In the UK and North Sea alone, around 475 installations will eventually have to be decommissioned and the associated costs for the rest of this decade are expected to average at £1.3billion per year .

In the UK and North Sea alone, around 475 installations will eventually have to be decommissioned and the associated costs for the rest of this decade are expected to average at £1.3billion per year .

Accounting for a potential 40-50% of the cost of decommissioning an asset, well abandonment is an increasingly costly and complex activity to consider. Preparations must start early and in the North Sea, that time is already upon us.

This topic will be a key focus for the Society of Petroleum Engineers (SPE) on Tuesday, 21 April, as the Aberdeen Section hosts the 5th European Well Abandonment Seminar.

A number of major operators, service companies and industry bodies are set to highlight new and existing abandonment techniques and case studies, including Decom North Sea, GE Oil & Gas, Hess and Shell UK.

Ross Lowdon, chairman of SPE Aberdeen, said: "The number of decommissioning projects estimated for the future is the reason behind the rapid growth of the well abandonment sector, and this will only continue to increase.

"The North Sea is home to many leaders in modern well abandonment techniques and this forum is a hugely effective way for the industry to come together, sharing best practice and new technologies. In order to maximise efficiency whilst importantly keeping costs to a minimum and safety as priority, we must learn from the innovations of others."

This seminar will be of interest to anyone involved in, or planning for well abandonment across the drilling, completions, project, well integrity, environmental and commercial personnel disciplines.

Mr Lowdon continued: "I would urge anyone who is, or is likely to become involved in decommissioning to attend this event. We have an excellent programme of speakers who will cover some of the well abandonment industry's most pressing issues, which I am confident will stimulate conversation and collaboration."

New for this year is the pre-conference training day, 'An Overview on Well Abandonment'. This course will be presented by technical experts from Baker Hughes and Helix Well Ops and is a must-attend for anyone looking for an introduction or refresher on this specialist subject.

The pre-conference training day will take place on Monday, 20 April with the full seminar and exhibition following on Tuesday, 21 April. Both events will be hosted at the Aberdeen Exhibition and Conference Centre.

For seminar bookings, exhibition space and sponsorship opportunities, please visit www.spe-uk.org/aberdeen

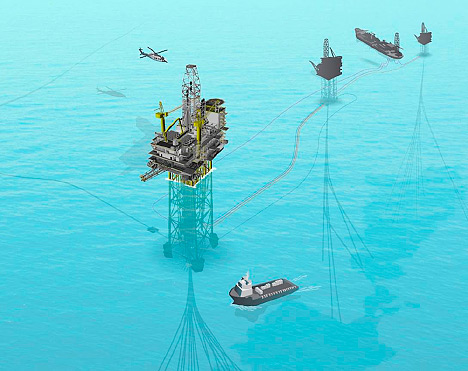

Phase II solution, with Platform C in the foreground.

Phase II solution, with Platform C in the foreground. At OTC 2015,

At OTC 2015,

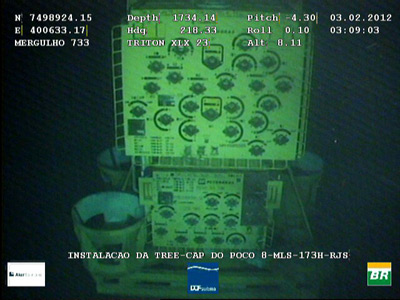

Deep Endeavour is a multi-purpose subsea support construction and cable-lay vessel, with work class ROV, riser recovery and deployment system and more than 1,600m2 of deck space. Vessels track record includes ROV based subsea maintenance operations, saturation diving support, as well topsides construction support. Vessel has already proven her performance in the Brazilian Inspection, Maintenance and Repair (IMR) market, and will maintain her special capability for repairing flexible pipelines and electro hydraulic control umbilicals.

Deep Endeavour is a multi-purpose subsea support construction and cable-lay vessel, with work class ROV, riser recovery and deployment system and more than 1,600m2 of deck space. Vessels track record includes ROV based subsea maintenance operations, saturation diving support, as well topsides construction support. Vessel has already proven her performance in the Brazilian Inspection, Maintenance and Repair (IMR) market, and will maintain her special capability for repairing flexible pipelines and electro hydraulic control umbilicals. McDermott International, Inc.

McDermott International, Inc. McDermott has successfully executed several offshore electrification projects for Saudi Aramco such as the one pictured. (Photo: Business Wire)

McDermott has successfully executed several offshore electrification projects for Saudi Aramco such as the one pictured. (Photo: Business Wire) McDermott's Indonesian fabrication facility has broad experience delivering customized and high-quality subsea solutions.

McDermott's Indonesian fabrication facility has broad experience delivering customized and high-quality subsea solutions. NYC-based

NYC-based

Peterhead offshore supply base, owned and operated by ASCO (Photo: ASCO)

Peterhead offshore supply base, owned and operated by ASCO (Photo: ASCO) Cal Dive International, Inc

Cal Dive International, Inc Suretank,

Suretank, Subsea 7 S.A.

Subsea 7 S.A.  In the UK and North Sea alone, around 475 installations will eventually have to be decommissioned and the associated costs for the rest of this decade are expected to average at £1.3billion per year .

In the UK and North Sea alone, around 475 installations will eventually have to be decommissioned and the associated costs for the rest of this decade are expected to average at £1.3billion per year . Bibby Offshore Holdings Limited

Bibby Offshore Holdings Limited