NYC-based PIRA Energy Group Reports that there are further markdowns to long-term fossil fuel prices. In the U.S., low runs and stronger demand pull product stocks lower and push crude stocks higher. In Japan, runs continue to ease and crude stocks are sharply lower. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

NYC-based PIRA Energy Group Reports that there are further markdowns to long-term fossil fuel prices. In the U.S., low runs and stronger demand pull product stocks lower and push crude stocks higher. In Japan, runs continue to ease and crude stocks are sharply lower. Specifically, PIRA’s analysis of the oil market fundamentals has revealed the following:

Low Runs, Stronger Demand Pull Product Stocks Lower, Push Crude Stocks Higher

Refinery turnarounds continue to dominate the U.S. petroleum balance sheet. Low crude runs are causing crude stocks to build, and product stocks to draw. Total weekly petroleum inventories set a new record, and increased their surplus over last year. Recent trends in gasoline and distillate demand coming in under modeled values could be an indication of an upward revision when we see the monthly data, but it also could be an indication of weakening economic trends. We expect one more week of peak refinery maintenance, followed by crude runs trending back up.

Even Lower Price May be Needed

With October halfway through, U.S. balances remain on course to end the month with storage near 4 TCF, which would mark a new high and also best the year ago level by ~0.4 TCF. Underlying balances for the month are pointing to more of the same with production still largely range bound and gas burn in the power sector somewhat stronger year-on-year. In sum, though, storage refills have remained relatively stout.

Eastern Grid/ERCOT Market Forecast

On-peak prices recorded a strong m/m increase (+33%) in Ontario (nuclear outages), saw moderate weather-related gains in the Northeast (MA Hub, NY-J, NY-G and PJM-W), fell slightly in the Great Plains (rising wind generation), and declined more sharply in ERCOT and MISO South (fading cooling loads). Northeast winter prices have been revised down as weaker fuel oil and LNG prices are expected to limit upside risk in gas prices. Winter prices are down year-on-year in most markets assuming normal weather (Feb 2015 was much colder than normal).

Bearish Fundamentals Continue to Depress Coal Pricing

The coal market returned to its downward trajectory this week, with prices essentially giving back all the gains made last week. Weaker oil prices, the end of the labor strike in South Africa, the extension of the lifting of the rail ban in Colombia, and news that Chinese import declined again in September all served to push the market lower. The market continues to search for a bottom, but with no end in sight to the declines in Chinese imports (particularly with domestic producers cutting prices) and limited production cutbacks, PIRA believes that this bottom has not yet been reached.

Pakistan Reveals RLNG Prices

Pakistan’s Oil and Gas Regulatory Authority (Ogra) has issued the much awaited RLNG (Regasified liquid natural gas) prices and announced the provisional rates of the gas. The authority, however, refused final determination of the RLNG prices until certain condition are met…the authority has agreed to determine the RLNG prices on provisional basis, the notification said.

Asian LPG Outperforms, Arbs Open

Asian LPG markets were by far the best performers last week, especially considering they didn’t have a chance to perform in the West’s Friday afternoon rebound. Propane and butane both lost around 2.5% of value, far less than seen in Western markets. The relative strength in Asia led to the opening of the spot arbitrage from the U.S. by the largest amount since June.

RGGI Nuke Retirements Tighten Balances

Nuclear units are a key source of non-emitting generation in the RGGI cap and trade region. Entergy announced it would close Massachusetts’ Pilgrim nuclear plant (680 MW) no later than June 1, 2019 and the James A. Fitzpatrick plant in NY, is facing some of the same challenges. Replacing power from these two plants with in-region natural gas combined cycle generation would add to emissions, challenging the RGGI compliance cushion.

U.S. Ethanol Prices and Margins Lower

Ethanol prices fell the week ending October 9, pressured by lower corn prices. Margins also declined, partly due to a drop in co-product DDG values.

Iowa is Dry and Confused

After a brief two-day visit to Iowa last week, two things are certain; it’s extremely dry, resulting in little propane use for crop drying, and there’s a lot of uncertainty about what 2016 will bring acreage-wise with these below profitable-level-prices in corn.

Freight Market Outlook

Rising tonnage demand and modest fleet growth have allowed excess capacity to be absorbed in 2015 and this has produced the strongest tanker markets since 2008, helped further by very cheap bunker fuel prices. But volatility remains as evidenced by the wide swings in tanker rates. VLCC markets staged a remarkable rally rising from their lowest levels of the year in late August to their highest in early October. But so far the knock-on benefits of higher VLCC rates have not filtered down to the other tanker groups, creating some unusual rate spreads and perhaps signaling that the VLCC rally was overdone.

Euro Area’s Economy Is Strengthening Broadly, but U.S. Is Still Ahead of the Curve

The U.S. and the euro area updated data on consumer spending, inflation, and manufacturing output this week. Key takeaways: household spending data have been mostly solid; excluding energy and food prices, inflation has been trending resiliently; and a recent slowing in U.S. manufacturing growth is potentially a worrisome sign. Next week’s major data releases include third quarter GDP from China.

Canadian Federal Elections: Lack of Outright Majority Signals Political Uncertainty To Come

Only a few days remain until Canada’s October 19 federal election, and the race is looking increasingly tight. At this point, it appears unlikely that any party will win an outright parliamentary majority. But at the very least an end to the Conservative Party’s four years of majority rule would have implications on the energy sector. On balance, the Conservatives are more supportive of pipelines and LNG projects, while the centrist Liberals and center-left New Democratic Party (NDP) favor more stringent carbon policies. Although the makeup of the next government is highly uncertain, we believe the lack of an outright majority will make the government formation process more complicated and reaching a consensus on core issues may be more difficult over the coming years.

Japanese Runs Continue to Ease, Crude Stocks Sharply Lower

For the week, crude runs eased again with very low imports such that crude stocks drew a sharp 5.5 MMBbls. Finished product stocks rose mostly on a naphtha stock build. Gasoil and kerosene stocks posted draws. Indicative refining margins remain good but were lower on the week.

Suppliers Immediately Responds to Weather-Induced Demand and Then Some

The response to colder than normal weather has been immediate and decisive by a variety of suppliers and shows that even in a relatively bullish environment for storage in Germany, the price risk to the upside is limited. If just-in-time-supply can perform for the entire winter like it has over the past week, the relatively lean storage situation compared to last year is not going to be an issue.

French Front Month Dive in Spite of Early Cold Snap

With colder weather emerging this past week, the most interesting dynamic was the ability of all gas-fired markets connected with France to lower their call on French power, with Italy even shifting into a net exporting position - an outcome we have not seen in a while. However, is this dynamic justifying France pricing at €40/MWh for the balance of the year?

Ethanol Stocks Rise

U.S. ethanol Inventories built by 144 thousand barrels to 19.0 million barrels the week ending October 9. Production was relatively flat the week ending October 9, decreasing slightly to 949 MB/D from 950 MB/D in the prior week.

Interest Waning

A quick look at Fund interest shows very little interest in corn and beans on a net basis with a continuing short position in wheat. Consensus pointed towards a short bean/long corn position going into last week’s WASDE and when the numbers failed to confirm the positioning an exodus ensued.

Fracking Policy Monitor

EPA, in August, issued a significant regulation impacting fracking, implementing President Obama’s Methane Strategy. Another higher profile federal effort suffered a setback as a judge called into question BLM’s authority to regulate fracking at all. Fracking rules are the subject of policy riders on still-pending federal budget bills. North Dakota continues to be responsive to industry concerns, relaxing regulations where production or profits are threatened. Seismic activity in Oklahoma continues to be a growing issue. Local authority to regulate fracking remains in question.

Key Indicators Continue to Improve

The S&P 500 posted a second week of gains. Also, all of the related indicators improved again (Russell 2000, volatility, high yield credit and emerging market credit). Overall, commodities eased slightly, but ex-energy was higher. Oil was slightly lower. With regard to currencies, many of the currency groups that had been performing poorly continued to post renewed strength. The U.S. dollar was slightly weaker against the euro and British pound. The Cleveland Fed released their expected inflation series for October, and all tracking maturities showed a lower rate of expected inflation.

Stock Build Slows

Commercial oil inventories in the three major OECD markets — United States, Europe and Japan — based on preliminary data increased 42 million barrels in the third quarter, down from 63 million barrels in 2Q and 92 million barrels in 1Q. The third quarter 2015 stock build was 9 million barrels less than the year earlier stock increase and, therefore, modestly reduced the year-on-year stock surplus to 181 million barrels (or 8%). While not a record, the end 3Q inventories were the highest level since 1990.

More Nuclear Restarts are Just the Beginning for Reduced Gas Demand in Japan

Almost everything about Japanese gas demand will be looked at to be some level of bearish at this point. Short of a full stop in nuclear restarts, both short and long-term considerations will mean the world's largest importer of LNG will be buying less and less in the months and years to come.

Saudi Arabia: Relying on Oil in Power Generation

Faced with rapidly increasing domestic demand for oil and gas in the power sector at still heavily subsidized prices, Saudi Arabia's stab at rebooting its energy policy squarely focuses at diversifying its supplies away from traditional sources. Such a transition is going to take time, but the goals are just as clear in Saudi as they are in Europe; a movement away from fossil fuel use in areas where both strategic and cost effective alternatives exist. An ambitious announcement of a large nuclear program of 16 reactors over the next several decades and a plan to bring online over 40 GWs of solar capacity by 2040 are the end game, but the Kingdom will continue to see increasing domestic oil and gas burning in the short- and medium-term in order to meet aggressive electricity demand growth.

Weak Fundamentals To Weigh on European Carbon Gains?

Higher auction volumes, combined with potential additional industrial sales, could increase EUA supply in 2016-2018. Emissions demand growth remains weak, and lower gas prices are leading to lower implied carbon prices. There are no upcoming policy developments until post-2020 reform discussions begin in earnest next year. Market sentiment can still play a major role, but stronger fundamentals may soon be needed to maintain the price increases of the last few months.

Global Equities Post a Third Straight Positive Week

Global equities gained again. In the U.S., many of the tracking indices were positive on the week, with utilities and technology performing the strongest. Energy was slightly higher, but underperformed. Internationally, all the tracking indices other than Latin America posted gains, with China doing the best.

Third Quarter Asian Demand Looking Robust

Partial third quarter demand data is now available for seven countries in Asia which represent over 24 MMB/D, or 77% of Asian oil demand. The data is admittedly preliminary but it is indicative and does show that this group of important Asian countries are growing 1.4 MMB/D, or 6% year on year. China and India account for 96% of the growth of the seven countries.

October Weather: U.S. Warm, Europe and Japan Cold

The new heating season is off to a cold start in Europe and Japan and warm weather in the U.S. With half the month completed and a second half forecast, October is expected to be 18% warmer than the 10-year normal and 5% warmer on a 30-year-normal basis.

Further Markdowns to Long-Term Fossil Fuel Prices

As a result of our bi-annual development of our long-term energy balances, PIRA has marked down its long-term fossil fuel price projections for crude oil, international gas (NBP and Asian LNG), and coal. In the case of oil, the principal driver was the view on long-run supply cost and price responsiveness. International gas price reductions reflected both lower crude prices and the impact of potential gas supply that looks likely to far exceed demand growth. The reductions in coal were primarily associated with greater competition from lower priced gas and lower costs associated with oil.

The information above is part of PIRA Energy Group's weekly Energy Market Recap - which alerts readers to PIRA’s current analysis of energy markets around the world as well as the key economic and political factors driving those markets.

Neptune

Neptune The

The  With the pace of decommissioning activity accelerating, Mark Walker, Client Partner at Optimus Seventh Generation, a behavioral change consultancy, discusses the vital need for leadership to help ensure projects are as safe as possible.

With the pace of decommissioning activity accelerating, Mark Walker, Client Partner at Optimus Seventh Generation, a behavioral change consultancy, discusses the vital need for leadership to help ensure projects are as safe as possible.  Sea Trucks

Sea Trucks CGG

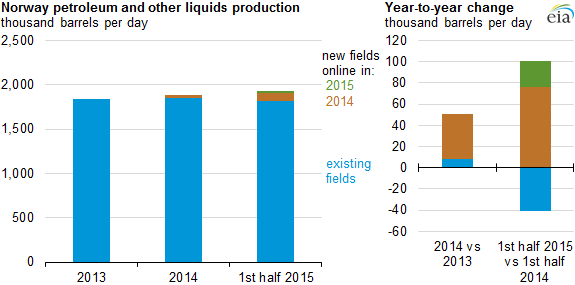

CGG Source: U.S. Energy Information Administration, based on Norwegian

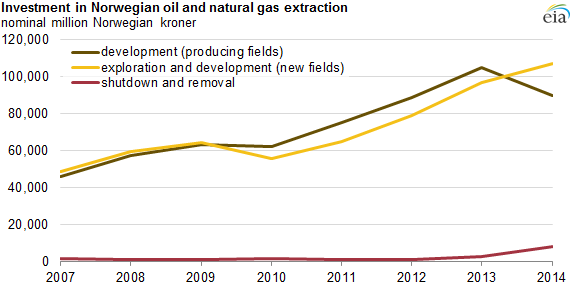

Source: U.S. Energy Information Administration, based on Norwegian  Source: U.S. Energy Information Administration, based on Statistics Norway

Source: U.S. Energy Information Administration, based on Statistics Norway  Subsea 7 S.A.

Subsea 7 S.A. Consilium

Consilium AAL

AAL DNV GL

DNV GL Greg Spence, Managing Director of ReftradeUK

Greg Spence, Managing Director of ReftradeUK  NYC-based

NYC-based

The horrific explosions in the Chinese port of Tainjin illustrated vividly just how volatile port operations can be. But safety issues are only one facet of risk in the complex world of shipping ports.

The horrific explosions in the Chinese port of Tainjin illustrated vividly just how volatile port operations can be. But safety issues are only one facet of risk in the complex world of shipping ports. Gulf Coast Shipyard Group (GCSG)

Gulf Coast Shipyard Group (GCSG) In the desert of New Mexico, just forty miles from producing wells in Artesia, lies an aircraft boneyard filled with the remains of once great aeroplanes. Like these planes, nearly 4,000 frac trucks are sitting idle throughout the United States as the demand for horsepower (HP) has fallen as quickly as WTI over the past year. Could there be potential for these trucks to be utilized again, or will frac trucks join aeroplanes in boneyards across Texas and North Dakota?

In the desert of New Mexico, just forty miles from producing wells in Artesia, lies an aircraft boneyard filled with the remains of once great aeroplanes. Like these planes, nearly 4,000 frac trucks are sitting idle throughout the United States as the demand for horsepower (HP) has fallen as quickly as WTI over the past year. Could there be potential for these trucks to be utilized again, or will frac trucks join aeroplanes in boneyards across Texas and North Dakota?