NYC-based PIRA Energy Group reports that problems at Canadian oil sands facilities curtailed production and lifted northern differentials last month, while outright crude prices registered a very mild recovery. In the U.S., total commercial stocks built less than last week, albeit to a new record level. In Japan, crude stocks posted a large rise, but finished products drew. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group reports that problems at Canadian oil sands facilities curtailed production and lifted northern differentials last month, while outright crude prices registered a very mild recovery. In the U.S., total commercial stocks built less than last week, albeit to a new record level. In Japan, crude stocks posted a large rise, but finished products drew. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

North American Midcontinent Oil Forecast

Problems at Canadian oil sands facilities curtailed production and lifted northern differentials last month, while outright crude prices registered a very mild recovery. Crude stocks declined from Alberta to Oklahoma, but rose along the Gulf Coast, lifting Cushing WTI values relative to foreign and coastal grades.

Weather Emerges to Add Demand Early in the Fourth Quarter; Supply Comes From…

The PIRA 10-day daily demand outlook shows a significant increase in demand emerging due to colder than normal weather. The colder-than-normal weather is not emerging in the heart of the winter, but it is emerging at a time when minor supply side questions have been raised on several fronts.

Colder Weather and Poor Wind Generation Underpin Short-term Prices

While French nuclear unavailability has returned well above year ago levels, colder weather will add about 5 GWs of demand on average in France in the upcoming week, firming day ahead prices. The upcoming week will provide some indications of the potential swings in French exports under a colder weather scenario, especially in light of the recent increase in the NTC with Spain and introduction of the FB Market Coupling with CWE.

U.S. NGLs Rally with Crude

The U.S. NGL complex rose with broader energy markets last week. Crude oil’s 9% rally helped Mt Belvieu propane prices to increase by 4.2% to 49.1¢/gal for November delivery – this despite a 1.6 MMB increase in stocks to a record 95.9 MMB. Butane at the market center improved by nearly the same amount, while purity ethane prices jumped to near the strongest levels of the year, just below 20¢/MMBtu.

Coal Moves Higher On Oil and Gas Rally, Labor Strike

The coal market experienced its first weekly rally since early August, with prices rising by between $0.70/mt to $1.45/mt across the forward curve. The rise in pricing was mostly due to the labor strike in South Africa, but also stronger oil and gas prices. While the loss of some South African coal is unquestionably bullish for pricing, the magnitude of the oversupply in the global seaborne market will limit the upside for pricing even if it lasts for several weeks. PIRA continues to believe that coal prices over the next 90 days have limited upside, although an expected rise in oil prices in the latter stages of 2016 should stimulate coal pricing somewhat as costs rise. However, until demand and supply structurally recalibrate, any bullish rally will likely be tamped down by the prevailing fundamentals.

California Emissions Trading System Market Outlook

The surrender for Compliance Period 1 (2013-14) will take place in less than a month, on Nov. 2nd. Offset usage will ultimately determine the size of the bank carryover. While the CP1 offset limit is about 26 MT, sources do not appear well-positioned to maximize offsets use. CARB is engaging stakeholders in developing post-2020 regulations to implement the 2030 target (Scoping Plan), to amend the cap and trade and to comply with the Clean Power Plan. While CARB is looking to streamline the offsets process, at the same time it has moved to invalidate additional offsets. In moving forward with its own ambitious, economy-wide and international climate agenda, CA does not appear to make interstate carbon trading under the CPP a priority. Allowance prices held steady in Sept., although moved up at the end of the month. PIRA continues to expect a rise in allowance prices through the end of the year, with floor price expectations for 2017 starting to play a larger role.

U.S. Ethanol Prices Increase

Prices rose the week ending October 2. Higher corn and oil assessments provided support, but manufacturing margins decreased partly due to lower co-product DDG values.

WASDE Corn Surprise

A decrease in corn acreage was expected, an increase in yield was not. In the end, carry-out for the current marketing year was reduced 31 million bushels, not enough for the Managed Money net long which added 50K longs in the week prior to the report. For now, the corn market seems once again stuck in the $3.75 to $4.00 range, making trading difficult to say the least.

China Is Not Facing Currency Crisis; Key Central Banks Update Their Message

After an unexpected currency devaluation in mid-August, China’s monetary authority has drawn down foreign exchange reserves aggressively to defend the post-devaluation exchange rate. Unlike high-flying emerging Asian economies in mid-1990s, China is not facing a balance-of-payment crisis. But the government is still likely to guide the currency lower in the not so distant future. Communication materials were released by the U.S. Federal Reserve, the European Central Bank, and the Bank of Japan this week. Financial markets now widely expect the BOJ to expand its quantitative easing program in end-October.

U.S. Commercial Stock Build Slows

Total commercial stocks built less than last week, albeit to a new record level. They also built less than last year, so the surplus narrowed. Driven primarily by weakness in other demand, the latest four-week average of total petroleum demand was negative for the first time since earlier in the year. The decline in crude runs due to refinery maintenance dominates the crude balance, and we expect fall maintenance to peak the week of October 9. The latest monthly average of weekly domestic crude supply continues to decline.

US Gulf/ Mideast Gulf Competition to Emerge This Winter

The competition between Qatar and the U.S. for market share in N.W. Europe is about to heat up with first volumes from Sabine Pass coming this winter. Both suppliers have contract obligations to varying degrees for N.W. Europe specifically, where the spot market is going into the winter with relatively low stocks and is counting on LNG, to a larger extent, to balance seasonal increases.

U.S. Ethanol Production Higher

U.S. ethanol production climbed the week ending October 2, rising to 950 MB/D from 943 MB/D in the prior week. Inventories were essentially flat, building by only 30 thousand barrels to 18.8 million barrels.

Key Indicators Show Strength

The S&P 500 posted strong gains for the week, the best weekly performance since mid-December ‘14. All the related indicators also improved (Russell 2000, volatility, high yield credit and emerging market credit). Overall, commodities improved, both energy and ex-energy. With regard to currencies, many of the currency groups that had been performing poorly posted noted strength. Emerging Asia, along with commodity producers such as Russia, Brazil, Canada and Australia all posted gains. Indian, South African and Turkish currencies also displayed strength.

Japanese Crude Stocks Post a Large Rise, but Finished Products Draw

For the week, crude runs eased slightly with higher imports such that crude stocks posted a large rise to begin October. Finished product stocks drew on lower gasoline, gasoil, and naphtha inventories. Gasoline demand eased, but so did yield and stocks drew slightly. Gasoil demand rebounded from holiday impacts, while yield rose, but exports ebbed and stocks posted a moderate draw. Kerosene demand rebounded with lower yield and the stock build rate moderated. Indicative refining margins remain good.

Global Equities Post Another Strong Rebound Global equity markets posted a solid rebound this week, the second in a row. In the U.S. market, energy, materials, and industrials all outperformed by a large margin. They utility index was the laggard, but still posted a gain. Internationally, all the tracking indices again advanced with Latin America and emerging markets doing the best.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

Two recent events have highlighted how the

Two recent events have highlighted how the

Jamie Burrows,

Jamie Burrows,  The acquisition of

The acquisition of  McDermott has been awarded a sizeable brownfield offshore project by Qatar Petroleum for the engineering, procurement, construction and installation (EPCI) of four wellhead jackets, similar to this file photograph. (Photo: Business Wire)

McDermott has been awarded a sizeable brownfield offshore project by Qatar Petroleum for the engineering, procurement, construction and installation (EPCI) of four wellhead jackets, similar to this file photograph. (Photo: Business Wire)  Asset Guardian Solutions Ltd (AGSL)

Asset Guardian Solutions Ltd (AGSL) As Mexico’s first offshore bidding round for already discovered fields saw bids significantly higher than the minimum set up by the government, adding further transparency to the process would be positive for the round as it approaches its deepwater phase, according to an analyst with research and consulting firm

As Mexico’s first offshore bidding round for already discovered fields saw bids significantly higher than the minimum set up by the government, adding further transparency to the process would be positive for the round as it approaches its deepwater phase, according to an analyst with research and consulting firm  The World Ocean Council (WOC)

The World Ocean Council (WOC) James Fisher and Sons plc has announced the launch of

James Fisher and Sons plc has announced the launch of  On behalf of the Johan Sverdrup license,

On behalf of the Johan Sverdrup license,  Global shipping, logistics and marine services provider

Global shipping, logistics and marine services provider  Claxton,

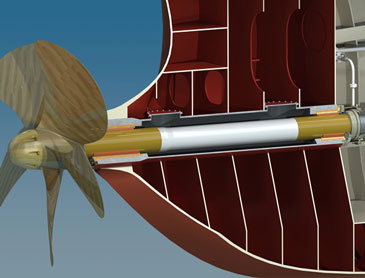

Claxton,  Thordon Bearings’

Thordon Bearings’ NYC-based

NYC-based