NYC-based PIRA Energy Group reports that May WTI price rises as Cushing crude stocks fall. In the U.S., commercial stocks reach another new record level, even as surplus falls. In Japan, crude runs continue dropping with higher stocks. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group reports that May WTI price rises as Cushing crude stocks fall. In the U.S., commercial stocks reach another new record level, even as surplus falls. In Japan, crude runs continue dropping with higher stocks. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

May WTI Price Rises as Cushing Crude Stocks Fall

The rebound in crude prices continued in May, with WTI averaging nearly $60/Bbl and exceeding that level on several occasions. Crude balances remained tight in Canada and West Texas, and stocks began to decline from record high levels in Cushing and the Rockies. Most price differentials were little changed, remaining near or slightly above pipeline parity, except for heavy Canadian grades, which continued to strengthen on heavy demand and late-month wildfires.

U.S. Commercial Stocks Reach Another New Record Level, Even as Surplus Falls

Total commercial stocks built a combined 7.4 million barrels this week, but still built less than this week last year, so the year-over-year surplus narrowed. Demand fell about 1.1 million barrels a day this week, reflecting a similar fall last year, most likely influenced by the Memorial Day holiday. The total commercial stock level was a new record high.

Japanese Crude Runs Continue Dropping with Higher Stocks

Crude runs dropped another 89 MB/D, with a big reduction in the crude import rate such that the crude stock build was limited to 1.6 MMBbls. Finished product stocks rose primarily due to builds in naphtha and fuel oil with a lesser rise in kerosene. Gasoline stocks built slightly and gasoil stocks drew. The indicative refining margin remains good but slightly lower on the week due to narrower light product cracks but better fuel oil cracks.

2015 Iraq Oil Monitor

Rhetoric is escalating between Baghdad and the KRG over alleged noncompliance with the export- and revenue-sharing agreement. The need for revenue is expected to drive cooperation for now, but risks to the deal are rising. The fight against ISIS does not present an imminent danger to Baghdad or southern production, but the growing role of Shiite militias in Anbar province threatens to exacerbate sectarian tensions. Investment cuts could endanger anticipated production ramps, but new infrastructure and segregation of crude grades at Basrah should facilitate higher exports starting in June.

EIA’s Upwardly Revised U.S. Monthly Crude Production Not Necessarily Bearish

The recent upward revisions to monthly and weekly crude production data caught analysts off guard. We do not think this is a bearish development, however, because the offsetting decline to the crude balance item, following the upward revisions to crude production, minimizes the bearish impact of the higher reported production numbers. March crude stocks and stock change were revised down, not up, in spite of the highest reported monthly crude production since 1970.

OPEC

OPEC met to roll over the existing agreement. Efforts to have a non-OPEC/OPEC output cut have been thwarted by Russia’s unwillingness to participate. The recent strength in oil prices over the last month has reduced pressure for this initiative. The Gulf OPEC members see strong demand for their crude and expect prices to strengthen to end year with $75/Bbl Brent a distinct possibility.

Ethanol Prices Fall

U.S. ethanol prices tumbled the week ending May 29 pressured by higher production and lower corn values. The EPA's bearish announcement of proposed biofuel mandates added to the decline.

Ethanol Output Increases

U.S. ethanol production continued to advance the week ending My 29, rising to a four-month high 972 MB/D from 969 MB/D in the prior week. Inventories were essentially flat, declining by only 29 thousand barrels to 20.1 million barrels.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

NYC-based

NYC-based

Mattress recovery operation

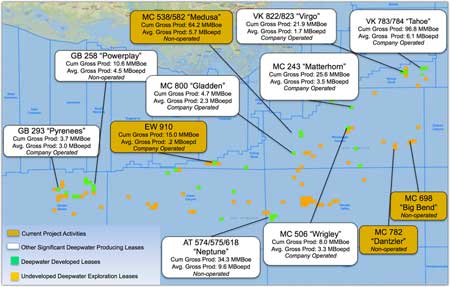

Mattress recovery operation  Revolutionizing subsea field architecture from concept delivery and beyond

Revolutionizing subsea field architecture from concept delivery and beyond Despite surging production from U.S. shale plays, the scale of long-term production remains uncertain, leading to the question of where will be the next major play? Attention is being focused on Arctic Alaska, where reserves are waiting to be exploited. Geologists estimate total Arctic oil reserves of nearly 134bn BOE, 28% of which lie in US territory, and some 39bn BOE of natural gas. So what’s the catch?

Despite surging production from U.S. shale plays, the scale of long-term production remains uncertain, leading to the question of where will be the next major play? Attention is being focused on Arctic Alaska, where reserves are waiting to be exploited. Geologists estimate total Arctic oil reserves of nearly 134bn BOE, 28% of which lie in US territory, and some 39bn BOE of natural gas. So what’s the catch? Caption: Walter Robertson, left, and Mike Munro

Caption: Walter Robertson, left, and Mike Munro

Maersk Drilling is live on IFS Applications and will continue the rollout and further development of advanced maintenance planning functionality in collaboration with IFS

Maersk Drilling is live on IFS Applications and will continue the rollout and further development of advanced maintenance planning functionality in collaboration with IFS The

The

Global operator in the subsea inspection, repair and maintenance sector (IRM),

Global operator in the subsea inspection, repair and maintenance sector (IRM),  Excelerate FSRU vessel “Exquisite” Courtesy Excelerate Energy

Excelerate FSRU vessel “Exquisite” Courtesy Excelerate Energy