NYC-based PIRA Energy Group reports that U.S. consumer spending share on energy will hit record low. In the U.S., stocks make a new high. In Japan, crude imports fell back and stocks moved up fractionally. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group reports that U.S. consumer spending share on energy will hit record low. In the U.S., stocks make a new high. In Japan, crude imports fell back and stocks moved up fractionally. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

U.S. Stocks Make New High

This past week’s inventory build pushed stocks to a new all-time high. The crude surplus to last year has been narrowing as more of it is converted into products. The overall surplus to last year is about flat versus the beginning of the year, but the crude surplus is down 21 million barrels while the products surplus is up by a similar amount. Within products, the gasoline surplus versus the start of the year is up 21 million barrels, the distillate surplus is up 12 million barrels, while year-on-year surplus in the rest of the products is down 11 million barrels.

Low Oil Prices Strain PEMEX; Budget Likely to Come Under Fire

U.S. gas exports into Mexico remain impressive early in 2016. Indeed, February exports are projected to again be near 3.4 BCF/D, ~1 BCF/D more than the prior year. These stout gains have been primarily facilitated by weaker domestic production and increased gas-fired electric generation — a trend that should continue well into this year. PIRA’s Reference Case calls for exports to average ~3.6 BCF/D in 2016, which would mark yet another record-breaking year.

Takes from E-world in Essen: "For they will drink and forget what is decreed."

This issue of plant retirements was brought up in several of PIRA's discussions during E-world, with concerns that even some lignite units may be shut down. We have noted in our prior EES scorecard that daily average lignite output declined substantially over the past 30 days, as day-ahead prices moved lower. So far, with average daily data from Jan. 1, 2016, we want to note that lignite output moved down to about 11.2 GWs, as day-ahead prices settled at €12/MWh on Jan. 30, equivalent to a loss of 7.5 GWs.

Colombian Labor Strike Risk Buoys Coal Pricing

The coal market rebounded notably last week, with API#2 (Northwest Europe) and API#4 (South Africa) prices recording similarly strong gains at the front of the curve, while FOB Newcastle (Australia) price increases were more subdued. A modest rebound in oil/gas pricing provided some of the updrafts for coal pricing, although a growing likelihood of a labor strike at the Cerrejón mine in Colombia gave Atlantic Basin pricing the extra amount of stimulus. In the Pacific Basin, a reduction in Australia’s thermal coal exports in December/January, coupled with news that Anglo American is looking to divest its coal assets globally, is showing that pressures to curtail coal supply are becoming more binding.

Indian LPG Imports Set to Drop in 2016

India’s domestic LPG production is jumping a step change higher as the Indian Oil Corporation inaugurates its eighth refinery in Paradip on the east coast. The refinery includes a one-of-a-kind heavy oil-to-LPG conversion unit that is ramping to a production capacity of 1 million MT of LPG/year. Indian LPG production is climbing 11% higher this year as a result of Paradip’s startup, effectively backing out 24 VLGC cargo imports/year.

Global Equities Stage a Broad and Strong Rebound

Global equities posted solid and broad gains on the week. In the U.S., all of the tracking indices gained ground, with the retail, consumer discretionary, housing, and technology indices outperforming. Internationally, all the tracking indices also gained. The best performers were China, the other BRICs, Emerging Asia, and Japan.

Ethanol Stocks Soar

U.S. ethanol inventories set another record last week, building by 262 thousand barrels to 23.2 million barrels. Ethanol production increased for the second consecutive week, rising to a four-week high 975 MB/D.

Annual Outlook Forum this Week

Focus this week will be on the USDA’s Outlook Forum generally and how government analysts keep the corn carry out below 2 billion bushels and soybeans below 500 million specifically. All this in preparation for the Prospective Plantings report at the end of March, which last year showed a combined 173.8 million acres intended to be planted with either corn or soybeans, a fact that seems lost on many estimating the 2016 acreage mix.

Justice Scalia’s Passing Improves Prospects for Clean Power Plan’s Survival

With the recent unexpected passing of Supreme Court Justice Antonin Scalia, the chances that EPA's Clean Power Plan will survive legal review have improved. The 5-4 decision to stay the CPP last week indicated the Court would likely strike down the rule. With the current court split 4-4, the identity of that last justice is critical to the prospects of the CPP and may not be determined until after the 2016 elections. In the event the CPP is ultimately upheld by the Supreme Court, we would expect EPA to toll the CPP's deadlines for both filing SIPs and compliance by roughly two to three years.

Japanese Crude Imports Fell Back and Stocks Moved Up Fractionally

Crude runs showed very little change on the week. Crude imports fell back, and on balance crude stocks moved up fractionally. Finished products drew 2.4 MMBbls with almost half the decline in kerosene. Gasoline, gasoil, jet-kero, and fuel oil demands all fell back, but stocks still drew to varying degrees. Major product demand was lower on the week, but it continued rising slightly on a trend basis. Margins have softened in January and into February, but on the week were slightly higher.

How Will the European Gas Market Cope with the Ever Lengthening LNG Market?

With winter nearing an end, is it still worth staying short? The answer looks to be yes. Even though spot prices have come down by 8% M/M and by 16% quarter-on-quarter, prices can still go lower. As always, significant risks remain in place, especially as we enter the summer period, when injection account for over 20% of what happens to supply.

Stress Eases this Week

Financial stress appears to have eased up a bit this week. The S&P 500 rose Friday to Friday and on a weekly average basis. All of the other indicators, such as volatility, high-yield debt and emerging market debt, also staged varying degrees of improvement. The U.S. dollar has been increasingly mixed. Commodities ex-energy are looking marginally better. The Cleveland Fed released its inflation expectations for February, which showed a ratcheting down across all time frames.

U.S. Ethanol Prices Fall; Margins Trending Downward

Record-high inventories and lower oil values drove ethanol prices to a three-week low last week. High demand on the export market prevented sharper declines, though prices are expected to fall further in upcoming weeks. Manufacturing margins were up slightly last week, but they were trending downward by the weekend.

U.S. Consumer Spending Share on Energy Will Hit Record Low

U.S. consumer spending on energy will soon hit a record low as a share of total consumer expenditures. Variations in the consumer energy spending share have been largely driven by oil prices, and the decline in retail gasoline prices should push the share below 3.5% this quarter. As consumers have spent less of their budget on energy goods and services, they have spent more on healthcare goods and services and in restaurants. As oil prices start to recover later in 2016, as PIRA projects, these industries may well face headwinds as the share of consumer spending on energy increases.

End to 2015-16 Heating Season Already in Sight

The mild-weather forecasts weighing on gas prices are reinforcing perceptions of an “early end” to the heating season. As it now stands, the next EIA weekly storage report is likely to feature the last triple-digit withdrawal of this heating season. While the books have not yet closed on February, PIRA’s balances are coalescing around an end-month storage position of ~2.48 TCF, which would yield a year-on-year surplus of ~840 BCF. Consequently, March, largely viewed as a bookend to the season with its seasonally dwindling degree days, is front and center.

The Good, the Bad, and the Potentially Ugly of the U.S. Economy

Recent U.S. data releases on manufacturing, jobs, consumer spending, and housing have been encouraging and pointed to an acceleration in economic activity during the first quarter. Business investment, on the other hand, may experience a contraction in the near term. A firmer-than-expected inflation reading for January is likely to embolden hawkish members of the Federal Reserve policy committee.

Japan’s SPR Will Be Drawn Down Under a New Proposal

The Japanese government released a new proposal about the management of its strategic petroleum reserve. A government stock sale of at least 20 MB/D on average over the next four years is in store, since the current official reserve level is elevated according to the new rule. Separately, the draft recommended an expansion of government storage for LPG by 4.2 MMB in the next two years, based on the positive demand outlook for the fuel.

UK Businesses Will See Lower Gas Prices Later this Year

British firms can expect to see their energy bills fall by between 10-20% this summer as turmoil in the oil market pays dividends for customers. The wholesale cost of gas on the UK market has plummeted by more than 40% in the last year due to a global oversupply and depressed oil prices. The weaker gas price has also caused wholesale electricity prices to slump by more than 30%, because a large amount of the UK's power network is gas fired.

Asian Demand Update: Growth Continues to Slow

PIRA's latest update of Asian product demand shows continued slowing. PIRA's January update had shown growth of 741 MB/D, down from over 1 MMB/D in the December update. The latest average three-month data indicate growth of only 294 MB/D. Looking at the upside, India and Korean growth is still good at 335 MB/D and 179 MB/D (vs. 396 MB/D and 154 MB/D last month). A weak performance was registered by China with growth of only 48 MB/D (255 MB/D last month), while Japan now posts a decline of -274 MB/D (-98 MB/D last month). The current growth assessment for Asia picks up preliminary January data on China and India and full 4Q15 data for all the other countries other than Thailand. Looking at individual products, gasoline accounts for 223 MB/D of the growth, but down from growth of 308 MB/D in our last assessment. Weakness continues in middle distillate demand performance, both gasoil and jet-kero. Asian gasoil demand growth is now 77 MB/D, down from 149 MB/D last month, while Asian jet-kero demand growth has also slowed.

Tighter Europe-Asia Spreads Feed AB Supply Glut Concerns

The specter of JKM dipping below NBP in the coming months looms large, particularly as Japan appears to be contemplating the restart of Tepco’s Kashiwazaki-Kariwa (KK) nuclear facility. It is highly unlikely that such a thing would happen this year; in fact, any restart at KK is not built into the PIRA nuclear forecast in Japan at all at this point, owing to the very high political hurdles that are in place for Tepco in particular. But the fact that it is now on the table is worrisome for Asian gas consumption.

Rising U.S. VMT Growth Supports Strong Gasoline Demand

Since mid-2013, growth in U.S. vehicle miles traveled has displayed accelerating growth. Even with that growth, the pace has been below what traditionally has occurred out of a deep recession and compared to what PIRA’s modeling efforts would indicate. In the most recent VMT data, year-on-year gains remain robust, up over 4% in November. The good year-on-year growth in VMT, seen in the most recent data for 2015, helps explain the strong gasoline demand that has been witnessed. For 2015, PIRA estimates gasoline demand grew 2.5%, or 227 MB/D, the strongest since 2002, when year-on-year growth was 2.8%, or 238 MB/D.

Competition Is Heating Up for Product Exports to Australia

Australia has emerged as a major importer of refined products in the Asia-Pacific region over the past few years due to refinery closures there. Net imports more than doubled from some 233 MB/D in 2010 to about 506 MB/D last year, led by diesel, gasoline and jet fuel. Competition is heating up among exporters to supply Australia, with China and India entering the market Down Under. But Australia’s imports of refined products are expected to only increase slowly from here due to relatively slow demand growth, unless there are more refinery closures, and none are currently expected. Australia alone will not correct the surplus of refined product production capacity in Asia-Pacific.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

JDR

JDR Churchill Drilling Tools

Churchill Drilling Tools Sparrows Group

Sparrows Group DLB ‘Norce Endeavour’

DLB ‘Norce Endeavour’ Leading international oilfield services company,

Leading international oilfield services company,  NYC-based

NYC-based  On Sunday February 21st at 12:09PM Eastern time, the LNG ship Asia Vision arrived in Sabine’s southern berth.

On Sunday February 21st at 12:09PM Eastern time, the LNG ship Asia Vision arrived in Sabine’s southern berth.  Magne Viking, care of Viking Supply Ships.

Magne Viking, care of Viking Supply Ships. Subsea 7 S.A. (Oslo Børs: SUBC, ADR: SUBCY) announces it has secured a sizeable(1) extension to the existing contract by BP Exploration Operating Company Limited, for the provision of Subsea Construction, Inspection, Repair and Maintenance (IRM) services in the North Sea.

Subsea 7 S.A. (Oslo Børs: SUBC, ADR: SUBCY) announces it has secured a sizeable(1) extension to the existing contract by BP Exploration Operating Company Limited, for the provision of Subsea Construction, Inspection, Repair and Maintenance (IRM) services in the North Sea.

The protracted low price environment is pushing the offshore marine supply chain to breaking point. Rig managers, OSV contractors and subsea vessel owners are trading at 60-70% discounts to 2013 highs and every week seems to usher in a new wave of profit warnings, impairments or defaults. Although E&P customers are also taking a beating, they are firmly in the driving seat when it comes to bargaining power.

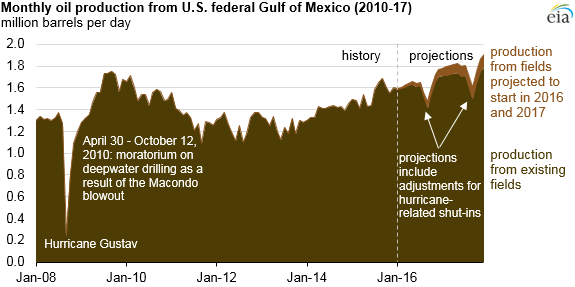

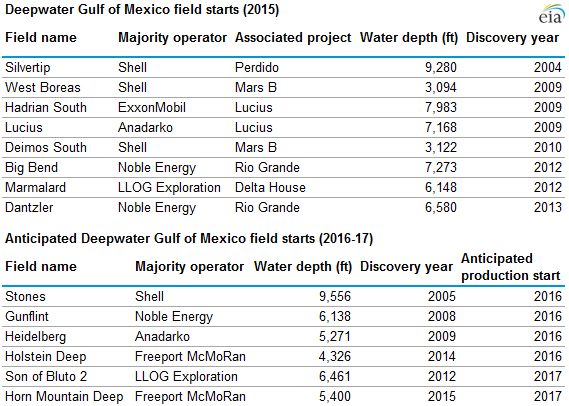

The protracted low price environment is pushing the offshore marine supply chain to breaking point. Rig managers, OSV contractors and subsea vessel owners are trading at 60-70% discounts to 2013 highs and every week seems to usher in a new wave of profit warnings, impairments or defaults. Although E&P customers are also taking a beating, they are firmly in the driving seat when it comes to bargaining power. U.S. Gulf of Mexico (GOM) crude oil production is estimated to increase to record high levels in 2017, even as oil prices remain low. EIA projects GOM production will average 1.63 million barrels per day (b/d) in 2016 and 1.79 million b/d in 2017, reaching 1.91 million b/d in December 2017. GOM production is expected to account for 18% and 21% of total forecast U.S. crude oil production in 2016 and 2017, respectively.

U.S. Gulf of Mexico (GOM) crude oil production is estimated to increase to record high levels in 2017, even as oil prices remain low. EIA projects GOM production will average 1.63 million barrels per day (b/d) in 2016 and 1.79 million b/d in 2017, reaching 1.91 million b/d in December 2017. GOM production is expected to account for 18% and 21% of total forecast U.S. crude oil production in 2016 and 2017, respectively. Source: U.S. Energy Information Administration,

Source: U.S. Energy Information Administration,  Source: EIA

Source: EIA An offloading system enables an offshore unit to offload oil to a shuttle tanker or tanker of opportunity.

An offloading system enables an offshore unit to offload oil to a shuttle tanker or tanker of opportunity. International manufacturer

International manufacturer  GE Oil & Gas has signed a Master Service Agreement with Statoil for new subsea projects that will enable GE to continue to support the international energy company’s value creation in a low oil price environment.

GE Oil & Gas has signed a Master Service Agreement with Statoil for new subsea projects that will enable GE to continue to support the international energy company’s value creation in a low oil price environment. McDermott International, Inc.

McDermott International, Inc. Photo credit: BOEM

Photo credit: BOEM