Subsea cable and connector specialist Hydro Group has teamed up with mechanical engineering group EnerMech to launch an innovative new product offering to the market.

Subsea cable and connector specialist Hydro Group has teamed up with mechanical engineering group EnerMech to launch an innovative new product offering to the market.

In response to significant customer demand, Hydro Group and EnerMech have combined expertise to deliver a new hydraulics hose product, offering lay-up and over-sheathing of hydraulic hoses for use in umbilical, topside and well intervention projects in the oil and gas industry. The partnership could generate in the region of £500,000 in the next 12 months.

Graham Wilkie, Sales Director at Hydro Group said: “Building on three decades of proven capability and industry experience at Hydro Group, we know collaboration, diversification and innovation are key to surviving in challenging markets. Knowledge sharing with EnerMech has resulted in an important market offering which brings together expertise from both companies.”

The bundled hose, which are available in ¼” to 2” size from Hydro Cable Systems, a Hydro Group company, integrate hydraulic components with electrical and fibre optic cables, resulting in a more compact and easier to handle assembly.

Mr Wilkie continued: “The new hose bundles offer significant benefits to installers and users for flying lead, workover umbilicals, well intervention, Topside and BOP control and injection systems. The bundles also allow greater versatility when faced with awkward routing or high dynamic usage, and may incorporate strength members such as aramid braiding, steel wire central ropes and aramid central ropes to the customer’s specification.”

EnerMech supplies a broad range of mechanical services to the international energy industry and has a 40 year heritage in hydraulic services including engineering and design, hydraulic component supply and hose integrity management.

Gary McRobb, EnerMech Business Development Manager, said: “Innovation and offering integrated solutions for our global clients is a central tenet of everything we do at EnerMech. Together with Hydro Cables Systems we are able to provide full engineering support, sourcing and supplying hoses, including high specification hoses such as High Collapse Resistance (HCR), and can also supply fully fitted, flushed and pressure-tested umbilicals which can also be deployed onto a reeler at the customer’s request.”

Further expanding the product offering and several recent increases to capabilities has meant the creation of new jobs for Hydro Group. Staff numbers at the firm’s Aberdeen base rose to over 100 for the first time this year and projected turnover for 2015 is predicted to rise by 12% from £9million thanks to increased development of new and existing markets.

Hydro Group has seen a period of significant investment in new machinery, with this new capability allowing the company to extrude up to 120mm diameter over composite bundles or single hoses. Final produced lengths can be supplied from 50 to 2000 metres depending on the size of hose, number of components and the finished diameter of the umbilical.

Mr Wilkie added: “Training and information transfer will be mutual between EnerMech and Hydro Cable Systems, for the benefit of customers and the market as a whole. Evolving our product offering in line with client demand is paramount and the new hose bundles, as an extension of our current products, represents significant growth potential.”

Hydro Group is at the forefront in the development and innovation of subsea product technologies, with involvement from prototype concept through to design, manufacture and project management. Hydro Group manufacture the complete package including FAT at its state-of-the-art facilities in Aberdeen, Scotland; umbilical cables, electrical and optical connection systems / assemblies for data, power and signal transmission.

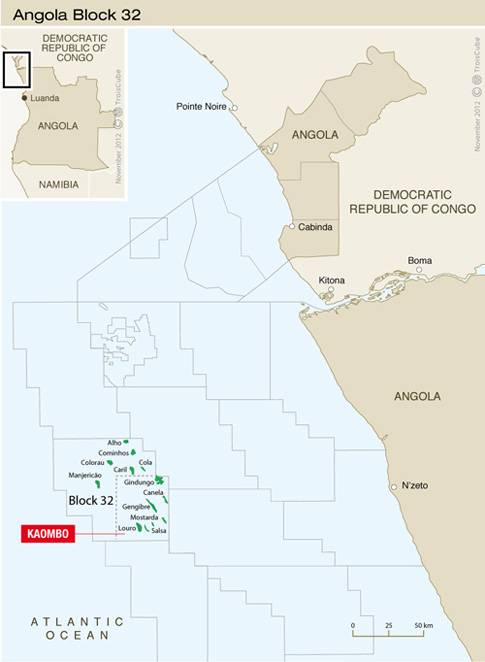

Total E & P Angola has awarded the marine warranty services (MWS) contract for their flagship Kaombo project. Angola is a country of strategic importance for

Total E & P Angola has awarded the marine warranty services (MWS) contract for their flagship Kaombo project. Angola is a country of strategic importance for

This landmark transaction will bring next generation Damen PSVs to the offshore industry of Nigeria and the Gulf of Guinea for the first time.

This landmark transaction will bring next generation Damen PSVs to the offshore industry of Nigeria and the Gulf of Guinea for the first time. Advising on the agreement was RS Platou Africa (RSP), a global organisation with an in-depth knowledge of the industry and the region particularly. Dedicated to creating productive relationships between shipbuilders, operators & end-users, RSP has been a trusted advisory party to LATC and Damen. Advising on the agreement was RS Platou Africa (RSP), a subsidiary of Clarksons the world’s largest shipbrokers, a global organisation with an in-depth knowledge of the industry and the region particularly. Dedicated to creating productive relationships between Shipbuilders, operators & end-users, RSP has been a trusted advisory party to LATC and Damen. Mr Simon Pethick, Head of RSP’s Offshore Support Vessel & Drilling Units division, comments: “For some years now, we have seen the need for Innovation in Vessel Designs of Higher Quality & Efficiency and especially sustainable services throughout Africa’s west coast operations. Hence, new - and newly built – tonnage is needed. At the same time, both businesses and governments need long-term stability to grow.

Advising on the agreement was RS Platou Africa (RSP), a global organisation with an in-depth knowledge of the industry and the region particularly. Dedicated to creating productive relationships between shipbuilders, operators & end-users, RSP has been a trusted advisory party to LATC and Damen. Advising on the agreement was RS Platou Africa (RSP), a subsidiary of Clarksons the world’s largest shipbrokers, a global organisation with an in-depth knowledge of the industry and the region particularly. Dedicated to creating productive relationships between Shipbuilders, operators & end-users, RSP has been a trusted advisory party to LATC and Damen. Mr Simon Pethick, Head of RSP’s Offshore Support Vessel & Drilling Units division, comments: “For some years now, we have seen the need for Innovation in Vessel Designs of Higher Quality & Efficiency and especially sustainable services throughout Africa’s west coast operations. Hence, new - and newly built – tonnage is needed. At the same time, both businesses and governments need long-term stability to grow.

NYC-based

NYC-based

Subsea cable and connector specialist

Subsea cable and connector specialist  Despite major cost reduction measures, Q1 2015 earnings for supermajors are expected to be the weakest in recent memory. Operational and financial indicators for FY 2014, however, reveal that recent performance amongst the big 5 has been far from homogeneous.

Despite major cost reduction measures, Q1 2015 earnings for supermajors are expected to be the weakest in recent memory. Operational and financial indicators for FY 2014, however, reveal that recent performance amongst the big 5 has been far from homogeneous. Diversification in to renewables and interconnector market rewarded

Diversification in to renewables and interconnector market rewarded

Leading classification society

Leading classification society