Announcing its results for the 2013 financial year, VIKING Life-Saving Equipment A/S has again led the way in its industry, achieving growth in both turnover and profits for 10 straight years.

Announcing its results for the 2013 financial year, VIKING Life-Saving Equipment A/S has again led the way in its industry, achieving growth in both turnover and profits for 10 straight years.

In doing so, the Danish-based company with a worldwide presence has once more beaten the

odds in an industry plagued by reductions in passenger and cargo ship newbuilds, falling exchange rates in key markets, and downward price pressure.

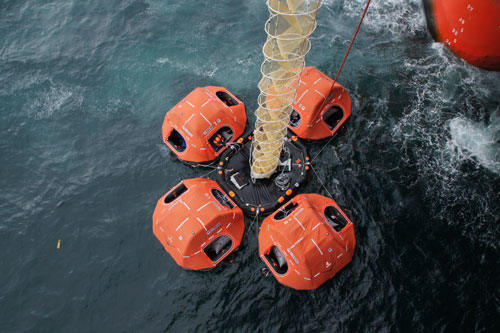

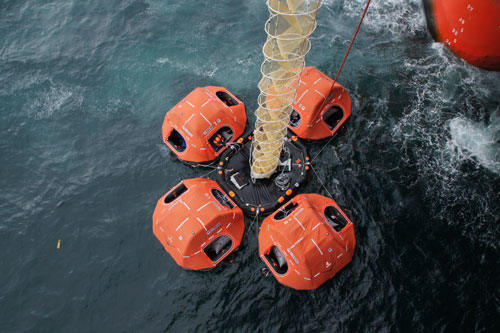

Photo: Viking Offshore Evacuation System

Adjusted for falls in the US dollar exchange rate, currencies pegged to the dollar, and European member state non-euro currencies, the company's turnover for 2013 increased 6 percent to DKK

1.612 billion. Profit before tax grew more than 20 percent to a record DKK 141.2 million.

"Our earnings have now reached an appropriate level for a healthy manufacturing company," says VIKING CEO Henrik Uhd Christensen. "In 2013, VIKING achieved moderate growth in turnover, and the increased profit level primarily reflects internal improvements. We have, in fact, been able to reduce the costs of administration, logistics and production while simultaneously strengthening customer service."

Long-term strategy in a sluggish market

As one of the world's leading manufacturers of maritime safety equipment, VIKING is closely tied to the newbuild market for passenger and cargo ships, a market that has been declining in recent years. Southern European countries, in particular, the traditional stronghold of ferry traffic in the Mediterranean, are still feeling the effects of the economic crisis. Moreover, low economic growth rates in several large markets have had considerable influence on global cargo traffic which, in turn, affects contracts for new cargo ships.

"We have been able to handle the worldwide market saturation of recent years because VIKING's owners take a long-term approach to expanding our global market position, focusing on growth and making sure we are right where our customers are," says Henrik Uhd Christensen. "During the

crisis years, we have continued to develop a competitive product portfolio based on concepts and

services tailored to each customer's specific needs."

Offshore market continues to grow

Henrik Uhd Christensen points to the VIKING Shipowner Agreement, where his company offers to take care of all aspects of a shipowner's safety equipment and servicing tasks for predictable, transparent prices. It's a concept that addresses shipowner needs for flexibility at a time where access to financing is limited, and has quickly become the industry's gold standard since its launch four years ago.

With its broad product portfolio, VIKING has also been able to compensate for slower activity in some market segments by expanding in more promising ones. Here the offshore industry stands out, with growth rates fueled by continued high oil prices.

"As the hunt for new oil and gas discoveries moves further from shore, higher-quality safety equipment and servicing arrangements are necessary," says Henrik Uhd Christensen. "With a product range well-suited to the North Sea and polar conditions, and with a specialised offshore business unit based in Norway, VIKING is uniquely positioned to dominate the offshore market for the foreseeable future."

2014 just as difficult

Despite difficult prevailing market conditions, VIKING expects to see growth both in turnover and profit during 2014.

"We are again facing a challenging year where there is little room for improvement in newbuilds, or strong growth in other areas. We expect the passenger and cargo markets will marginally improve, and that the offshore market will continue to show its strength. Within these largely unchanged parameters, we will continue to be on the offensive with our products and services, tailored to individual customer needs," says Henrik Uhd Christensen.

The positive earnings for 2013, combined with a conservative dividends policy, have contributed to further strengthening the company. VIKING's equity at the end of the financial year amounted to DKK 617.2 million.

.

Western Europe will continue to rely on imported Russian gas into the 2020s as mature offshore provinces struggle for growth, while large-scale shale gas extraction looks increasingly unlikely in the medium term. Following Moscow's intervention in Ukraine and the resulting strained diplomatic ties with the West, it remains to be seen if North Sea production can rally to support any drop in gas flow from Russia.

Western Europe will continue to rely on imported Russian gas into the 2020s as mature offshore provinces struggle for growth, while large-scale shale gas extraction looks increasingly unlikely in the medium term. Following Moscow's intervention in Ukraine and the resulting strained diplomatic ties with the West, it remains to be seen if North Sea production can rally to support any drop in gas flow from Russia. Noble Corporation

Noble Corporation NYC-based

NYC-based  Songa Offshore SE

Songa Offshore SE DW'

DW' Announcing its results for the 2013 financial year,

Announcing its results for the 2013 financial year,  Aker Solutions

Aker Solutions Oceaneering International, Inc.

Oceaneering International, Inc.