NYC-based PIRA Energy Group believes that $60 oil is not enough: demand growth will outstrip supply growth without higher prices. In the U.S., the stock surplus continues to sharply narrow. In Japan, runs rise, crude and product stocks build. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group believes that $60 oil is not enough: demand growth will outstrip supply growth without higher prices. In the U.S., the stock surplus continues to sharply narrow. In Japan, runs rise, crude and product stocks build. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

$60 Oil Is Not Enough: Demand Growth Will Outstrip Supply Growth Without Higher Prices

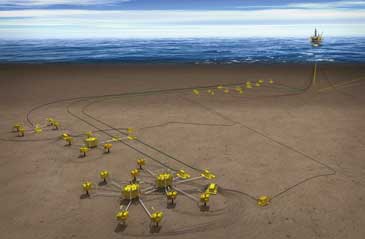

More than ever, the divide over where oil prices are heading in the future is driven by diverging views on supply costs. If you're one who believes that there will be very large quantities of shale oil (or light tight oil) available at a cost under $60/Bbl, enough to meet demand growth and offset depletion of existing production, then prices need not rise from current levels. Alternatively, if you believe that shale volumes will not be sufficient and higher-cost supplies, including oil sands and deepwater, will be required to balance global supply and demand, then a rise in price is likely required.

U.S. Stock Surplus Continues to Sharply Narrow

This past week’s 6.7 million barrel overall inventory decline sharply contrasts with last year’s 5.2 million barrel inventory build for the same week. The year-over-year stock surplus decreased by 12 million barrels to 128 million barrels, down from 177 million barrels at the beginning of April.

Japanese Crude Runs Rise; Crude and Product Stocks Build

Crude runs rose for the second straight week and crude imports recovered from low levels, which led to a sizable 3.7 MMBbls stock build. Major product demand performance was weaker and finished product stocks posted a build of slightly less than 1 MMBbls. The indicative refining margin remains very good. Light product cracks eased slightly while fuel oil cracks were a bit stronger.

Update on Russia Shale Oil Development

Interest in developing Russia's enormous shale oil was riding high in the last few years until the West imposed sanctions over the Ukraine crisis a year ago. Development of shale oil, which is specifically targeted by western sanctions, has slowed substantially. Activities in a number of JVs that have been formed with Western partners, notably between Rosneft and Exxon, Statoil and BP, Lukoil and Total, and Gazprom Neft and Shell, were put on hold. Efforts to replicate the shale boom in the U.S. have also hindered by the collapse of oil prices over the past year.

Financing Not a Major Concern for Most U.S. Independent Producers in Low Oil Price Environment

In the current low oil price environment, cash flow generated by U.S. independents has gone down, debt has increased and debt ratios (i.e. debt/EBITDA) have gone up. However, debt ratios are still acceptable for most U.S. independents, major debt repayments are not due for a few more years, and several companies have mitigated the downside by hedging future oil production. In addition, there is plenty of money available to be lent, interest rates are still low, it is fairly simple to issue new shares, and companies that try to sell assets to maintain liquidity are finding buyers. Therefore, financing is not a major concern for most U.S. independents. There are exceptions and some smaller and highly leveraged producers have had to restructure or declare bankruptcy.

U.S. LPG Prices Rebound

Prices rebounded strongly last week, as brine issues at Lonestar’s Mt. Belvieu storage terminal were seen as transitory and not endemic of a larger containment issue. July propane futures at the Texas market center rallied 10%, while butane, which has been unfairly dragged lower by C3 in recent weeks, jumped 14% to 57.2¢/gal by Friday’s settle. Ethane prices were mostly unchanged around 19¢/gal.

Inventories Drop to the Lowest Level Since January 2

U.S. ethanol production soared to 994 MB/D the week ending June 19, the highest level ever reported in the DOE's weekly supply report. Inventories declined by a whopping 878 thousand barrels to 19.8 million barrels, the lowest since the week ending January 2.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

Harvey Gulf International Marine (HGIM)

Harvey Gulf International Marine (HGIM)

A new piece of research could help the oil and gas industry understand and implement greater collaboration in the North Sea, as the sector continues to manage lower oil prices.

A new piece of research could help the oil and gas industry understand and implement greater collaboration in the North Sea, as the sector continues to manage lower oil prices.

NYC-based

NYC-based  Ivar Aasheim, head of field development on the Norwegian continental shelf, submitting the amendment to the PDO for the Gullfaks license to Minister of Petroleum and Energy, Tord Lien, on 30 June. (Photo: Ole Jørgen Bratland - Statoil)

Ivar Aasheim, head of field development on the Norwegian continental shelf, submitting the amendment to the PDO for the Gullfaks license to Minister of Petroleum and Energy, Tord Lien, on 30 June. (Photo: Ole Jørgen Bratland - Statoil) Swire Oilfield Services

Swire Oilfield Services Gibraltar-based ship repair company,

Gibraltar-based ship repair company,  Between 2009 and 2014, refining margins rarely exceeded $5/bbl in Europe and $8/bbl in Asia, whilst the USA was the only safe-haven, averaging $15/bbl. In 2015, however, the game changed as the global oversupply triggered a crude price collapse, resulting in healthier refining margins – year-to-date averages in Europe are $9, $12 in Asia and the in USA $20.

Between 2009 and 2014, refining margins rarely exceeded $5/bbl in Europe and $8/bbl in Asia, whilst the USA was the only safe-haven, averaging $15/bbl. In 2015, however, the game changed as the global oversupply triggered a crude price collapse, resulting in healthier refining margins – year-to-date averages in Europe are $9, $12 in Asia and the in USA $20. Fugro’s

Fugro’s Global operator in the subsea inspection, repair and maintenance sector (IRM),

Global operator in the subsea inspection, repair and maintenance sector (IRM),  Reducing expenditure while continuing to improve safety and reduce risk is a key driver for the oil and gas industry especially in today’s cost constrained environment.

Reducing expenditure while continuing to improve safety and reduce risk is a key driver for the oil and gas industry especially in today’s cost constrained environment.

GAC’s commitment to sustainability is demonstrated through its efforts to develop services like HullWiper, GAC EnvironHull’s diver-free underwater hull cleaning system that reduces fuel consumption whilst protecting the sea from contamination by removed fouling, alien species and chemical or toxic substances.

GAC’s commitment to sustainability is demonstrated through its efforts to develop services like HullWiper, GAC EnvironHull’s diver-free underwater hull cleaning system that reduces fuel consumption whilst protecting the sea from contamination by removed fouling, alien species and chemical or toxic substances.