NYC-based PIRA Energy Group believes that Brent crude prices will continue to struggle due to a large global commercial oil stock surplus. In the U.S., the commercial stock surplus increased. In Japan, crude runs resume rising and product demands improve. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group believes that Brent crude prices will continue to struggle due to a large global commercial oil stock surplus. In the U.S., the commercial stock surplus increased. In Japan, crude runs resume rising and product demands improve. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

European Oil Market Forecast

Brent crude prices will continue to struggle due to a large global commercial oil stock surplus which PIRA estimates will total 500 million barrels above normal levels by end 2015. Oil markets are likely to run out of onshore crude storage in 1Q16. Brent will perform better than WTI over the very short term. Gasoline cracks will stay reasonably firm this winter due to relatively tight inventory coverage which will underpin a strong 2016 gasoline season. For middle distillates, stocks are very high and will stay well above average next year, capping distillate cracks. Europe has effectively assumed a larger role as swing regional refiner supplying gasoline to the Atlantic Basin as required but limited by oversupply and softer pricing for middle distillates.

Nearly All Prices Struggling Under Weight of High Storage, Especially Henry Hub (HH)

The debut of Jan-2016 futures as the NYMEX nearby contract was greeted with a wave of selling that resulted in new contract lows, albeit amidst light volume. Even so, it is still nearly 10% above cash Henry Hub (HH) prices, as well as many all other regional prices that are also near the $2 mark. More material heating loads would help HH cash reconnect with the NYMEX contract, but the benchmark may continue to exhibit weakness relative to other markers to promote gas burn that would absorbs residual supply surpluses in the region abetted by bloated South Central storage. While the MW was at the heart of the regional flow changes that unfolded this month, the South has been impacted as well — directly and indirectly. And more changes loom.

Western Grid Market Forecast

Spot energy prices fell at all hubs in November with on-peak price declines from October ranging from ~$3/MWh at Mid-Columbia to ~$4/MWh at Palo Verde and NP15 and $5/MWh at SP15. Off-peak markets saw smaller price declines with the largest drop about $2 at Mid-Columbia. Weaker gas prices and a sharp seasonal decline in the call on gas-fired generation were the major factors. In the Northwest, near term forecasts indicate above normal temperatures which will limit seasonal increases in heating loads and may lead to stronger runoff (i.e., rain vs. snow). As a result we have revised down near term heat rate projections. In the Southwest, the call on gas through the winter months is expected to increase year-on-year due to lower net imports from the Northwest and some gains from coal. Heat rate projections remain up year-on-year (by ~10%), but we have revised them down relative to last month.

Asian LPG Prices Roll Over Despite Higher CPs

Cash LPG prices cratered in Asia as the trading window transitioned to January arrivals. Propane cargoes were called an astonishing $66/MT lower at $457/MT while butane was felled by $61 to $481/MT. Such was the response to a hard to understand increase in Saudi contract prices, which were increased by $65 (to $460/MT) for propane cargoes loading in December. With spot VLGC tanker freight from the Middle East gulf to Japan around $70 currently, and the Asian propane premium to CP’s negative, contract holders can’t be too happy about these latest developments.

California Carbon: Reserve Price Guiding Prices

CA set the minimum auction reserve price for 2016, which was also the level at which the Nov. auction cleared. With 13 MT of offsets used for compliance, an allowance bank after CP1 of 50 MT will likely double after 2015 year results. The role of the cap and trade price signal post-2020 will depend on the Scoping Plan update and cost containment is a key issue. Linkage potential has been prominently discussed, with plans for Ontario coming into focus, and with WA state, Manitoba, and Northeastern U.S. states on the horizon.

OPEC Breakevens Flat at $100/Bbl in 2016, But Still No Impact On Oil Price

PIRA estimates OPEC budgetary breakeven prices will remain flat to slightly down at $100/Bbl in 2016. Breakevens are down $10/Bbl from 2014 levels, mostly due to currency depreciation and government spending cuts. Many OPEC countries still face significant budget deficits. Yet the widening gap to Brent oil prices (PIRA forecasts $49/Bbl in 2016) highlights the limitations of budgetary breakeven analysis in general. Breakevens provide interesting insight into countries’ budgetary pressures. However, we have long argued that breakevens are not a useful predictor of oil prices, or a price level (or floor) that OPEC will support. Countries are more likely to adjust to the reality of low oil prices by cutting spending or drawing on reserves, just as we’ve seen over the past year.

Biofuels Weekly Update

U.S. ethanol prices rose Monday and Tuesday November 23 and 24 boosted by higher corn and petroleum values. Assessments then declined before the Thanksgiving holiday, pressured by record production that led to the highest inventory in 16 weeks.

U.S. Job Growth Is Solid; the Euro Is Stronger After ECB Easing

U.S. job growth in November exceeded market expectations, though details were somewhat mixed. Latest data on the good-producing sector (the ISM index and exports) were disappointing, though the current U.S. industrial slump is not yet particularly severe from a historical perspective. The European Central Bank expanded its quantitative easing programs, yet the value of the euro area currency strengthened – apparently, some speculative financial positions for a weaker euro had to be unwound quickly after the action fell short of expectations. India’s economic growth was faster than China’s during the third quarter. Brazil’s recession deepened.

North American Midcontinent Oil Forecast

Crude stocks rose in November in Cushing, as well as in West Texas and Western Canada. Differentials vs. WTI were stronger for northern grades from Alberta to Clearbrook, in advance of two new pipeline start-ups. Differentials weakened in Midland and Guernsey – two locations where prices had been well above pipeline parity for several months.

Will Switching Economic Be Broad Enough to Offset Weather-Related Losses?

Coal-to-gas switching will remain the hot topic in Europe, as temperatures continue to cool. The problem for sellers is that temperatures are not cooling fast enough, so what is being gained in terms of demand growth from the power sector is being handed right back in terms of losses in the R/C sector. The dynamic is well under way in the U.K. and continues to spread to other markets. November was even warmer than normal than the previous year and the 10-day outlook is serving up more of the same in the early part of the month.

Exports to Southern Markets Underpin French Prices

While weather conditions have been milder than normal over the Continent, pockets of price strength have emerged. In France, nuclear output is now recovering, but stronger flows toward Switzerland and the Southern markets, in part due to drier weather and lower plant availabilities, are preventing French prices from moving lower.

Are RGGI Allowances Like “Forever Stamps”?

The December RGGI auction exceeded secondary market pricing on the day of the auction, with bullish implications for the market. Price increases are not tied to current program balances - PIRA projects RGGI to be oversupplied through 2020. Rather, they are tied to this year's Program Review to result in stricter post-2020 caps. RGGI representatives confirmed at the November Stakeholder Meeting that currently-traded RGGI allowances will carry forward at full value – potentially more similar to U.S. Post Office "forever stamps."

U.S. Commercial Stock Surplus Increases

Another overall U.S. inventory increase this past week pushed the stock surplus to last year up by 3 million barrels. The crude stock surplus hit a new 2015 high as inventories quickly approach last April’s all-time weekly high. The gasoline inventory surplus narrowed to just 8 million barrels (4%), as it remains the one standout in a rather glutted market.

Production Lags, Export Opportunities Narrow

Canadian dry gas production declined sequentially in 3Q15, a likely sign of things to come. The quarter-on-quarter loss was symptomatic of a shrinking export market, as gas from Appalachia displaces traditional TransCanada (TCPL) markets in eastern Canada and the northeastern U.S. These conditions are exacerbated as storage in eastern Canada is near capacity, leaving less appetite for new gas from Alberta or B.C. Consequently, production in Canada is expected to decline through 4Q15 and into next year.

Japanese Crude Runs Resume Rising, Product Demands Improve

Japanese crude runs rose in broad agreement with our turnaround schedules. Crude imports increased from very low levels, but crude stocks still posted a modest draw. Finished product stocks declined with all the products other than kerosene posting draws. Refining margins remain strong with gasoline, naphtha, and fuel oil cracks posting gains.

Chennai Refinery Flooded

Flooding has closed the Indian Oil Corporation’s Chennai refinery in southeast India. It is too early to determine the duration of the outage. Production lost is roughly 50 MB/D of naphtha/gasoline and 120 MB/D of middle distillates. However, with the new Paradip refinery (300 MB/D) now in the process of starting up, its production should cover some of the Chennai shortfall, particularly if it were to last into 2016.

What Will Paris Talks Mean for Gas Demand?

In the near term, Chinese gas growth has slowed significantly and LNG imports remain down YTD by around 3% or 2-mmcm/d. It’s not a large amount, but does help explain many of the supply tenders popping up around Asia for 2016. Since so much LNG demand growth hinges on new supply dedicated to the Chinese market, this lack of buying does not bode well for sellers. China, being the largest producers of solar panels in the world, also undermines the use of gas as a power generation fuel in the future, as the largest incremental buyer of LNG in the world is also trying to solve environmental problems at multiple levels. Gas will play a role in solving these issues, but it has moved from a starring role to being more of a supporting cast member.

Aramco Pricing Adjustments for January – Europe Tightened, Asia and U.S. More Generous

Saudi Arabia's formula prices for January were just released. The adjustments made to differentials against their key regional benchmarks suggests Saudi Arabia is striving to maintain volumes and liftings. European pricing was tightened, but terms for Asia and the U.S. were generally made more generous.

More Bearish Momentum

Weather is proving to be the prime driver in fundamentals as the market waited past the traditional start of the heating season for the first reported weekly withdrawal. Now, the latest mild turn in forecasts has rocked the prompt contract, bringing it to new lows. In line with these recent forecasts, PIRA has adjusted its GWHDD assumption for December to 12% milder than the 10-year normal.

EPA Finalizes Renewable Fuel Standards Through 2016

After long delay and under court order, the EPA on November 30th issued a regulatory announcement finalizing the overall renewable fuel requirements for 2014, 2015 and 2016 as well as the 2017 mandate for biomass-based diesel (BBD). Those looking for the EPA to match its earlier May 15th proposal, were disappointed. The mandates are significantly higher than proposed in May.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

The contract signing, with Sandra Laurenson, Chief Executive, Lerwick Port Authority, and James Woodward, Area Sales Manager, Transas.

The contract signing, with Sandra Laurenson, Chief Executive, Lerwick Port Authority, and James Woodward, Area Sales Manager, Transas. NYC-based

NYC-based  New SPE Aberdeen Chairman Ian Phillips

New SPE Aberdeen Chairman Ian Phillips By Julia Schweitzer

By Julia Schweitzer On 23 November 2015, Nakilat Damen Shipyards Qatar (NDSQ) celebrated its first 5 years of operation. With 40 vessels delivered or under construction, the yard has proven its capability to support Qatar’s national strategy for economic diversification.

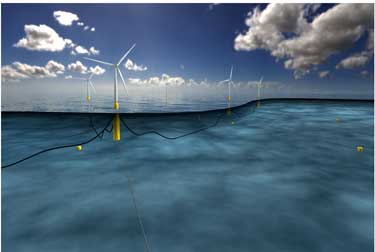

On 23 November 2015, Nakilat Damen Shipyards Qatar (NDSQ) celebrated its first 5 years of operation. With 40 vessels delivered or under construction, the yard has proven its capability to support Qatar’s national strategy for economic diversification. In November, Energy Secretary Amber Rudd announced her vision for the energy system: to put consumers first, increase competition and secure electricity generation for the UK. In addition to a proposal to end unabated coal-fired power stations and prioritise gas-fired power stations, the Energy Secretary disclosed a commitment to offshore wind (OW) whereby the government will support the target of 10GW of capacity by 2020, if costs reduction conditions are met.

In November, Energy Secretary Amber Rudd announced her vision for the energy system: to put consumers first, increase competition and secure electricity generation for the UK. In addition to a proposal to end unabated coal-fired power stations and prioritise gas-fired power stations, the Energy Secretary disclosed a commitment to offshore wind (OW) whereby the government will support the target of 10GW of capacity by 2020, if costs reduction conditions are met. BMT Designers & Planners

BMT Designers & Planners HARKAND

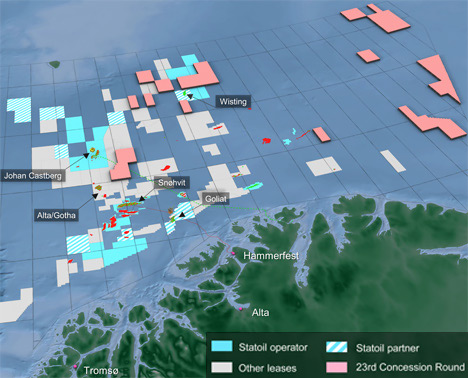

HARKAND Statoil

Statoil Leading classification society

Leading classification society

MacGregor

MacGregor Neil Coutts, Process & Facilities Manager of Xodus Group

Neil Coutts, Process & Facilities Manager of Xodus Group Ingen Ideas

Ingen Ideas Some 20% of the remaining UK oil reserves are expected to be West of Shetland, a challenging environment on the surface and subsea.

Some 20% of the remaining UK oil reserves are expected to be West of Shetland, a challenging environment on the surface and subsea. The 65-meter high spec. survey vessel, Fugro Searcher, is one of three specialist vessels deployed by Fugro on the contract at the Fortuna Project

The 65-meter high spec. survey vessel, Fugro Searcher, is one of three specialist vessels deployed by Fugro on the contract at the Fortuna Project