Newcomer to the UKCS, Hungary-based MOL Group is set to discuss its high-profile entry into the North Sea market at a Society of Petroleum Engineers (SPE) Aberdeen event on 6 May, 2015.

Newcomer to the UKCS, Hungary-based MOL Group is set to discuss its high-profile entry into the North Sea market at a Society of Petroleum Engineers (SPE) Aberdeen event on 6 May, 2015.

MOL Group, an integrated oil and gas company with operations in more than 40 countries, completed a deal in March 2014 to acquire 14 North Sea licenses which resulted in the creation of MOL Energy UK.

Managing Director of MOL Energy UK, Chris Bird, will speak at the next SPE Aberdeen Simplified Series event, organised by the Young Professionals Committee but aimed at oil and gas industry professionals of all ages.

Mr. Bird said: “The future rate of production in the UK Continental Shelf (UKCS) depends on a number of factors, such as continued investment and the success of further exploration. Establishing operations in the UK North Sea has been a major step for MOL Group and a carefully planned, strategic move which I look forward to discussing at this SPE Aberdeen event.”

As part of the presentation, Mr.. Bird will focus on risk management, value creation and the importance of industry collaboration and partnership. He will also discuss the way forward for the oil and gas sector in the UKCS, as well as the importance of this region to the global oil and gas industry.

SPE Aberdeen chairman Shankar Bhukya added: “SPE Aberdeen is thrilled to welcome MOL Energy UK to present at our next Simplified Series event. The company’s global experience will offer valuable lessons to all attendees and its recent move into the North Sea promises to be an extremely interesting topic. This is an event not to be missed.”

Chris Bird has approximately 30 years’ experience in the upstream oil and gas industry and has worked extensively with operators and contractors across the full value chain, focusing on turning around and growing businesses by developing people and technology. Chris enjoys both a European and Chartered Engineer status while being a Fellow of the IMechE, IoD and APM.

The SPE Aberdeen Simplified Series, currently sponsored by RESMAN and GE Oil & Gas, is a monthly event highlighting a technical issue or project within the oil and gas industry, approaching it in ‘simplified’ terms so that it appeals to a wider cross-section of industry professionals.

This event, which is free to attend, will take place from 6.45pm to 8.30pm on Wednesday, 6 May at the Aberdeen Station Hotel. Please note that demand for this event is expected to be high. For more information and booking please visit www.spe-uk.org/aberdeen/events.

About SPE

The Society of Petroleum Engineers (SPE) is a not-for-profit professional association whose members are engaged in energy resources development and production. SPE serves more than 124,000 members in 135 countries worldwide. SPE is a key resource for technical knowledge related to the oil and gas exploration and production industry and provides services through its publications, events, training courses, and online resources at www.spe.org.

About SPE Aberdeen

The SPE Aberdeen Section is the largest in the UK with more than 2,500 members and is run entirely by volunteers.

SPE Aberdeen members represent a range of ages, genders and nationalities, and the Section has student chapters at five universities in Scotland. SPE Aberdeen works closely with the oil and gas industry, Scottish universities and local schools, institutes and academia, to advance the learning and technical excellence in all aspects of the industry: offshore, onshore and internationally.

SPE Aberdeen won the SPE International Award for Section Excellence for the fifth consecutive year in 2014, the year it celebrated its 40th anniversary. For more information on the award winning section, please visit http://www.spe-uk.org.

About MOL Energy UK

MOL Energy UK Ltd. (a 100% subsidiary of MOL Group) was established in Aberdeen in March 2014. The company completed its first acquisition of four offshore licenses in December 2013, and then acquired six further offshore licenses in June 2014.

MOL Group is an integrated, independent, international oil and gas company, headquartered in Budapest, Hungary. The Group is active in over 40 countries with a dynamic international workforce of nearly 30,000 people and a track record of more than 100 years in the industry. MOL’s exploration and production activities are supported by more than 75 years’ experience. At the moment, there are production activities in eight countries and exploration assets in 13 countries. The Group operates four refineries and two petrochemicals plants, under integrated supply chain management, in Hungary, Slovakia and Croatia. MOL Group also owns a network of over 1,700 service stations across 12 countries in Central & South Eastern Europe.

The next

The next  NYC-based

NYC-based

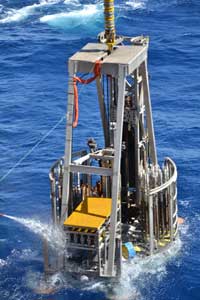

Amid low oil prices, pressure is growing to find industry wide solutions which can reduce costs. The documentation demanded today for subsea operations is time-consuming, complex and costly to deliver. Now a

Amid low oil prices, pressure is growing to find industry wide solutions which can reduce costs. The documentation demanded today for subsea operations is time-consuming, complex and costly to deliver. Now a  The industrial revolution and ensuing growth of the great cities of the western world some 200 years ago was enabled by a change in primary energy supply – from wood to coal. Today it is said we are at the beginning of another period of change, from fossil fuels to sustainable energy – the move from black to green. However, this cannot be achieved all at once, it is a long journey and the first step is to change from burning highly polluting coal to cleaner natural gas.

The industrial revolution and ensuing growth of the great cities of the western world some 200 years ago was enabled by a change in primary energy supply – from wood to coal. Today it is said we are at the beginning of another period of change, from fossil fuels to sustainable energy – the move from black to green. However, this cannot be achieved all at once, it is a long journey and the first step is to change from burning highly polluting coal to cleaner natural gas. Enhanced geomechanics technology and services strengthen geoscience portfolio

Enhanced geomechanics technology and services strengthen geoscience portfolio

Newcomer to the UKCS, Hungary-based MOL Group is set to discuss its high-profile entry into the North Sea market at a Society of Petroleum Engineers (SPE) Aberdeen event on 6 May, 2015.

Newcomer to the UKCS, Hungary-based MOL Group is set to discuss its high-profile entry into the North Sea market at a Society of Petroleum Engineers (SPE) Aberdeen event on 6 May, 2015.

Reservations are now open for

Reservations are now open for  ▪ U.S. could miss out on widely acknowledged economic and environmental benefits associated with LNG exports

▪ U.S. could miss out on widely acknowledged economic and environmental benefits associated with LNG exports