HOUSTON--(BUSINESS WIRE)--PACIFIC COAST OIL TRUST (OTC–ROYTL) (the “Trust”), a royalty trust formed by Pacific Coast Energy Company LP (“PCEC”), announced today that there will be no cash distribution to the holders of its units of beneficial interest of record on June 27, 2022 based on the Trust’s calculation of net profits generated during April 2022 (the “Current Month”) as provided in the conveyance of net profits interests and overriding royalty interest (the “Conveyance”). Given the Trust’s receipt of insufficient monthly income from its net profits interests and overriding royalty interest during 2020 and 2021, the Trust had been expected to terminate by its terms at the end of 2021; however, as described further below, a court has issued a temporary restraining order enjoining the dissolution of the Trust until an arbitration tribunal can rule on the plaintiff’s request for injunctive relief. As described further below, based on information from PCEC, the likelihood of distributions to the unitholders in the foreseeable future is extremely remote. All financial and operational information in this press release has been provided to the Trustee by PCEC.

The Current Month’s distribution calculation for the Developed Properties resulted in operating income of approximately $2.1 million. Revenues from the Developed Properties were approximately $4.0 million, lease operating expenses including property taxes were approximately $1.9 million, and development costs were approximately $100,000. The average realized price for the Developed Properties was $103.75 per Boe for the Current Month, as compared to $110.26 per Boe in March 2022. Oil prices in recent months generally have remained elevated well above their 2020 and 2021 levels, and were higher in the Current Month as compared to April 2021. The cumulative net profits deficit amount for the Developed Properties declined approximately $1.6 million, to approximately $16.3 million in the Current Month versus approximately $17.9 million in the prior month.

The Current Month’s calculation included approximately $143,000 generated from the 7.5% overriding royalty interest on the Remaining Properties from Orcutt Diatomite and Orcutt Field. Average realized prices for the Remaining Properties were $102.03 per Boe in the Current Month, as compared to $106.86 per Boe in March 2022. The cumulative net profits deficit for the Remaining Properties decreased by approximately $308,000 and was approximately $1.0 million for the Current Month.

The monthly operating and services fee of approximately $100,000 payable to PCEC, together with Trust general and administrative expenses of approximately $21,000 and the payment to PCEC of approximately $42,000 of accrued interest under the promissory note between the Trust and PCEC, together exceeded the payment of approximately $143,000 received from PCEC from the 7.5% overriding royalty interest on the Remaining Properties, creating a shortfall of approximately $21,000.

PCEC has provided the Trust with a $1 million letter of credit to be used by the Trust if its cash on hand (including available cash reserves) is not sufficient to pay ordinary course administrative expenses as they become due. As of March 31, 2021, the letter of credit has been fully drawn down. Further, the trust agreement provides that if the Trust requires more than the $1 million under the letter of credit to pay administrative expenses, PCEC will, upon written request of the Trustee, loan funds to the Trust in such amount as necessary to pay such expenses. Under the trust agreement, the Trust may only use funds provided under the letter of credit or loaned by PCEC or another source to pay the Trust’s current accounts or other obligations to trade creditors in connection with obtaining goods or services or for the payment of other accrued current liabilities arising in the ordinary course of the Trust’s business. As the Trust has fully drawn down the letter of credit, PCEC will be loaning funds to the Trust to pay the expected shortfall of approximately $21,000, which would bring the total amount of outstanding borrowings (including the amount drawn from the letter of credit, which also must be repaid as provided in the trust agreement) from PCEC to approximately $3.4 million plus interest thereon, related to shortfalls from prior months. Consequently, no further distributions may be made to Trust unitholders until the Trust’s indebtedness created by such amounts drawn or borrowed, including interest thereon, has been paid in full.

Sales Volumes and Prices

The following table displays PCEC’s underlying sales volumes and average prices for the Current Month:

|

Underlying Properties

|

|

Sales Volumes

|

|

Average Price

|

|

(Boe)

|

(Boe/day)

|

|

(per Boe)

|

Developed Properties (a)

|

38,301

|

1,277

|

|

$103.75

|

Remaining Properties (b)

|

18,932

|

631

|

|

$102.03

|

|

|

|

|

|

(a) Crude oil sales represented 99% of sales volumes

|

|

|

(b) Crude oil sales represented 100% of sales volumes

|

|

|

East Coyote and Sawtelle Fields Operations Update

As previously disclosed, WG Holdings SPV, LLC (“WG Holdings”), the operator of the East Coyote and Sawtelle fields, had not made any payments to PCEC for production from such fields since April 30, 2021, despite repeated requests from PCEC. Because PCEC accrues for estimated future net income to be received from WG Holdings, PCEC previously passed through the Trust’s share of approximately $1 million in net income from these fields, which was approximately $830,000 net to the Trust, in the relevant monthly net profits interest calculations. As disclosed in last month’s press release, due to WG Holdings’ withholding of these past-due payments, PCEC reversed the cash flows attributable to these properties for the net profits interest calculation month of February 2022 (because PCEC had not received payment), pending the resolution of the payment issue with WG Holdings. As of the date of this press release, PCEC still has not received any payments from WG Holdings. PCEC has retained counsel and continues to take steps to secure its interest in these fields; however, the outcome is uncertain.

Update on Estimated Asset Retirement Obligations

As previously disclosed, in November 2019, PCEC informed the Trustee that, as permitted by the Conveyance, PCEC intended to begin deducting its estimated asset retirement obligations (“ARO”) associated with the West Pico, Orcutt Hill, Orcutt Hill Diatomite, East Coyote and Sawtelle fields, thereby reducing the amounts payable to the Trust under its Net Profits Interests. ARO is the recognition related to net present value of future plugging and abandonment costs that all oil and gas operators face. PCEC engaged an accounting firm, Moss Adams LLP (“Moss Adams”), acting as third-party consultants, to assist PCEC in determining its estimated ARO, and on February 27, 2020, PCEC informed the Trustee that based on the analysis performed by Moss Adams, PCEC’s estimated ARO, as of December 31, 2019, was $45,695,643, which is approximately $10.0 million less than the undiscounted amount that was originally estimated before Moss Adams completed its analysis, as previously disclosed in the Trust’s Current Report on Form 8‑K filed on November 13, 2019. According to PCEC and its third-party consultants, its estimated ARO, which reflected PCEC’s assessment of current market conditions as of December 31, 2019 and changes in California law, was determined to be approximately $33.2 million for the Developed Properties and approximately $12.5 million for the Remaining Properties, or approximately $26.5 million and approximately $3.1 million net to the Trust, respectively, and PCEC has reflected these amounts beginning with the calculation of the net profits generated during January 2020. The accrual has resulted in a current cumulative net profits deficit of approximately $17.3 million, which must be recouped from proceeds otherwise payable to the Trust from the Trust’s Net Profits Interests. Therefore, until the net profits deficit is eliminated, the only cash proceeds the Trust will receive are pursuant to the 7.5% overriding royalty interest.

PCEC has informed the Trustee that in accordance with generally accepted accounting principles, PCEC will evaluate the ARO on a quarterly basis. As a result of that re-evaluation, the actual ARO incurred in the future may be greater or less than the estimated amounts provided by PCEC. As previously disclosed, PCEC has informed the Trustee that at year-end 2020, and following the end of each of the first, second and third quarters of 2021, in light of the accounting guidance under Accounting Standards Codification 410-20-35-3, which requires the recognition of changes in the asset retirement obligation due to the passage of time and revision of the timing or amount of the originally estimated undiscounted cash flows, PCEC re-evaluated the estimated ARO, which resulted in an aggregate increase to the ARO accrual for the Developed Properties by approximately $5.1 million, net to the Trust’s interest, and an aggregate increase to the ARO accrual for the Remaining Properties by approximately $288,000, net to the Trust’s interest.

Based on PCEC’s estimate of its ARO attributable to the Net Profits Interest, deductions relating to estimated ARO are likely to eliminate the likelihood of any distributions to Trust unitholders for the foreseeable future, as previously disclosed in the Trust’s Current Report on Form 8-K filed on November 13, 2019.

As previously disclosed, the Trust engaged Martindale Consultants, Inc. (“Martindale”), a provider of analysis and compliance review services to the oil and gas industry, to perform an independent review of the estimated ARO in the Moss Adams report that PCEC provided to the Trustee. The Trustee also has engaged an accounting expert to advise the Trustee regarding the accruals that PCEC has booked relating to its estimated ARO. As disclosed in the Trust’s Current Report on Form 8-K filed on December 29, 2020, Martindale has completed its review of the estimated ARO and on December 21, 2020 provided its analysis and recommendations to the Trustee. Based on Martindale’s recommendations provided in its report to the Trust, as disclosed in the Trust’s Current Report on Form 8-K filed on December 29, 2020, the Trustee requested that PCEC promptly make several adjustments to its calculations and methods of deducting ARO from the proceeds to which the Trust is otherwise entitled pursuant to its Net Profits Interests. PCEC has responded to the Trustee, indicating PCEC’s view that the adjustments would violate applicable contracts and accounting standards, and has therefore declined to make any adjustments to the estimated ARO calculation based on those requests and the recommendations of the Martindale report. The Trustee has concluded that it has taken all action reasonably available to it under the Trust’s governing documents in connection with PCEC’s ARO calculation and therefore has determined not to take further action at this time.

As described in more detail in the Trust’s filings with the SEC, the trust agreement provides that the Trust will terminate if the annual cash proceeds received by the Trust from the Net Profits Interests and 7.5% overriding royalty interest total less than $2.0 million for each of any two consecutive calendar years. Because of the cumulative net profits deficit—which PCEC contends is the result of the substantial reduction in commodity prices during 2020 due to the COVID-19 pandemic and PCEC’s deduction of estimated ARO beginning in the first quarter of 2020—the only cash proceeds the Trust has received since March 2020 have been attributable to the 7.5% overriding royalty interest. As a result, the total proceeds received by the Trust in each of 2020 and 2021 were less than $2.0 million. Therefore, the Trust had been expected to terminate by its terms at the end of 2021.

Status of the Dissolution of the Trust

As previously disclosed in the Trust’s Current Report on Form 8-K filed on December 23, 2021, on December 8, 2021, Evergreen Capital Management LLC (“Evergreen”) filed an Amended Class Action and Shareholder Derivative Complaint alleging a derivative action on behalf of the Trust and against PCEC in the Superior Court of the State of California for the County of Los Angeles (the “Court”).

On December 10, 2021, Evergreen filed a motion for temporary restraining order and for preliminary injunction, seeking to (1) enjoin the Trustee from dissolving the Trust, (2) enjoin PCEC from dissolving the Trust, (3) direct PCEC to account for all monies withheld from the Trust on the basis of ARO costs since September 2019, and (4) direct PCEC to place such monies in escrow.

On December 16, 2021, the Court granted Evergreen’s application for a temporary restraining order. Accordingly, the Trust did not dissolve at the end of 2021 and commence the process of selling its assets and winding up its affairs. On January 11, 2022, PCEC and Evergreen filed an agreed stipulation to stay the prosecution of Evergreen’s derivative claims pending an arbitration of such claims. On January 13, 2022, the Court signed an Order dissolving the December 16, 2021, temporary restraining order and entering a new temporary restraining order to preserve the status quo until a tribunal of three arbitrators appointed pursuant to the trust agreement could rule on any request by Evergreen for injunctive relief. On April 11, 2022, PCEC notified the Court, at the arbitrators’ request, that the arbitration panel had issued an order on April 7, 2022, denying Evergreen’s request for injunctive relief. On April 13, 2022, Evergreen notified the Court that Evergreen had filed a motion for reconsideration with the arbitration panel that same day. On June 9, 2022, PCEC and Evergreen filed a stipulation, requesting that the Court stay the lawsuit for 90 days pending further ruling from the arbitration panel.

Production Update

PCEC has informed the Trustee that PCEC continues to strategically deploy capital to enhance production. Costs associated with returning wells to service must be recovered before cash flow to the Trust can be created. Although oil prices have improved significantly from their lowest levels in 2020, any monthly payments that PCEC may make to the Trust may not be sufficient to cover the Trust’s administrative expenses and outstanding debt to PCEC, and therefore the likelihood of distributions to the unitholders in the foreseeable future is extremely remote.

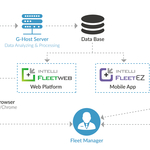

Overview of Trust Structure

Pacific Coast Oil Trust is a Delaware statutory trust formed by PCEC to own interests in certain oil and gas properties in the Santa Maria Basin and the Los Angeles Basin in California (the “Underlying Properties”). The Underlying Properties and the Trust’s net profits, and royalty interests are described in the Trust’s filings with the SEC. As described in the Trust’s filings with the SEC, the amount of any periodic distributions is expected to fluctuate, depending on the proceeds received by the Trust as a result of actual production volumes, oil and gas prices, development expenses, and the amount and timing of the Trust’s administrative expenses, among other factors. For additional information on the Trust, please visit https://royt.q4web.com/home/default.aspx.

Cautionary Statement Regarding Forward-Looking Information

This press release contains statements that are "forward-looking statements" within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this press release, other than statements of historical facts, are "forward-looking statements" for purposes of these provisions. These forward-looking statements include estimates of future asset retirement obligations, expectations regarding the impact of deductions for such obligations on future distributions to unitholders, estimates of future total distributions to unitholders, expectations regarding the outcome of the legal proceedings relating to the Trust and any future dissolution of the Trust, expectations regarding the impact of lower commodity prices on oil and gas reserve estimates, statements regarding the impact of returning shut-in wells to production, expectations regarding PCEC’s ability to loan funds to the Trust, and the amount and date of any anticipated distribution to unitholders. In any case, PCEC’s deductions of its estimated asset retirement obligations will have a material adverse effect on distributions to the unitholders and on the trading price of the Trust units and may result in the termination of the Trust. Any anticipated distribution is based, in part, on the amount of cash received or expected to be received by the Trust from PCEC with respect to the relevant period. Any differences in actual cash receipts by the Trust could affect this distributable amount. The amount of such cash received or expected to be received by the Trust (and its ability to pay distributions) has been and will be significantly and negatively affected by low commodity prices, which declined significantly during 2020, could decline again and could remain low for an extended period of time as a result of a variety of factors that are beyond the control of the Trust and PCEC. Other important factors that could cause actual results to differ materially include expenses related to the operation of the Underlying Properties, including lease operating expenses, expenses of the Trust, and reserves for anticipated future expenses. Statements made in this press release are qualified by the cautionary statements made in this press release. Neither PCEC nor the Trustee intends, and neither assumes any obligation, to update any of the statements included in this press release. An investment in units issued by Pacific Coast Oil Trust is subject to the risks described in the Trust's Annual Report on Form 10-K for the year ended December 31, 2018 filed with the SEC on March 8, 2019, and if applicable, the Trust’s subsequent Quarterly Reports on Form 10-Q. The Trust's Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q are available over the Internet at the SEC's website at http://www.sec.gov.

Contacts

Pacific Coast Oil Trust

The Bank of New York Mellon Trust Company, N.A., as Trustee

Sarah Newell

1(512) 236-6555