with government share of the reserves expected to be about 30–50%, the potential impact on economic development in these countries could be great. However, new infrastructure, including an export pipeline, is required to enable commercialization of these discoveries, says an analyst with research and consulting firm

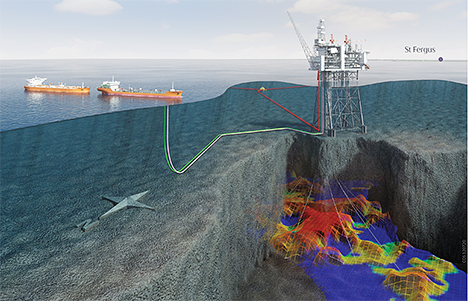

With recoverable oil reserve estimates of approximately 750 and 600 million barrels (mmbbl) in Uganda and Kenya respectively, and with government share of the reserves expected to be about 30–50%, the potential impact on economic development in these countries could be great. However, new infrastructure, including an export pipeline, is required to enable commercialization of these discoveries, says an analyst with research and consulting firm  ICE

ICE Hyperdynamics Corporation

Hyperdynamics Corporation As of 1 January 2016 vessels are no longer able to discharge ballast in US waters unless their ballast water treatment (BWT) systems are compliant with stringent demands from the USCG. Experts believe that now, more than ever, it is imperative that shipowners make the right BWT choice.

As of 1 January 2016 vessels are no longer able to discharge ballast in US waters unless their ballast water treatment (BWT) systems are compliant with stringent demands from the USCG. Experts believe that now, more than ever, it is imperative that shipowners make the right BWT choice. NYC-based

NYC-based  Crowley Maritime Corporation

Crowley Maritime Corporation

With an emphasis on efficiency improvements,

With an emphasis on efficiency improvements,  Oil prices have been extremely volatile since the first trading day of 2016 and hit 12-year lows last week with Brent dropping below $33 a barrel for the first time since 2005. The fall in the Chinese manufacturing index, the Saudi-Iran standoff and North Korean nuclear test have all had a significant impact on shaping oil price trends.

Oil prices have been extremely volatile since the first trading day of 2016 and hit 12-year lows last week with Brent dropping below $33 a barrel for the first time since 2005. The fall in the Chinese manufacturing index, the Saudi-Iran standoff and North Korean nuclear test have all had a significant impact on shaping oil price trends. Rob Spillard (photo) brings over twenty-five years’ experience in the offshore survey industry and will take overall responsibility for the technical direction of the Wirral-based company. Having previously performed key roles at Fugro EMU, the Maritime and Coastguard Agency and the United Kingdom Hydrographic Office, Rob will play an intrinsic part in the continuing growth of the company.

Rob Spillard (photo) brings over twenty-five years’ experience in the offshore survey industry and will take overall responsibility for the technical direction of the Wirral-based company. Having previously performed key roles at Fugro EMU, the Maritime and Coastguard Agency and the United Kingdom Hydrographic Office, Rob will play an intrinsic part in the continuing growth of the company. Prosafe and Statoil (U.K.) Ltd (“Statoil”) have agreed to re-phase the Mariner Project in the UK Continental Shelf of the North Sea from 2016 into 2017, and extend the firm hire duration from 8 months to 13 months.

Prosafe and Statoil (U.K.) Ltd (“Statoil”) have agreed to re-phase the Mariner Project in the UK Continental Shelf of the North Sea from 2016 into 2017, and extend the firm hire duration from 8 months to 13 months.