U.S. Commercial Stocks Draw as Demand Increases Sharply

U.S. Commercial Stocks Draw as Demand Increases Sharply

U.S. commercial inventories drew for the second week in a row, the first time that has occurred this year. However, the decline was modest. Crude stocks saw a gain, while the four major products drew sharply; it was the largest weekly drop of the year and more than experienced at any weekly point in 2015.

Something Has to Give

NYMEX futures brief excursion back below $2/MMBtu suggests the market is having second thoughts about the industry’s ability to cope with surplus supplies this season. Though the largest weekly storage injections typically occur during the spring, when weather-related demand is at a low ebb, the recent acceleration in stockpiling has nevertheless reignited oversupply concerns.

Qatari LNG Pricing Is Getting More Competitive across Europe

LNG pricing around Europe is not so clear cut as Henry Hub + X or JKM – Y. As LNG globally is a continually maturing market, we are seeing gas pricing evolve in multiple ways across different regions of Europe. Based on volume of sales and available data, Qatari LNG prices offer the best window into the competitiveness of LNG on the Continent until now, but we are going to see U.S. LNG stake its claim in the months ahead and subvert the status quo.

U.S. Gulf LNG Cargos Ship Out; FOB Pricing Details Emerge. Liquefaction Costs?

As Shell’s first “contracted” cargo sets sail from Cheniere’s Sabine Pass terminal as part of a BG legacy tolling agreement, the first official FOB pricing data from February/March for U.S. Gulf-generated cargos at the export point at Sabine Pass is registering from U.S. government sources. The numbers, while striking, offer little in the way of information regarding the actual unit costs for U.S. liquefaction.

Indonesian Industrial End-Users Get Price Relief

The Indonesian government lowered the price of natural gas for seven industry sectors to accelerate economic growth and improve the competitiveness of national industry. The decline in gas prices retroactively from January 1, 2016, is contained in the Presidential Decree No. 40 of 2016. The seven industries that obtain the reduced gas prices are fertilizer, petrochemical, oleochemical, steel, ceramics, glass, and rubber gloves.

Italian Gas-Fired Dispatching Surges

In spite of a surprisingly low day-ahead price settlement, Italian day-ahead prices have been generally supported during May, in tandem with a significant recovery in the utilization of the Italian gas fleet, as shown by gas burn increasing over 25% Y/Y so far during May. While a lack of solar output has contributed to a larger increase in Italian gas dispatching over the past weeks, we see a structural trend toward a higher utilization of the CCGTs in the Italian market, in line with the recovery in the spark spread we have also seen along the curve. This is in part tied to the retirements of older steam units and, most likely, lower load factors of less efficient coal units.

A Tighter Market in 2017

PIRA’s outlook for the U.S. coal market in 2017 projects that the current trajectory of coal supply cuts will ultimately drive stockpile levels back into balance early next year. Rising natural gas (and oil) prices will result in potential coal market shortfall, as coal demand recovers against a backdrop of a much smaller and perhaps constrained coal logistics chain.

Massachusetts Supreme Court Decision: RGGI Is Not Enough

The Massachusetts Supreme Court handed down a unanimous opinion that found that the state’s DEP had failed to properly implement regulations as required under the state’s Global Warming Solutions Act. The DEP is now required to issue new regulations, but it is unclear how this can be enforced from a practical and political standpoint. The Court faulted the RGGI as inadequate because it allows Massachusetts entities to purchase out-of-state reductions. Massachusetts is the third-highest RGGI-emitting state and its emissions exceeded the state budget in 2015. More broadly, this decision highlights issues with the RGGI program review and its alignment with individual state climate goals.

Global Equities Fractionally Changed

Global equities were, on balance, modestly changed. The broad U.S. market was higher on a Friday-to-Friday basis. The growth indicator moved higher, while the defensive indicator gave ground. The strongest sectors were banking and energy. The weakest sectors were the defensive sectors of utilities and consumer staples. Internationally, most of the tracking indices moved higher, though Latin America posted a moderate decline.

Freight Market Outlook

Low oil prices are causing non-OPEC production to decline by 870 MB/D in 2016, offset by a near equal rise in OPEC output, benefiting the tanker sector. Most of the non-OPEC production declines in 2016 are for onshore grades in the U.S., China and Canada and shorter-haul grades from Mexico and the North Sea. These are being replaced by higher output from OPEC, mostly Iraq, Iran and Kuwait, boosting waterborne trade and ton-miles. While there are still substantial volumes of excess crude being contained on tankers via floating storage or operational slowdown, these will soon decline as excess stocks are worked down over the balance of 2016.

Propane Stocks in U.S. Build Slowly; Surplus Narrows

Strong export volumes and higher propane demand caused a relatively small build in propane (excluding propylene) stocks last week. The DOE reported the total propane inventory to be 70.2 MMB with a week-on-week build of 920,000 barrels. The year-on-year surplus narrowed by 1.3 MMB to a slim 4.6 MMB.

Stocks and Production Declined

Ethanol stocks declined for the ninth time in 13 weeks the week ending May 13. Output fell to 948 MB/D as several plants were undergoing routine maintenance.

Meal’s the Deal

Without question the meal market has been the bullish star since the May WASDE. The soybean complex is full of rumors as to why meal has outperformed everything else in the grain/oilseed sector, especially soybeans themselves. Speculative upside pressure continues to be strong despite an increase in futures margin last week, which seemed to do nothing but squeeze out some weak shorts. Traders appear desperate to find both a reason for the extended meal rally as well as searching for that elusive “top.”

Japanese Runs Ease; Both Crude and Product Stocks Build

Crude runs continued to fall amid increasing turnarounds. Crude imports fell back, but not sufficiently to prevent a crude stock build. Finished product stocks also built, largely due to middle distillate stocks moving higher. The kerosene stock build rate throttled back with higher demand and lower yield. Refining margins remain very soft, though on the week light product cracks improved.

State of the Global Economy in Early Second Quarter

In PIRA’s economic outlook for 2016, global activity is expected to pick up steam after a sluggish start to the year. For this forecast to track, data for the second quarter will need to register meaningful improvements from the first quarter. It is too early to determine whether the expected lift is taking place — key global statistical releases currently extend only through April. But available information has been generally encouraging for the U.S., Europe, India, and Brazil, while growth in China will probably stay similar to the pace observed during the first quarter.

Biofuels Prices Increase the Week Ending May 13

The main driver of increased biofuels prices was sharply lower stocks. Rising corn and petroleum prices provided support. Margins jumped.

Freight Rates Hold Steady on China’s Solid Start to 2016

Cape fixing volumes have slowed and bunker prices have continued to climb, giving fundamental support to rates. In a rollercoaster month, 180,000 dwt Cape rates have generally covered typical operating costs although the Baltic 5TC average weakened recently to close at just under $7,000/day. With the Panama Canal Expansion now a reality, voyage calculations show that exporting Colombian coal to Asia via an expanded Panama Canal will prove hard to justify in comparison to sending fully-loaded Capes to Asia via the Cape of Good Hope.

D.C. Circuit Grants En Banc Appeal for Clean Power Plan Litigation

In another unusual move in a litigation that has been marked by unusual moves, the D.C. Circuit, of its own volition, decided to shorten the review of the Clean Power Plan by bypassing the three-judge panel and preemptively granting review to the entire D.C. Circuit Court en banc. PIRA had expected a review by the Court en banc in the event EPA lost in the initial panel decision. That it has been granted now does not change our expected timeline much. Key to whether the move actually impacts the CPP’s chances at being upheld is whether two Democrat-appointed judges on the D.C. Circuit — Merrick Garland, and Nina Pillard — will recuse themselves from considering the merits of the case, impacting the balance of power on the Court.

Saudi Arabia's Financial Cushion Remains Substantial

Saudi Arabia's ability to weather lower oil prices remains substantial. Foreign exchange reserves have been liquidated by $159 billion, or 21%, since peaking in August 2014. Even so, reserves of foreign exchange are $587 billion at end-March, still a substantial cushion. As oil prices have recovered from January lows, the rate of FX liquidation has slowed with the decline for March being $5.6 billion. However, if Saudi Arabia were forced to continue drawing down reserves, it would at some point put increased pressure to re-adjust (devalue) its currency, which has been pegged to the dollar at 3.75 SAR/USD since 1986.

Fed Inflation Expectations Rise

The Cleveland Fed released its assessment of inflation expectations for May, which showed a second straight rise in inflation across all the key timeframes. The S&P 500 eased slightly on a weekly average basis, but it was modestly higher Friday-to-Friday. High yield debt (HYG) and emerging market debt (EMB) rose slightly. The U.S. dollar was generally higher, and commodities continued their uptrend.

EPA Proposes Biofuels Requirements Higher Than this Year’s Mandates

The proposed total renewable fuel mandate for 2017 is 18.8 billion gallons, up from 18.11 billion in 2016. It is much less than the 26.0 billion gallons in RFS2. The proposal will be open to public comment through 2011.

Coal Pricing Moves Sideways Along with Oil

Prompt seaborne coal prices mirrored those of oil last week, with a modest rally on Monday largely negated by a downshift over the balance of the week. 3Q16 API#4 (South Africa) and FOB Newcastle (Australia) prices ticked up modestly, while API#2 (Northwest Europe) lost some ground. Coal fundamentals, specifically in the Atlantic Basin, offer minimal support to pricing currently, given weak demand from Europe and strong supply from Russia. The most bullish factor for coal pricing is the continued strengthening in the oil market.

Asian Demand Update: China Again Boosts Regional Growth

PIRA's latest update of Asian oil demand again shows improved growth due to further gains in Chinese apparent demand. The most recent demand growth assessment is 1.16 MMB/D. PIRA's April update of Asian demand had shown growth of 909 MB/D. China's most recent growth assessment, covering Feb.-Apr., is showing growth of 850 MB/D, an improvement from the 525 MB/D seen last month (Jan.-Mar.). It still needs to be emphasized that the Chinese improvement is not necessarily actual consumption, but is based on apparent demand calculations and reflects a crude import figure for April of 7.9 MMB/D.

RIN Balances to Tighten; Prices to Rise

The EPA’s proposed renewable fuel standards for 2017 is expected to tighten the RIN market and drive up prices. The volume of banked RINs is plummeting and is anticipated to be practically exhausted by the end of 2017. RIN prices are expected to surpass $1 by the beginning of next year.

Canadian Oil Sands Restart Plans Halted

The situation in and around Fort McMurray has degraded significantly. Fires are now moving north of Fort McMurray towards oil sands sites. On May 16 a mandatory evacuation was issued for the area north of Fort McMurray, affecting Syncrude and Suncor’s main operations. The Enbridge system has also been affected with fires encroaching within 1 km of the crucial Cheecham terminal. Given the deteriorating situation, PIRA now estimates the cumulative loss will be around 25 million barrels in a most optimistic scenario and 30 million barrels in a most likely scenario.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

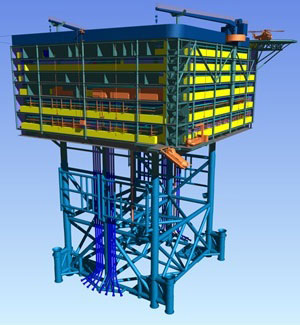

Photo credit: FMC

Photo credit: FMC Fugro deployed its WARIS to monitor bpTT’s subsea equipment integrity in an area of strong currents. Credit: Fugro

Fugro deployed its WARIS to monitor bpTT’s subsea equipment integrity in an area of strong currents. Credit: Fugro Rowan Relentless. Photo courtesy: Rowan

Rowan Relentless. Photo courtesy: Rowan Oilennium™ Ltd.

Oilennium™ Ltd. The eLearning course, which consists of seven modules, was launched and offered free-of-charge on 7 March 2016 by the IWCF. Within just 28 days, 2667 from 1000 companies in 100 countries had registered, and 745 had passed it.

The eLearning course, which consists of seven modules, was launched and offered free-of-charge on 7 March 2016 by the IWCF. Within just 28 days, 2667 from 1000 companies in 100 countries had registered, and 745 had passed it. Photo credit: Sevan Marine

Photo credit: Sevan Marine Olympic Athene. Photo credit: Olympic Shipping

Olympic Athene. Photo credit: Olympic Shipping Image credit: Damen

Image credit: Damen From small trawlers to large container ships, producing clean, fresh water while underway is an essential shipboard operation. Thousands of professional mariners have placed their trust in

From small trawlers to large container ships, producing clean, fresh water while underway is an essential shipboard operation. Thousands of professional mariners have placed their trust in  Artist's impression of the BorWin gamma HVDC platform © Petrofac

Artist's impression of the BorWin gamma HVDC platform © Petrofac Image Courtesy: Sky-Futures

Image Courtesy: Sky-Futures Subsea 7 S.A.

Subsea 7 S.A. U.S. Commercial Stocks Draw as Demand Increases Sharply

U.S. Commercial Stocks Draw as Demand Increases Sharply API has called on the federal government to align its offshore leasing program to reflect America’s new role as a global energy superpower and focus on the opportunities this creates for the country.

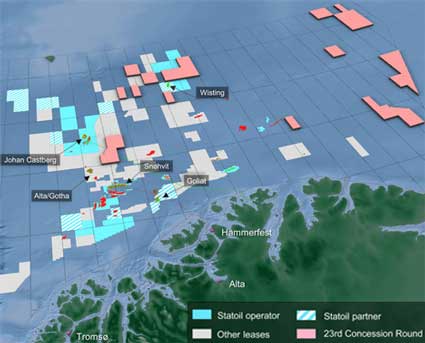

API has called on the federal government to align its offshore leasing program to reflect America’s new role as a global energy superpower and focus on the opportunities this creates for the country.  The Ministry of Petroleum and Energy has awarded five licenses to

The Ministry of Petroleum and Energy has awarded five licenses to  West Hercules drilling rig (Photo: Ole Jørgen Bratland/Statoil)

West Hercules drilling rig (Photo: Ole Jørgen Bratland/Statoil) Wood Group

Wood Group