Leading Medium and Heavy-Duty Electric Vehicle Manufacturer Showcases Bidirectional Charging Technology in New Video

MONTREAL--(BUSINESS WIRE)--Northern Genesis Acquisition Corp. (NYSE: NGA) announces that its proposed business combination partner, Lion Electric (Lion), has been successful in using its electric school buses to supply electricity back to Con Edison utility customers, as part of the company’s vehicle-to-grid (V2G) pilot deployment in White Plains, New York. Lion is an innovative manufacturer of purpose-built all-electric medium and heavy-duty urban vehicles.

A new video highlighting the project can be seen here.

The project, which began in 2018 in partnership among Lion, Nuvve, White Plains School District and National Express, is known by the company to be the first successful deployment in the state of New York of a vehicle-to-grid pilot whereby electricity flows from electric school buses back to the grid – marking a significant milestone in advancing V2G technology in North America. As a result of the deployment, Con Edison is now able to successfully transmit energy from the LionC school buses of the White Plains School District back into the grid, which energy can then be distributed to customers aided by Nuvve’s V2G technology.

The success of this initial V2G pilot deployment is significant as it serves as an example of how school buses – which are ideal for V2G integration due to their daily use patterns and overnight storage – can be used to sell power back to the grid when demand for energy is high, saving operators money and benefiting grid health in the process. As such, all of Lion’s buses and heavy-duty vehicles come equipped standard with V2G technology onboard, providing new ROI opportunities for its customers to unlock and realize.

As governments around the globe pursue increasingly ambitious carbon neutrality goals based largely on renewable energy sources and zero-emission transportation, V2G integration becomes an increasingly important tool in balancing grids – especially when taking into account the high peak supply inherent to renewable energy sources.

“V2G has been a trendy word in the EV industry for many years, but now we have proven that V2G is real thanks to our great partners at Con Edison, Nuvve, White Plains School District and National Express. This great project is the result of exceptional teamwork and innovation between the partners,” said Marc-Andre Page, Vice President of Commercial Operations at Lion Electric. “This important milestone for V2G outlines the cooperation required between utilities, fleet operators, school districts and regulatory organizations to successfully implement a project of this scale. Lion is very proud of this first successful V2G deployment and is fully equipped to support the rollout of other similar projects throughout North America.”

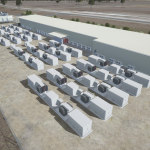

The V2G charging and discharging takes place at a depot in North White Plains, where the buses remain plugged into a charger when not in use. The batteries are charged when demand for power is low, and the chargers are programmed to reverse the power flow into the grid at times when the buses are not in operation. By charging when demand and thus price for electricity is low and discharging when demand is high, operators can save money on energy costs for their fleet.

The fleet of five LionC buses are operated for the school district by National Express, which also pays for the energy costs during the school year. Con Edison, the New York State Energy Research and Development Authority and National Express collaboratively contributed to the purchase of the electric bus fleet, while Lion aided in the project design.

“We think electric school buses may provide an opportunity to achieve two of our company’s goals, which are reducing carbon emissions, and maintaining our industry-leading reliability,” said Brian Ross, Con Edison’s manager for the project. “We are innovating to help our state and region achieve a clean energy future in which electric vehicles will have a big role.”

“Our V2G software platform is designed to deliver grid services such as those to Con Edison from electric school buses,” said Gregory Poilasne, Chairman and CEO of Nuvve Corp. “The electric buses provide a cleaner environment for communities and help lower CO2 emissions while ensuring that driving energy needs are met every day.”

“Our operators are dedicated to enabling the success of school bus electrification and V2G for the White Plains School District, with safety and reliability remaining as our top priorities,” said Charlie Bruce, SVP of Business Development at National Express.

All of Lion’s vehicles are purpose-built for electric propulsion from the ground up, and are manufactured at Lion’s North American facility, which has a current capacity to produce 2,500 electric vehicles per year. Over the last decade, Lion has established itself as a leader in the all-electric school bus industry, having delivered over 300 all-electric school buses in North America with over 6 million miles driven since 2016.

About Lion Electric

Lion Electric is an innovative manufacturer of zero-emission vehicles. The company creates, designs and manufactures all-electric class 5 to class 8 commercial urban trucks and all-electric buses and minibuses for the school, paratransit and mass transit segments. Lion is a North American leader in electric transportation and designs, builds and assembles all its vehicles’ components, including chassis, battery packs, truck cabins and bus bodies.

Always actively seeking new and reliable technologies, Lion vehicles have unique features that are specifically adapted to its users and their everyday needs. Lion believes that transitioning to all-electric vehicles will lead to major improvements in our society, environment and overall quality of life.

About Northern Genesis Acquisition Corp.

Northern Genesis Acquisition Corp. (NYSE: NGA) is a special purpose acquisition company formed for the purpose of effecting a merger, stock exchange, acquisition, reorganization or similar business combination with one or more businesses. The Northern Genesis management team brings a unique entrepreneurial owner-operator mindset and a proven history of creating shareholder value across the sustainable power and energy value chain. Northern Genesis is committed to helping the next great public company find its path to success; a path which will most certainly recognize the growing sensitivity of customers, employees and investors to alignment with the principles underlying sustainability.

Transaction with Northern Genesis Acquisition Corp.

On November 30, 2020, Lion announced that it had entered into a business combination agreement and plan of reorganization pursuant to which, subject to the satisfaction of customary closing conditions, a wholly-owned subsidiary of Lion will merge with Northern Genesis Acquisition Corp. (NYSE: NGA), a publicly traded special purpose acquisition company focused on a commitment to sustainability and strong alignment with environmental, social and governance principles. Upon completion of the transaction, Lion is expected to be listed on the New York Stock Exchange (NYSE) under the new ticker symbol “LEV”.

Lion Electric, The Bright Move

Thelionelectric.com

Important Information and Where to Find It

In connection with the proposed business combination, Lion Electric intends to file a registration statement on Form F-4 (the “Registration Statement”) with the SEC, which will include a proxy statement of Northern Genesis in connection with Northern Genesis’ solicitation of proxies for the vote by its stockholders with respect to the transaction and other matters as described in the Registration Statement, as well as the prospectus relating to the registration of the securities to be issued by Lion Electric to Northern Genesis’ stockholders in connection with the transaction. After the Registration Statement has been filed and declared effective, Northern Genesis will mail a definitive proxy statement, when available, to its stockholders. Investors and security holders of Northern Genesis and other interested parties are urged to read, when available, the Registration Statement, any amendments thereto and other any other documents filed with the SEC, including the preliminary proxy statement/prospectus and amendments thereto and the definitive proxy statement/prospectus (the “Joint Proxy Statement/Prospectus”), because they will contain important information about Lion Electric, Northern Genesis and the proposed business combination. Investors and security holders of Northern Genesis may obtain free copies of the Joint Proxy Statement/Prospectus (when available) and other documents filed with the SEC by Northern Genesis and Lion Electric through the website maintained by the SEC at http://www.sec.gov or by directing a request to: Northern Genesis Acquisition Corp., 4801 Main Street, Suite 1000, Kansas City, MO 64112 or (816) 983-8000. The information contained on, or that may be accessed through, the websites referenced in this press release is not incorporated by reference into, and is not a part of, this press release.

Participants in the Solicitation

Northern Genesis and its directors and executive officers and other persons may be deemed to be participants in the solicitations of proxies from Northern Genesis’ stockholders in respect of the proposed business combination. Lion Electric and its officers and directors may also be deemed participants in such solicitation. Information regarding Northern Genesis’ directors and executive officers is available under the heading “Management” in its final prospectus dated August 17, 2020 filed with the SEC on August 18, 2020 (the “Company IPO Prospectus”). Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, which may, in some cases, be different than those of their stockholders generally, will be contained in the Joint Proxy Statement/Prospectus and other relevant materials to be filed with the SEC in connection with the proposed business combination when they become available. Stockholders, potential investors and other interested persons should read the Joint Proxy Statement/Prospectus carefully when it becomes available before making any voting or investment decisions. When available, these documents can be obtained free of charge from the sources indicated above.

No Offer or Solicitation

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities or constitute a solicitation of any vote or approval. No offer of securities, other than with respect to the PIPE, shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Forward-Looking Statements

All statements other than statements of historical facts contained in this press release constitute “forward-looking statements” (which shall include forward-looking information within the meaning of Canadian securities laws) within the meaning of Section 27A of the Securities Act. Forward-looking statements may generally be identified by the use of words such as “believe,” “may,” “will,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “could,” “plan,” “project,” “potential,” “seem,” “seek,” “future,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters, although not all forward-looking statements contain such identifying words. These forward-looking statements include, but are not limited to, statements regarding the transaction, including with respect to timing and closing thereof, the ability to consummate the transaction, the benefits of the transaction, the ability to satisfy the Cash Condition, the completion of the PIPE, estimates and forecasts of financial and other performance metrics, visibility on potential orders and business relationships, sufficiency and use of funds following completion of the proposed transaction, as well as the combined company’s strategy, future operations, estimated financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of Lion Electric’s and Northern Genesis’ management and are not predictions of actual performance. These forward-looking statements are provided for the purpose of assisting readers in understanding certain key elements of the Lion Electric’s current objectives, goals, targets, strategic priorities, expectations and plans, and in obtaining a better understanding of the Lion Electric’s business and anticipated operating environment. Readers are cautioned that such information may not be appropriate for other purposes and is not intended to serve as, and must not be relied on by any investor as a guarantee, an assurance, a prediction or a definitive statement of fact or probability.

Forward-looking statements involve inherent risks and uncertainties, most of which are difficult to predict and many of which are beyond the control of Lion Electric and Northern Genesis, and are based on a number of assumptions, as well as other factors that Lion Electric and Northern Genesis believe are appropriate and reasonable in the circumstances, but there can be no assurance that such estimates and assumptions will prove to be correct or that the Lion Electric’s vision, business, objectives, plans and strategies will be achieved. Many risks and uncertainties could cause Lion Electric’s actual results, performance or achievements or future events or developments to differ materially from those expressed or implied by the forward-looking statements, including any adverse changes in the U.S. and Canadian general economic, business, market, financial, political and legal conditions; Lion Electric’s inability to successfully and economically manufacture and distribute its vehicles at scale and meet its customers’ business needs; Lion Electric’s inability to execute its growth strategy; Lion Electric’s inability to maintain its competitive position; Lion Electric’s inability to reduce its costs of supply overtime; any inability to maintain and enhance Lion Electric’s reputation and brand; any significant product repair and/or replacement due to product warranty claims or product recalls; any failure of information technology systems or any cybersecurity and data privacy breaches or incidents; natural disasters, epidemic or pandemic outbreaks, boycotts and geo-political events; the risk that a condition to closing of the transaction (including the obtention of Northern Genesis’ stockholders approval) may not be satisfied; the failure to realize the anticipated benefits of the proposed transaction; the amount of redemption requests made by Northern Genesis’ public stockholders; the risk that the proposed transaction disrupts Lion Electric’s or Northern Genesis’ current plans and operations as a result of the announcement of the transaction; the outcome of any legal proceedings that may be instituted against Lion Electric or Northern Genesis following announcement of the transaction; the inability of the parties to successfully or timely consummate the proposed transaction; and those factors discussed in Northern Genesis’ IPO Prospectus, and any subsequently filed Quarterly Report on Form 10-Q, in each case, under the heading “Risk Factors,” and other documents of Northern Genesis filed, or to be filed, with the SEC, as well as any documents to be filed by Lion Electric in accordance with applicable securities laws. These factors are not intended to represent a complete list of the factors that could affect Lion Electric, and there may be additional risks that neither Northern Genesis nor Lion Electric presently know or that Northern Genesis and Lion Electric currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Northern Genesis’ and Lion Electric’s expectations, plans or forecasts of future events and views as of the date of this press release. The Company and Lion Electric anticipate that subsequent events and developments will cause Northern Genesis’ and Lion Electric’s assessments to change. However, while Northern Genesis and Lion Electric may elect to update these forward-looking statements at some point in the future, Northern Genesis and Lion Electric have no intention and undertake no obligation to do so except as required by applicable law. These forward-looking statements should not be relied upon as representing Northern Genesis’ and Lion Electric’s assessments as of any date subsequent to the date of this press release.

Contacts

Lion:

Patrick Gervais

Lion Electric

Vice President of Marketing and Communications

This email address is being protected from spambots. You need JavaScript enabled to view it.

514-992-1060

This email address is being protected from spambots. You need JavaScript enabled to view it.

This email address is being protected from spambots. You need JavaScript enabled to view it.

Northern Genesis:

Avi Das

Investor Relations

This email address is being protected from spambots. You need JavaScript enabled to view it.

816-514-0324