Leading international oil companies (IOCs) are restructuring their businesses to adopt new energy transition technologies such as low carbon hydrogen to become integrated energy providers, says GlobalData.

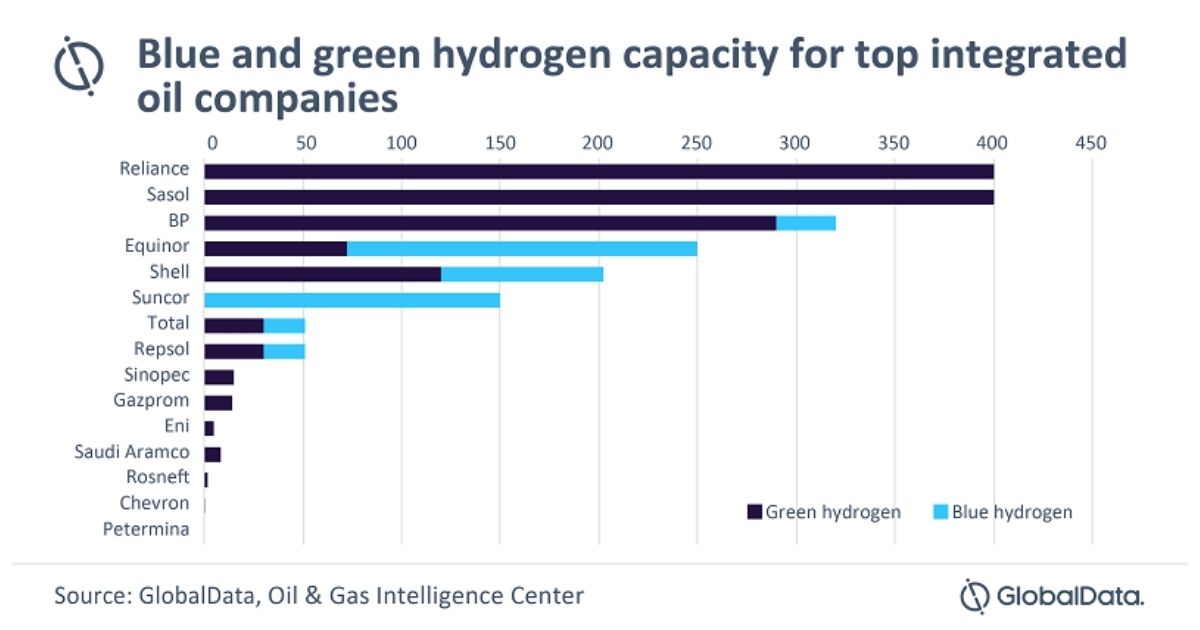

The leading data and analytics company notes that, as interest in hydrogen increases, top integrated oil companies have so far announced projects to produce over 2.9 million tonnes per annum of low-carbon hydrogen.

Barbara Monterrubio, Energy Transition Analyst at GlobalData, comments: “Some companies are acting faster and more decisively than others and are now increasing their investments in mainly green hydrogen production. This is due to their decarbonization commitments and the potential benefits they would gain from the forecasted growth in the hydrogen economy further down the line.”

According to GlobalData’s report, ‘Hydrogen in Oil and Gas – Thematic Research’, in line for decarbonizing their business portfolios, companies have started to invest in the development of green hydrogen projects, with 87% of the pipeline capacity coming from those projects.

Monterrubio continues: “For supporting green hydrogen economy, IOCs have also improved their footprints in other aspects of the purported hydrogen economy. They have done this by investing in fuel cell technologies, refueling networks, and hydrogen storage to create alternative revenue streams in the energy sector. Furthermore, European integrated companies have also rapidly invested in cleaner energy sectors.”

The refinery and chemicals sectors represent the bulk of existing hydrogen demand. Low carbon hydrogen projects can help decarbonization efforts for oil and gas companies’ own operations. Utilizing hydrogen as a key feedstock for the chemical industry in producing low carbon ammonia and methanol, as well as developing biofuels, are sectors which will see increasing hydrogen demand within the oil and gas sector.

Monterrubio adds: “Hydrogen demand in other sectors, such as transportation and power, has the potential to increase rapidly. Hydrogen’s potential as a cleaner burning alternative to conventional fuels makes it a good alternative, as the oil and gas industry can leverage its assets to reap benefits in the evolving hydrogen economy.

“The big oil companies are investing in the development of hydrogen refueling stations. For example, Sinopec expects to set up 1,000 hydrogen fueling stations across China in the next five years. Companies have also invested in fuel cells to capitalize on the prospective application of hydrogen fuel in the transportation sector.”