Deep Sea Mooring (DSM), a leading provider of mooring solutions, is expanding its international footprint with the opening of a new office in Perth, Australia. The facility, which will officially open 8 October, will provide sales and technical support to customers across Australasia.

Deep Sea Mooring (DSM), a leading provider of mooring solutions, is expanding its international footprint with the opening of a new office in Perth, Australia. The facility, which will officially open 8 October, will provide sales and technical support to customers across Australasia.

To support its mooring operations, the company has also secured a 13,000m² yard in Karratha, 1500km north of Perth, which is a main access point to major oil and gas developments offshore Western Australia.

DSM CEO, Åge Straume, says the company has confidence in Australia's future as a key global player in the offshore oil and gas industry.r and size of developments offshore Australia has created a steady market for drilling rigs," he explains, noting, "and with the local industry's increasingly stringent standards we believe there's now a strong foundation for long-term growth and success.

"Companies operating in Australia are very QHSE oriented," Straume adds, "so they understand the benefits of quality mooring equipment, smarter mooring solutions and performing pre-laying in order to maximize uptime. This fits our profile and our offer is tailored to meet that market demand head on."

Testament to this conviction is the 7000 tons of mooring equipment in transit to the Karratha yard. The company has already procured most of the equipment heading for Australia, which has a value of USD 30m, bringing the total value of its rental pool up to more than USD 125m. The equipment used in DSM's Australian operations will be optimized for local hard-rock geological formations.

"We will also bring our unique combination of planning tools, logistics systems and patented RFID electronic marking on all equipment," Straume states. "These proven innovative systems reduce operational time, impacting positively on safety and efficiency standards."

Expansion into the Australian market comes off the back of a track record of success on mooring projects around the world and in particular in the North Sea, where the company honed its advanced technology and harsh environment experience. Recent DSM developments of note include project wins with Repsol and Maersk Drilling.

The Australian subsidiary, Deep Sea Mooring Australia Pty Ltd., will initially employ nine people, led by Managing Director, Barry Silver, who brings over 16 years of experience in the mooring industry.

"Our regional contacts report that they see a real need for increased competition in the Australian market and welcome our arrival. We bring proven expertise, innovative technology and a fresh perspective to the industry here, and we believe that's a compelling business proposition for this exciting, dynamic marketplace," states Silver.

Fugro Pioneer second of three vessels to be delivered to Fugro in 2014

Fugro Pioneer second of three vessels to be delivered to Fugro in 2014 Deep Sea Mooring (DSM)

Deep Sea Mooring (DSM) Songa Dee (photo)

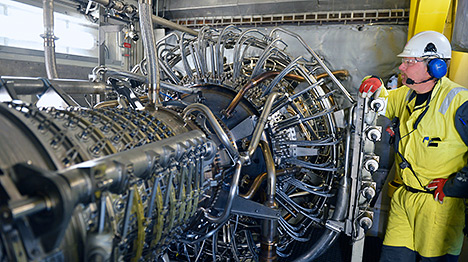

Songa Dee (photo) The compressor will help boost recovery rate and accelerate production on the Kvitebjørn field. (Photos: Harald Pettersen)

The compressor will help boost recovery rate and accelerate production on the Kvitebjørn field. (Photos: Harald Pettersen) NYC-based

NYC-based  Aberdeen-based wireline and well intervention technology specialist

Aberdeen-based wireline and well intervention technology specialist  Modeled After Innovative Gulf of Mexico Terminal Hub, C-Port

Modeled After Innovative Gulf of Mexico Terminal Hub, C-Port Global energy company Repsol has selected

Global energy company Repsol has selected  In many of the key deepwater markets, estimated to be worth $72bn by 2018, E&P and OFS companies alike are exposed to challenging local content requirements. Local content agreements are typically motivated by a desire to stimulate industrial development, and promote technology transfer. A typical local content agreement stipulates that E&P companies must procure a minimum percentage of equipment and services from local contractors. Recent examples can be seen in countries such as Brazil (Petrobras new-build FPSO units to use domestically-built hulls), Angola (BP partnering with Sonangol) and Nigeria (Total utilising a 90% local work force for the AKPO FPSO).

In many of the key deepwater markets, estimated to be worth $72bn by 2018, E&P and OFS companies alike are exposed to challenging local content requirements. Local content agreements are typically motivated by a desire to stimulate industrial development, and promote technology transfer. A typical local content agreement stipulates that E&P companies must procure a minimum percentage of equipment and services from local contractors. Recent examples can be seen in countries such as Brazil (Petrobras new-build FPSO units to use domestically-built hulls), Angola (BP partnering with Sonangol) and Nigeria (Total utilising a 90% local work force for the AKPO FPSO). Danish product tanker carrier

Danish product tanker carrier  Damen Fast Crew Suppliers (FCS) 2610 at Wind Energy in Hamburg. The two new vessels, to be named SeaZip 3 and SeaZip 4, will be mobilized in transporting personnel and small quantities of freight to North Sea offshore wind farms.

Damen Fast Crew Suppliers (FCS) 2610 at Wind Energy in Hamburg. The two new vessels, to be named SeaZip 3 and SeaZip 4, will be mobilized in transporting personnel and small quantities of freight to North Sea offshore wind farms. Helix Energy Solutions Group, Inc

Helix Energy Solutions Group, Inc

HC2 Holdings, Inc. ("HC2")

HC2 Holdings, Inc. ("HC2") CSA Ocean Sciences Inc.

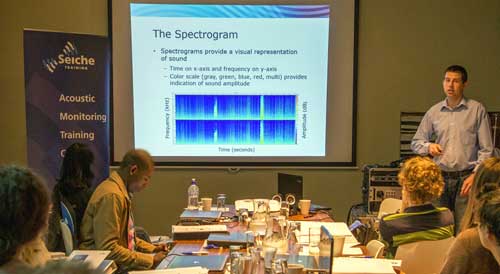

CSA Ocean Sciences Inc. Day 1 (classroom)

Day 1 (classroom) Three tugs of

Three tugs of