NYC-based PIRA Energy Group reports that North American crude differentials were mixed in June, with little change in outright prices. In the U.S., both crude and product stocks posted a build. In Japan, crude runs jumped, crude stocks built, yet finished products drew. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group reports that North American crude differentials were mixed in June, with little change in outright prices. In the U.S., both crude and product stocks posted a build. In Japan, crude runs jumped, crude stocks built, yet finished products drew. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

North American Midcontinent Oil Forecast

North American crude differentials were mixed in June, with little change in outright prices. Rising pipeline takeaway capacity and shrinking production generally strengthened differentials in the Rockies, Permian Basin and Cushing area. At the same time, an end to wildfires and oil sands upgrader maintenance brought Canadian differentials back down from very strong springtime levels.

Another Large U.S. Stock Build

Both crude and product stocks posted a build last week, and weekly commercial stocks stand at 145 million barrels, or 13% above year-ago levels. Some of this excess is for infrastructure expansion. While moderating, demand growth remains strong, with total product demand growth estimated to be up 1.06 MMB/D versus last year, over the last four weeks. Our construct domestic crude supply – reported production plus balance item – has moved up in recent weeks, after seemingly peaking a few months ago.

Japanese Crude Runs Jump, Crude Stocks Build, Yet Finished Products Draw

Crude runs posted a significant rise as maintenance continues to wind down and unplanned outages began to restart. Crude imports increased and stocks built. Finished product stocks drew, due to lower jet-kero, gasoline, and fuel oil stocks more than offsetting builds in naphtha and gasoil. The indicative refining margin remained good, though it was somewhat softer on the week as all the major cracks again gave ground.

Strong Air Traffic Growth Means Robust Jet Fuel Demand

The International Air Transport Association (IATA) recently released their data on global air travel through May. On a global basis, Revenue Passenger Kilometers (RPKs) grew 6.3% for the year through May, when compared with the same period in 2014. Available Seat Kilometers (ASKs) are a better indication of jet fuel demand by eliminating the impact of changing load factors, and this measure of global air travel was up 5.9%. This strong growth in air travel indicates robust demand for jet fuel. PIRA's World Energy Demand model shows jet fuel consumption growing 3.6% in 2015, followed by a gain of 3.1% in 2016, with volumetric growth averaging more than 190 MB/D per year.

Smaller-Than-Expected 2Q Stock Build in Latest 3 Major OECD Data

Preliminary data indicate commercial onshore inventories in the three major OECD markets - - United States, Europe and Japan - - built 48 million barrels (525 MB/D) in the second quarter with crude stocks flat and the entire build essentially occurring outside of the major products. The overall stock increase is less than last year’s 66 million barrel stock build (725 MB/D) in the second quarter. The stock data are consistent with PIRA’s just released World Oil Market Forecast (June 30) and PIRA’s estimate of 260 million barrels of surplus global commercial inventory accumulated over the last four quarters, a far smaller figure than market analysts were generally expecting. Gasoline stocks are especially low, after adjusting both for higher 3Q demand in these markets and export demand.

U.S. LPG Prices Stand Strong in Flat Price Rout

The U.S. NGL complex outperformed the broader energy complex by a wide margin. July propane at Mt Belvieu was only 1¢ lower, settling near 43.5¢/gal Friday. Propane prices increased from below 30% of WTI to near 35% in this week’s price action. Contango in the front three months of the Mt Belvieu forward curve narrowed to the tightest levels in over a month – just under 3.5¢/gal, a remarkable reversal from nearly 8¢ prior to June expiry. Butane at the market center managed to increase 0.5% on the week to settle near 58.2¢/gal.

U.S. Ethanol Prices Jump

Ethanol prices soared the week ending July 3, following a spike in corn values. Lower output and inventories, as well as higher production of ethanol-blended gasoline, provided support.

U.S. Output and Inventories Increase

U.S. ethanol production climbed to 987 MB/D from a six-week low 968 MB/D the week ending July 3, continuing the saw-toothed pattern that began in late May. Stocks built by 309 thousand barrels to 19.8 million, reversing the nearly identical draw that occurred one week earlier.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

MOL Group has successfully completed a deal to acquire Ithaca Petroleum Norge

MOL Group has successfully completed a deal to acquire Ithaca Petroleum Norge

“Direct causes of Lost Time Injuries (LTIs) continue to be the ‘usual candidates’ – with struck by moving/falling objects the highest accounting for 110 incidents (26%); falls on the same level (including slips and trips) in second place with 88 incidents 21%) and struck against, entrapment, and falls from height accounting for 37 (9%), 34 (8%) and 33 (8%) incidents respectively. In all there were 424 LTIs recorded by IMCA members,” reports IMCA’s Technical Director and Acting Chief Executive, Jane Bugler.

“Direct causes of Lost Time Injuries (LTIs) continue to be the ‘usual candidates’ – with struck by moving/falling objects the highest accounting for 110 incidents (26%); falls on the same level (including slips and trips) in second place with 88 incidents 21%) and struck against, entrapment, and falls from height accounting for 37 (9%), 34 (8%) and 33 (8%) incidents respectively. In all there were 424 LTIs recorded by IMCA members,” reports IMCA’s Technical Director and Acting Chief Executive, Jane Bugler.  For the ninth consecutive year,

For the ninth consecutive year,

NYC-based

NYC-based

Oil and gas industry skills organization

Oil and gas industry skills organization  As strained negotiations between the Greek government and European financial ministers enter the end-game, the impact on energy markets remains uncertain. Setting aside both the deeply troubling social impact for Greek citizens and other major forces – from Chinese equities to an Iranian nuclear deal – the threat of Greece leaving the Euro is already dampening crude prices. The concern for oil markets centers around two factors: the consequences for economic stability and growth in Europe, and strengthening of the US dollar.

As strained negotiations between the Greek government and European financial ministers enter the end-game, the impact on energy markets remains uncertain. Setting aside both the deeply troubling social impact for Greek citizens and other major forces – from Chinese equities to an Iranian nuclear deal – the threat of Greece leaving the Euro is already dampening crude prices. The concern for oil markets centers around two factors: the consequences for economic stability and growth in Europe, and strengthening of the US dollar. Photo Caption: Jan Ward, Chair of AnTech’s Board of Directors

Photo Caption: Jan Ward, Chair of AnTech’s Board of Directors  The company has equipped its trenching vessel, Fugro Saltire (photo), with a compact, custom-made, cable-lay spread that comprises a reel drive system to store the cables, a tensioner to lay them, twin winches and a quadrant deployment system on rails. The equipment is fitted to the rear deck of the vessel alongside the existing trenching equipment.

The company has equipped its trenching vessel, Fugro Saltire (photo), with a compact, custom-made, cable-lay spread that comprises a reel drive system to store the cables, a tensioner to lay them, twin winches and a quadrant deployment system on rails. The equipment is fitted to the rear deck of the vessel alongside the existing trenching equipment.

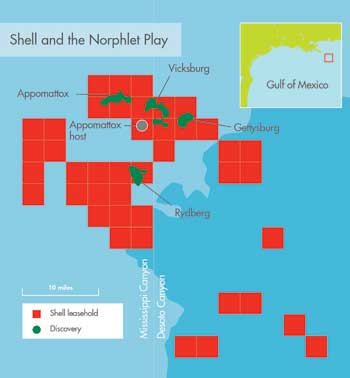

Royal Dutch Shell plc (Shell)

Royal Dutch Shell plc (Shell)