NYC-based PIRA Energy Group reports that Brent crude prices staged a modest recovery from late August through mid-October, but then prices ran into strong headwinds. In the U.S., commercial oil inventories fell this past week. In Japan, crude stocks posted a strong draw. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group reports that Brent crude prices staged a modest recovery from late August through mid-October, but then prices ran into strong headwinds. In the U.S., commercial oil inventories fell this past week. In Japan, crude stocks posted a strong draw. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

European Oil Market Forecast

Brent crude prices staged a modest recovery from late August through mid-October, but then prices ran into strong headwinds. However, the price increase of over $2/Bbl on October 28 could be an early taste of a rally that PIRA expects once the January contract is the front-month price and December inventory declines become evident. Refinery margins will hold up better than generally expected.

More Intensive Price Weakness at Henry Hub Overshadows Broader Market Weakness

The broader market downturn has gathered momentum despite many prices decoupling from Henry Hub in late October. While the dust has not settled, all upstream markers are now floundering near the $2 mark, closing this year’s longstanding gap between Dominion South and Westcoast St. 2 prices. The stepped-up assault against HH due to storage congestion in the Producing Region will end sooner rather than later, specifically when withdrawals commence. However, that is not likely until mid-November, and the timing and sustainability of a price recovery is murky given bearish weather risks.

Exports/Renewables Push Germany Up; France Bearish

PIRA’s price forecasts for Germany have been moved up on the back of a less bearish demand outlook, resilient exports, and a downgraded renewable generation outlook. The timing of the lignite stand-by reserve is slightly more bullish than expected, but the interaction between this stand-by reserve and market prices will depend on details of the dispatching. However, hedging of these units is no longer needed, which is bullish for the back of the forward curve.

Asian LPG Prices Push Higher

Asian LPG prices jumped higher on stronger crude and as speculators expected Saudi contract prices for November to increase by as much as $40/MT from current levels. The propane FEI gained 7.8% to $471 by Friday’s settle. Butane gained to widen its premium over propane to over $20/MT. With both LPG components trading at a premium to naphtha, the feedstock is priced out of petrochemical usage.

Near-Term Coal Pricing Outlook Remains Soft; 4Q16 Pricing Turns Somewhat Bullish

Despite some strengthening currencies vs. USD, Pacific Basin physical prices moved slightly lower in October due to a weaker oil market, Chinese coal pricing cuts, and insufficient supply discipline from Australia. With no clear evidence that China’s thermal coal imports will soon stabilize, PIRA maintains a bearish outlook for the Pacific Basin. Atlantic Basin prices moved somewhat higher in October, with stronger European coal burn giving CIF ARA (Northwest Europe) and FOB Richards Bay (South Africa) prices a boost. Similar to the Pacific, we have lowered our previously bearish forecast again, although we are now above forward for 4Q16.

Ethanol Prices Exhibited a “V-shaped” Pattern in October

U.S ethanol prices fell early in the month, but they rebounded during the second half as the market tightened. D6 RIN prices soared.

Wheat Shorts Cover

Friday’s Commitment of Traders report confirmed one worst kept secret in the markets while the heavily-watched wheat short declined enough to give the Chicago market a bit of a breather, though Kansas City saw the addition of more shorts.

Climate Policy in Flux in Canada

The victorious Liberals had the least specific climate platform and we do not expect changes to Canada’s GHG targets for global negotiations. Provincial premiers will join the talks. A broader climate policy discussion will follow. Ontario and Quebec announced aggressive 2030 goals, and Ontario continues planning for a carbon market link with California and Quebec. Alberta’s new government tightened the large emitter carbon program, impacting oil sector and pressuring coal. British Columbia began working to limit carbon intensity of LNG.

Canadian Elections: Liberal Victory Does Not Materially Change Oil Pipeline Outlook

The surprisingly decisive majority win of the centrist Liberal Party in Canada’s October 19 federal election does not materially change PIRA’s long-term outlook on new Canadian oil pipelines. PIRA still believes that at least one new Canadian pipeline project will come online at some point after 2020. This is in line with our view that crude price weakness and a slowdown in western Canadian production growth have delayed the urgency for new pipeline capacity until post-2020. That said, the Liberals’ support for a carbon price and promise to strengthen the environmental review process for oil projects have the potential to increase costs or contribute to delays for the oil industry.

Global Equities Slightly Lower

Overall global equities were down slightly on the week, though the U.S. S&P 500 gained a bit. For the U.S., retail and consumer discretionary were the best performers. Energy was little changed. Internationally, all the tracking indices lost ground with emerging markets, emerging Asia, and BRICs putting in the worst performances. With regard to individual markets, Argentina did the best for the week, posting a nearly 10% gain, and holds a 33% year-to-date gain, in dollar terms.

Asia-Pacific Oil Market Forecast

High stocks, both crude and product, along with October crude stock building because of refinery maintenance were enough to force prices to retrace earlier gains. Another short-term negative for price is the desire by some companies to reduce inventories for end-year accounting purposes (LIFO). Longer term, the market will increasingly need additional barrels, even after accounting for the return of Iranian barrels in spring 2016. By 2Q16, the market will have to begin signaling that more oil will be required and prices should begin a more sustained recovery.

Strong Supply Undermines Focus on Improving Demand

Buyers of Russian contract gas are not wasting any time in pursuing the minimum annual total even if they believe that oil-indexed prices will move lower. With LNG supply building on the water, pressure on spot prices will increase over the Gas Year and contract gas buyers want to be in a flexible place to take advantage of the price weakness.

Western Grid Market Forecast

Compared with September, spot on-peak power prices were down across the board in October, led by a $3/MWh drop at Mid-Columbia. Palo Verde prices fell by ~$2/MWh and the California hubs saw only slight declines. Warmer than normal weather and generation/transmission maintenance lent support to California electricity prices. Changes to the forecast include downward revisions to gas prices through the first half of 2016 and a lower hydro generation forecast based on early runoff projections. As a result, we remain bullish on Mid-Columbia heat rates through 1Q16. Southwest implied gas heat rates should also benefit from lower gas prices, with CCGTs again displacing higher cost coal units in the Southwest. However, all markets look weak during 3Q barring sustained hotter than normal conditions.

Dry Bulk Freight Market Struggles to Find Upward Momentum

Cape freight rates weakened during October with the 5TC average falling from just under $15,000/day to close to $9,000/day. Bunker fuel prices remain low, providing little support for rates. Australian iron ore exports dipped slightly month-on-month from strong September levels, with Brazilian iron ore loadings showing a similar trend. New Cape deliveries have started to outstrip Cape demolition, leading to a return to Cape fleet expansion. PIRA has taken a more bearish outlook for Cape freight rates through 2016, largely due to a notable drop in Cape port delays and low bunker prices capping rate increases.

U.S. Ethanol Demand Up; Stocks and Production Decline

U.S. ethanol-blended gasoline manufacture has risen for three consecutive weeks, reaching a near-record 9,162 MB/D the week ending October 23. Ethanol inventories declined by 599 thousand barrels to 18.3 million barrels, the lowest level of the year.

Constructive Tone of Economic Data Is Resulting in Improved Market Sentiments

The mood in global financial markets brightened considerably during October, as major market indices climbed back to levels last seen in mid-August. Recent dovish actions by developed world central banks likely played a role in boosting market confidence. But encouraging data from developed and emerging economies were much more important influences in all likelihood. This report also discusses U.S. GDP and other recently released third quarter data.

U.S. Commercial Stocks Draw

For the first time in several weeks, overall U.S. commercial oil inventories fell this past week. Strong reported demand, up 830 MB/D on the week, at the same time as refinery operations are still being impacted by large scale plant maintenance, caused product stocks to decline. The crude stock build moderated as runs increased and crude imports declined. The year-on-year stock surplus still managed to increase almost 5 million barrels to 170 million barrels as this week last year had an even larger stock decline.

Production Anemic, Demand Strong Implies More Upside Risk to U.S. Exports

Year-on-year net shipments of U.S gas into Mexico remains stout. For October, exports are projected to average ~2.9 BCF/D, a whopping gain of ~0.9 BCF/D year-on-year. Growth is being driven by both rising demand and dwindling supply. Notably, domestic natural gas production is running ~0.5 BCF/D lower year-on-year, a development that will likely persist as PEMEX budgets remain constrained and gas rig counts remain at record lows. But higher demand reflects a trend with staying power as new gas EG capacity and industrial projects come online. PIRA’s Reference Case exports to Mexico appear increasingly subject to upside risks if new pipeline interconnectivity comes online next year in a timely fashion.

Biofuels Programs Move Forward in Over 60 Countries

The market for ethanol in China has opened up. The country plans to resume building corn-based ethanol plants after a decade-long ban.

S&P 500 Continues to Gain

The S&P 500 posted a fourth week of gains. Also, all of the related indicators improved again (Russell 2000, volatility, high yield credit and emerging market credit). Overall, commodities eased, as did ex-energy. Oil was also lower. Palladium, which had posted six straight weeks of gains, was modestly lower for the third straight week, while aluminum fell again. With regard to currencies, the U.S. dollar was mostly stronger, most notably against the euro and key eastern European currencies.

Japan Crude Runs Soon to Rise, Crude Stocks Post a Strong Draw

Crude runs eased again and should be reaching a seasonal bottom as turnarounds begin to wind down. Crude imports were very low and stocks drew 5.5 MMBbls. Finished product stocks built slightly due to higher naphtha and kerosene stocks. Product demand, while lower for the single week, has begun to rise on a trend basis. The indicative refining margin was modestly higher on the week as all the cracks other than gasoline improved.

Bangladesh Revises Gas Rates in Preparation for LNG

The government of Bangladesh decided to combine the rate for locally extracted natural gas with re-gasified imported LNG as recommended by a six-member expert committee. Meanwhile, the government is set to prepare the final draft in consultation with Excelerate Energy (EE) for installing the LNG terminal at Moheshkhali. As per the deal, the company will implement the project on build-own-operate-transfer (BOOT) basis to meet the growing demand of the gas and it would be transferred to the government after the 15 years.

Lower Refinery Maintenance, Higher Crude Runs Drive Expected November and December Crude Stock Draw

The latest view of the October U.S. crude balance indicates that monthly end-October crude stocks will set a new U.S. record, surpassing the previous April 2015 peak by 1.3 million barrels, to 485.1 million barrels. We believe that stock levels will fall quickly from that level, however, as refinery CDU outages rapidly decline and crude runs pick up. We also expect domestic crude supply — crude production plus balance item — will continue to erode, while crude net imports should be largely unchanged from October levels. For the first quarter of 2016, higher crude runs, lower domestic crude supply, and somewhat lower crude oil net imports result in a significantly lower stock builds, compared to the first quarter of 2015.

Henry Hub Free Fall in the Face of New U.S. Supplies Implies Weakness for NBP

Extremely strong gas exports out of Norway and Russia are playing a role in cooling off NBP prices, but it is more LNG supply that would accelerate a decline in November and December assuming normal weather. Confidence levels regarding the speedy availability of attractively priced Atlantic Basin cargos are justifiably high given weak demand in Asia, combined with an ongoing surge in supply there.

Slow Capital Formation Has Inhibited Oil Demand

The decline in oil prices has not led to the promised increase in GDP. In fact, labor productivity growth, the presumptive engine of increased GDP growth, has actually slowed in the developed countries. Slower labor productivity growth is attributable to slower rates of capital formation. Because oil and capital are complementary factors of production, oil demand growth has also been adversely affected. We believe that capital formation has been delayed. The factors that pull the economy out of recession are out of sequence. Instead of residential and non-residential fixed investment being the prime movers for GDP growth, as has been the case in past recoveries, the current recovery in the U.S. was led by the household sector. Expansionary monetary policy repaired household balance sheets, which led to increased household consumption. We believe that in the next two years there will be a substantial pick-up in business fixed investment. Following the Keynesian paradigm, this will be followed by a new bout of consumer spending. Both the increase in capital formation and the subsequent increase in consumer spending will lead to increased oil demand growth.

North American GHG Quarterly Update: Canada

The victorious Liberal party had the least specific climate platform of the three major parties in the election, and we do not expect changes to Canada’s GHG targets for the global UNFCCC climate negotiations. Provincial premiers will join the Paris talks, highlighting the new focus on provinces. A broader climate policy framework will be discussed after Paris, as additional policies will be needed for Canada to meet 2020 and 2030 targets. Ontario in May announced an aggressive 2030 emissions target of a 37% reduction vs. 1990; Quebec followed in September with a 2030 target of a 37.5% reduction. Both provinces will likely need to address the transport sector to meet targets. Ontario continues planning for a carbon market link with California and Quebec, with the program start as early as 2017. Alberta’s new NDP government has set up a Climate Change Advisory Panel to drive discussions and advise the Minister. Alberta also tightened its large emitter carbon program, with greater intensity reductions and higher compliance fees impacting the oil sector and pressuring coal generation. British Columbia began work on regulations designed to limit the carbon intensity of LNG projects.

U.S. August 2015 DOE Monthly Revisions

DOE released its final monthly August 2015 (PSM) U.S. oil supply/demand data last week. August 2015 demand came in at 19.81 MMB/D, which is 50 MB/D lower than what PIRA had carried in its monthly balances. Compared to the DOE weeklies, total demand was lowered 429 MB/D, largely a function of the 704 MB/D reduction in “other.” Distillate was revised higher by 201 MB/D and resid demand raised 82 MB/D. Total demand for August 2015 versus August 2014 grew 414 MB/D, or 2.1%, a slowdown from the 700 MB/D growth versus year-ago seen in June and July 2015. Kero-jet demand again outperformed the barrel average, higher by 4.9%, similar to what was seen in July. Distillate lagged the barrel average, up only 0.3%, while gasoline and “other” also underperformed slightly, but each still up about 1.7% versus year-ago.

North American Gas Forecast Monthly

For many months, PIRA has warned of an impending Producing Region (PR) “storage crisis” unfolding in the early stages of the heating season due to the capacity constraints and record high seasonal storage carries throughout the summer. With threadbare margin available to avoid extreme congestion and a related meltdown of Henry Hub (HH) prices, the past month’s mild weather, and more of the same expected for November have been more than the market could handle. Consequently, the past week’s HH cash price crash from the mid-$2.50s toward $2/MMBtu should not be perceived as an “out of the blue” shock.

October Weather: U.S. and Japan Warm, Europe Cold

October weather for the three major OECD markets turned out to be 3% colder than the 10-year normal and the resulting oil-heat demand effects were 64 MB/D above normal. On a 30-year-normal basis, the markets were 7% warmer.

Gas Flash Weekly

For some time, PIRA has emphasized downside Henry Hub (HH) prices risks as the heating season looms and available Producing Region storage capacity dwindles. The more than 40¢ plunge in the November contract in its last six days took it to its lowest level in more than three years. Together with this week’s acute weakness in the HH cash market, these issues have highlighted a transition of storage congestion from a near-term threat to a very real factor impacting both injections and HH prices.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

Also announces Humpback well results offshore the Falkland Islands

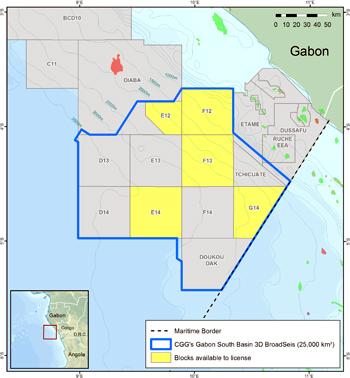

Also announces Humpback well results offshore the Falkland Islands CGG

CGG Across the offshore industry, two approaches to financing and project spend are apparent: life cycle value versus short term costs. This is according to Trelleborg’s offshore operation’s roundtable members, who analyzed findings from the company’s Next Level Report at Offshore Europe in September.

Across the offshore industry, two approaches to financing and project spend are apparent: life cycle value versus short term costs. This is according to Trelleborg’s offshore operation’s roundtable members, who analyzed findings from the company’s Next Level Report at Offshore Europe in September. Last week DW celebrated its 25-year anniversary with their DW25 Conference in London. Through the course of the afternoon, speakers offered insight into oil & gas business challenges and opportunities, spanning a multitude of industry sectors. The keynote speaker James West, Senior MD and Partner at Evercore, was joined by panelists Graham Bennett, Vice President at DNV GL, Bob Drummond, CEO at Hydrasun Group, Neil Hartley, Managing Director at First Reserve and Tony Hodgkins, Commercial Director at ORCAS. DW speakers were Chairman John Westwood, Research Director Steve Robertson, with Andrew Reid, CEO as moderator.

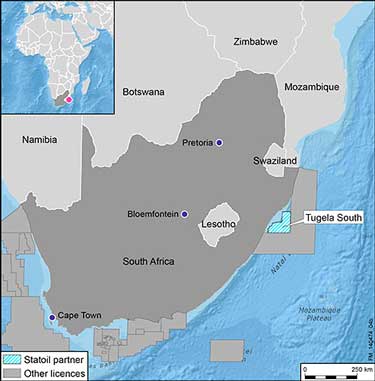

Last week DW celebrated its 25-year anniversary with their DW25 Conference in London. Through the course of the afternoon, speakers offered insight into oil & gas business challenges and opportunities, spanning a multitude of industry sectors. The keynote speaker James West, Senior MD and Partner at Evercore, was joined by panelists Graham Bennett, Vice President at DNV GL, Bob Drummond, CEO at Hydrasun Group, Neil Hartley, Managing Director at First Reserve and Tony Hodgkins, Commercial Director at ORCAS. DW speakers were Chairman John Westwood, Research Director Steve Robertson, with Andrew Reid, CEO as moderator. Statoil

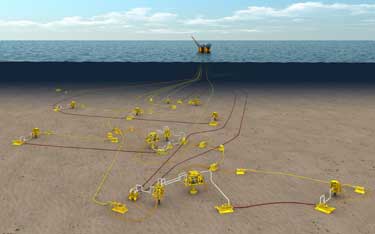

Statoil Contract win underpins Proserv’s track record of developing existing technologies that can co-exist together and be retrofitted.

Contract win underpins Proserv’s track record of developing existing technologies that can co-exist together and be retrofitted.  Gobbler Boats is committed to protecting the environment. Its new Gobbler Offshore 290 Oil Spill Recovery Vessel (OSRV) not only excels at remediation, but harnesses the latest in environmentally sound fire suppression technology. The boat comes standard with a

Gobbler Boats is committed to protecting the environment. Its new Gobbler Offshore 290 Oil Spill Recovery Vessel (OSRV) not only excels at remediation, but harnesses the latest in environmentally sound fire suppression technology. The boat comes standard with a  Songa Trym (Photo: Kjetil Larsen - Statoil)

Songa Trym (Photo: Kjetil Larsen - Statoil)  Wood Group

Wood Group TWMA men at work

TWMA men at work  Brazil will lead global growth in the Floating Production, Storage and Offloading vessel (FPSO) industry despite the country’s national oil company, Petrobras, recently facing allegations of corruption, says research and consulting firm GlobalData.

Brazil will lead global growth in the Floating Production, Storage and Offloading vessel (FPSO) industry despite the country’s national oil company, Petrobras, recently facing allegations of corruption, says research and consulting firm GlobalData.

McDermott International, Inc.

McDermott International, Inc. Established in 2006, HIOSL serves the Nigerian oil and gas industry with a wide range of maritime, security and logistics services. The Lagos headquartered company has ambitious plans to become the leading marine logistics provider in the Nigerian offshore industry.

Established in 2006, HIOSL serves the Nigerian oil and gas industry with a wide range of maritime, security and logistics services. The Lagos headquartered company has ambitious plans to become the leading marine logistics provider in the Nigerian offshore industry. NYC-based

NYC-based  Andrew McMurtrie, managing director at iSURVEY Offshore Limited

Andrew McMurtrie, managing director at iSURVEY Offshore Limited