Sale reflects market conditions, industry interest in steady development of federal offshore oil and gas resources

The Department of the Interior's Bureau of Ocean Energy Management (BOEM) t held an oil and gas lease sale yesterday for the Central Gulf of Mexico that drew $538,780,056 in high bids for tracts on the U.S. Outer Continental Shelf offshore Louisiana, Mississippi and Alabama.

The Department of the Interior's Bureau of Ocean Energy Management (BOEM) t held an oil and gas lease sale yesterday for the Central Gulf of Mexico that drew $538,780,056 in high bids for tracts on the U.S. Outer Continental Shelf offshore Louisiana, Mississippi and Alabama.

A total of 42 offshore energy companies submitted 195 bids on 169 tracts, covering about 923,700 acres. The sum of all bids received totaled $583,201,520.

"The Gulf remains a critical component of our nation's energy portfolio and holds important energy resources that spur economic opportunities for Gulf producing states, creating jobs and home-grown energy and reducing our dependence on foreign oil," said Secretary of the Interior Sally Jewell, who opened the lease sale. "While this sale reflects today's market conditions and industry's current development strategy, it underscores a steady, continued interest in developing these federal offshore oil and gas resources."

Lease Sale 235 builds on the first six sales held under the Obama Administration's Outer Continental Shelf Oil and Gas Leasing Program for 2012-2017 (Five Year Program) that offered more than 60 million acres for development, garnered $2.4 billion in bid revenues and awarded 877 leases. The Five Year Program makes available all offshore areas with the highest resource potential and includes 75 percent of the nation's undiscovered, technically recoverable offshore oil and gas resources.

"As one the most productive basins in the world, the Gulf of Mexico continues to be the keystone of the Nation's offshore oil and gas resources," BOEM Director Abigail Ross Hopper said. "The recent drop in oil prices and continued low natural gas prices obviously affect industry's short-term investment decisions, but the Gulf's long-term value to the nation remains high and the President's energy strategy continues to offer millions of offshore acres for development while protecting the human, marine and coastal environments, and ensuring a fair return to the American people."

Lease Sale 235 offered 7,788 unleased blocks, covering about 41.2 million acres, located from three to 230 nautical miles offshore in water depths ranging from nine to more than 11,115 feet (3 to 3,400 meters). BOEM estimates the sale could result in the production of 460 to 890 million barrels of oil, and 1.9 trillion cubic feet to 3.9 trillion cubic feet of natural gas.

The lease sale also included 201 blocks located, or partially located, within the three statute mile U.S. - Mexico Boundary Area, as well as blocks within the former Western Gap that lie within 1.4 nautical miles north of the Continental Shelf Boundary between the United States and Mexico. These ares are subject to the terms of the U.S. - Mexico Transboundary Hydrocarbon Agreement which entered into force on July 18, 2014. None of those blocks received bids yesterday.

BOEM established the terms for this sale after extensive environmental analysis, public comment and consideration of the best scientific information available. These terms include measures to protect the environment, such as stipulations requiring that operators protect biologically sensitive features as well as providing trained protected species observers. The observers would monitor marine mammals and sea turtles to ensure compliance with protective measures and restrict operations when conditions warrant.

The lease terms include a range of incentives to encourage diligent development and ensure a fair return to taxpayers, including an increased minimum bid for deepwater tracts and escalating rental rates. The leases would also allow a lessee to earn a longer lease term for spudding a well in deeper water or by drilling to a minimum target depth.

Following today's sale, each bid will go through a strict evaluation process within BOEM to ensure the public receives fair market value before a lease is awarded.

Statistics for Lease Sale 235 are available at http://www.boem.gov/Sale-235/ or at www.boem.gov.

An integral part of its global growth strategy, Frontier's new premises signifies further international expansion for the company and will support its increased activity in Asia and the Middle East. The Gurgaon-based operation will be led by local manager, Arjun Bhakhri, (photo) who brings with him over 10 years' oil and gas recruitment experience within India and the Middle East, with a history of working with both operators and tier 1 contractors.

An integral part of its global growth strategy, Frontier's new premises signifies further international expansion for the company and will support its increased activity in Asia and the Middle East. The Gurgaon-based operation will be led by local manager, Arjun Bhakhri, (photo) who brings with him over 10 years' oil and gas recruitment experience within India and the Middle East, with a history of working with both operators and tier 1 contractors. "The split allows us to reduce complexity, build on synergies and bring down costs, which makes us much better equipped to respond to the needs of customers in the 22 countries where we operate," said Chief Executive Officer Luis Araujo. "Our focus now is on creating value for our clients and shareholders through the right technology development, quality in execution, cost control and by applying the full force of our engineering skills at the conceptual stage of a project to find the most effective solutions."

"The split allows us to reduce complexity, build on synergies and bring down costs, which makes us much better equipped to respond to the needs of customers in the 22 countries where we operate," said Chief Executive Officer Luis Araujo. "Our focus now is on creating value for our clients and shareholders through the right technology development, quality in execution, cost control and by applying the full force of our engineering skills at the conceptual stage of a project to find the most effective solutions." Jordan Westmoreland brings extensive industry expertise to identify and meet customers' marine scientific equipment needs.

Jordan Westmoreland brings extensive industry expertise to identify and meet customers' marine scientific equipment needs. Statoil

Statoil

charter and add capacity to its Tramp and Projects division; providing worldwide trade for customers, with a specific focus on EU and US trades.

charter and add capacity to its Tramp and Projects division; providing worldwide trade for customers, with a specific focus on EU and US trades. assNK

assNK The Department of the Interior's Bureau of Ocean Energy Management (BOEM) t held an oil and gas lease sale yesterday for the Central Gulf of Mexico that drew $538,780,056 in high bids for tracts on the U.S. Outer Continental Shelf offshore Louisiana, Mississippi and Alabama.

The Department of the Interior's Bureau of Ocean Energy Management (BOEM) t held an oil and gas lease sale yesterday for the Central Gulf of Mexico that drew $538,780,056 in high bids for tracts on the U.S. Outer Continental Shelf offshore Louisiana, Mississippi and Alabama. ▪ Estimated project startup remains on target for 2016

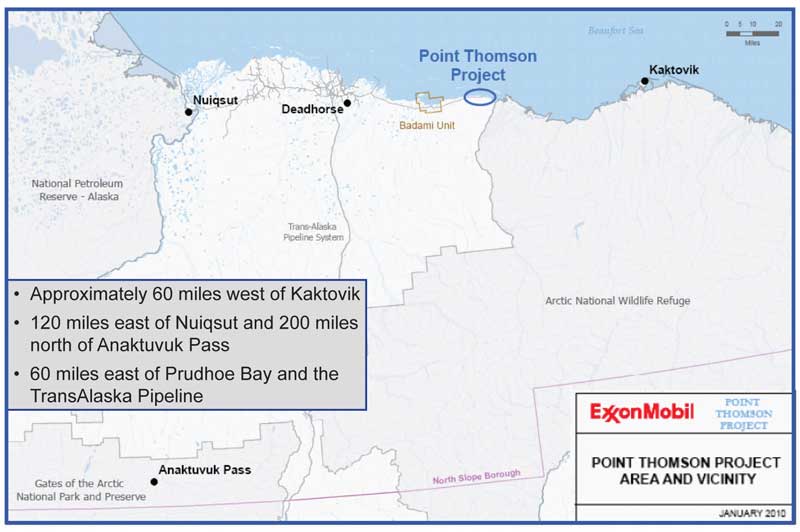

▪ Estimated project startup remains on target for 2016 NYC-based

NYC-based

Responding to the industry's need for more guidance on procedures related to liquefied natural gas (LNG) bunkering, the US Coast Guard (USCG) has published two new Policy Letters on LNG Bunkering, Personnel Training and Waterfront Facilities. With regard to simultaneous operations (SIMOPS) USCG points to DNV GL's Recommended Practice for "Development and Operation of LNG Bunkering Facilities" for guidance.

Responding to the industry's need for more guidance on procedures related to liquefied natural gas (LNG) bunkering, the US Coast Guard (USCG) has published two new Policy Letters on LNG Bunkering, Personnel Training and Waterfront Facilities. With regard to simultaneous operations (SIMOPS) USCG points to DNV GL's Recommended Practice for "Development and Operation of LNG Bunkering Facilities" for guidance. Since US ports do not have LNG liquefaction and storage facilities yet, ships will have to rely on small-scale bunkering for the time being. This practice harbors certain risks that had not been addressed by US legislation until now, but are covered in DNV GL's Recommended Practice RP-0006: 2014-01 on the Development and Operation of LNG bunkering. In 2013, DNV GL developed the Recommended Practice to help facilitate the development of an international LNG infrastructure while waiting for the final release of the ISO 18683 workgroup document on systems and installations for supply of LNG as fuel to ships. It was released on 15 January 2015 and builds on DNV GL's RP.

Since US ports do not have LNG liquefaction and storage facilities yet, ships will have to rely on small-scale bunkering for the time being. This practice harbors certain risks that had not been addressed by US legislation until now, but are covered in DNV GL's Recommended Practice RP-0006: 2014-01 on the Development and Operation of LNG bunkering. In 2013, DNV GL developed the Recommended Practice to help facilitate the development of an international LNG infrastructure while waiting for the final release of the ISO 18683 workgroup document on systems and installations for supply of LNG as fuel to ships. It was released on 15 January 2015 and builds on DNV GL's RP. resign as Executive Vice President and Chief Operating Officer. Also effective May 11, 2015, Scotty Sparks will be promoted to the position of Executive Vice President – Operations. Scotty has 25 years of industry experience and has been with Helix since 2001. He currently holds the office of Vice President – Commercial and Strategic Development, and has also served in various positions within Helix's robotics subsidiary, including as Senior Vice President, during his tenure at Helix. Prior to that Scotty held various positions within the industry, including Operations Manager at Global Marine Systems.

resign as Executive Vice President and Chief Operating Officer. Also effective May 11, 2015, Scotty Sparks will be promoted to the position of Executive Vice President – Operations. Scotty has 25 years of industry experience and has been with Helix since 2001. He currently holds the office of Vice President – Commercial and Strategic Development, and has also served in various positions within Helix's robotics subsidiary, including as Senior Vice President, during his tenure at Helix. Prior to that Scotty held various positions within the industry, including Operations Manager at Global Marine Systems.