Det norske oljeselskap ASA (Det norske) has entered into an agreement with BP p.l.c. (BP) to merge with BP Norge AS (BP Norge) through a share purchase transaction, to create the leading independent offshore E&P company. The transaction will significantly strengthen the combined company’s operations, cost efficiency and growth potential, enabling the company to initiate dividend payment. The company will be named Aker BP ASA (Aker BP) and will be headquartered at Fornebuporten, Norway, with Aker ASA (Aker) and BP as main industrial shareholders.

Det norske oljeselskap ASA (Det norske) has entered into an agreement with BP p.l.c. (BP) to merge with BP Norge AS (BP Norge) through a share purchase transaction, to create the leading independent offshore E&P company. The transaction will significantly strengthen the combined company’s operations, cost efficiency and growth potential, enabling the company to initiate dividend payment. The company will be named Aker BP ASA (Aker BP) and will be headquartered at Fornebuporten, Norway, with Aker ASA (Aker) and BP as main industrial shareholders.

“We are proud to announce this merger to create Aker BP, the leading independent offshore E&P company. Aker BP will leverage on Det norske’s efficient operations, BP’s International Oil Company capabilities and Aker’s 175 years of industrial experience. Together, we are establishing a strong platform for creating value for our shareholders through our unique industrial capabilities, a world-class asset base and financial robustness. We look forward to taking advantage of the attractive growth potential on the Norwegian Continental Shelf through this industrial partnership with BP and to deliver on Aker BP’s dividend story,” says Øyvind Eriksen, Chairman of the Board of Directors in Det norske.

“We are proud to announce this merger to create Aker BP, the leading independent offshore E&P company. Aker BP will leverage on Det norske’s efficient operations, BP’s International Oil Company capabilities and Aker’s 175 years of industrial experience. Together, we are establishing a strong platform for creating value for our shareholders through our unique industrial capabilities, a world-class asset base and financial robustness. We look forward to taking advantage of the attractive growth potential on the Norwegian Continental Shelf through this industrial partnership with BP and to deliver on Aker BP’s dividend story,” says Øyvind Eriksen, Chairman of the Board of Directors in Det norske.

Aker BP will be jointly owned by Aker ASA (40%), BP (30%) and other Det norske shareholders (30%). As part of the transaction, Det norske will issue 135.1 million shares based on NOK 80 per share to BP as compensation for all shares in BP Norge, including assets, a tax loss carry forward of USD 267 million (nominal after-tax value) and a net cash position of USD 178 million. In parallel, Aker will acquire 33.8 million shares from BP at the same share price to achieve the agreed-upon ownership structure.

“We have been in close dialogue with Folketrygdfondet, Det norske’s second-largest shareholder, which supports the transaction. From our start as an exploration company, we have developed the company into a fully-fledged E&P. With BP, we are taking another leap forward with the creation of Aker BP,” says Eriksen.

The transaction will strengthen Det norske´s balance sheet and is credit accretive through a 35% reduction in net interest-bearing debt per barrel of oil equivalent of reserves. Aker BP aims to introduce a quarterly dividend policy. The first dividend payment is planned for the fourth quarter of 2016, conditional upon the approval of creditors.

“BP and Aker have matured a close collaboration through decades, and we are pleased to take advantage of the industrial expertise of both companies to create a large independent E&P company. The Norwegian Continental Shelf represents significant opportunities going forward and we are looking forward to working together with Aker to unlock the long term value of the company through growth and efficient operations. This innovative deal demonstrates how we can adapt our business model with strong and talented partners to remain competitive and grow where we see long-term benefit for our shareholders,” says Bob Dudley, Group Chief Executive of BP.

Aker BP will hold a portfolio of 97 licenses on the Norwegian Continental Shelf, of which 46 are operated. The combined company will hold an estimated 723 million barrels of oil equivalent P50 reserves, with a 2015 joint production of approximately 122,000 barrels of oil equivalent per day. Det norske and BP had at the end of 2015 a combined workforce of approximately 1,400 employees.

“Aker BP will have a balanced portfolio of operated assets and a high quality inventory of non-sanctioned discoveries. The company has potential to reach a production above 250,000 barrels of oil equivalent per day in 2023,” says Karl Johnny Hersvik, Chief Executive Officer of Det norske.

Aker BP has the ambition to leverage on a lean and nimble business model and will gain access to state-of-the-art technological know-how and capabilities, through the industrial collaboration with BP.

“We will implement simple processes across the combined entity, and build a fit-for-purpose organisational structure, with corresponding capacity and competence from both organisations. We expect to realise significant cost cuts and synergies, which will be implemented in close cooperation with employees and suppliers,” says Hersvik.

Øyvind Eriksen will remain Chairman of the Board of Directors and Karl Johnny Hersvik Chief Executive Officer of the combined company.

Please find presentation of the transaction and videostream here.

The transaction is subject to approval by the relevant Norwegian and European Union authorities. An extraordinary general meeting of Det norske will be scheduled to approve the transaction. BAHR and Arctic Securities has acted as advisors to Det norske on the transaction.

Facts about BP Norge:

Proved plus probable reserves (end 2015)

2015 net average production

Number of licenses

Number of employees (end 2015)

2015 total revenues

2015 total assets

2015 free cash flow

225 mmboe

62,100 boe/day

13

870

NOK 7.9 billion

NOK 23.5 billion NOK 2.5 billion

Facts about Det norske:

Proved plus probable reserves (end 2015)

2015 net average production

Number of licenses (end 2015)

Number of employees (end 2015)

2015 total revenues

2015 total assets

2015 free cash flow

498 mmboe

60,000 boe/day

84

530

USD 1.2 billion

USD 5.2 billion USD -0.5 billion

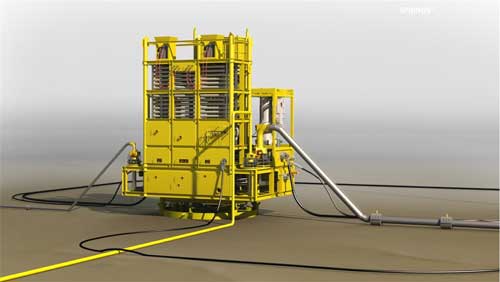

Photo courtesy: Trelleborg

Photo courtesy: Trelleborg Joseph Levy

Joseph Levy Johan Wramsby

Johan Wramsby Arash Hassanian

Arash Hassanian Delmar Systems, Inc.

Delmar Systems, Inc. Photo courtesy: Mermaid Maritime

Photo courtesy: Mermaid Maritime Kjell Eriksson, Regional Manager – Norway, DNV GL Oil & Gas

Kjell Eriksson, Regional Manager – Norway, DNV GL Oil & Gas Det norske oljeselskap ASA

Det norske oljeselskap ASA “We are proud to announce this merger to create Aker BP, the leading independent offshore E&P company. Aker BP will leverage on Det norske’s efficient operations, BP’s International Oil Company capabilities and Aker’s 175 years of industrial experience. Together, we are establishing a strong platform for creating value for our shareholders through our unique industrial capabilities, a world-class asset base and financial robustness. We look forward to taking advantage of the attractive growth potential on the Norwegian Continental Shelf through this industrial partnership with BP and to deliver on Aker BP’s dividend story,” says Øyvind Eriksen, Chairman of the Board of Directors in Det norske.

“We are proud to announce this merger to create Aker BP, the leading independent offshore E&P company. Aker BP will leverage on Det norske’s efficient operations, BP’s International Oil Company capabilities and Aker’s 175 years of industrial experience. Together, we are establishing a strong platform for creating value for our shareholders through our unique industrial capabilities, a world-class asset base and financial robustness. We look forward to taking advantage of the attractive growth potential on the Norwegian Continental Shelf through this industrial partnership with BP and to deliver on Aker BP’s dividend story,” says Øyvind Eriksen, Chairman of the Board of Directors in Det norske. A recently signed agreement will see

A recently signed agreement will see

The

The  Diamond Offshore’s Ocean BlackLion. Photo courtesy: Diamond Offshore

Diamond Offshore’s Ocean BlackLion. Photo courtesy: Diamond Offshore BP Egypt announced on June 9, another important gas discovery in the Baltim South Development Lease in the East Nile Delta.

BP Egypt announced on June 9, another important gas discovery in the Baltim South Development Lease in the East Nile Delta. BP

BP Semi subsea drilling vessel Polar Star: Photo courtesy: Gazflot

Semi subsea drilling vessel Polar Star: Photo courtesy: Gazflot Capt. Seven Gilkey, master, USNS Invincible and T-AGOS / T-AGM Port Captain and Program Manager, Capt. Jonathan "JC" Christian, accepting the awards on Crowley's behalf.

Capt. Seven Gilkey, master, USNS Invincible and T-AGOS / T-AGM Port Captain and Program Manager, Capt. Jonathan "JC" Christian, accepting the awards on Crowley's behalf.