• Repsol has discovered hydrocarbons in its TB14 well in the TSP block offshore Trinidad and Tobago, east of the Island of Trinidad.

• Repsol has discovered hydrocarbons in its TB14 well in the TSP block offshore Trinidad and Tobago, east of the Island of Trinidad.

• This discovery, made outside of the existing extension of the Teak field, has an estimated 40 million barrels of oil in place.

• The TB14 well has produced 1,200 barrels of oil a day of good quality crude in testing and is in commercial production.

• The find adds to the successful completion of the TB13 development well, which began producing in May.

The company has for the last three years beaten its own resource addition targets, outlined in its 2012-2016 strategic plan.

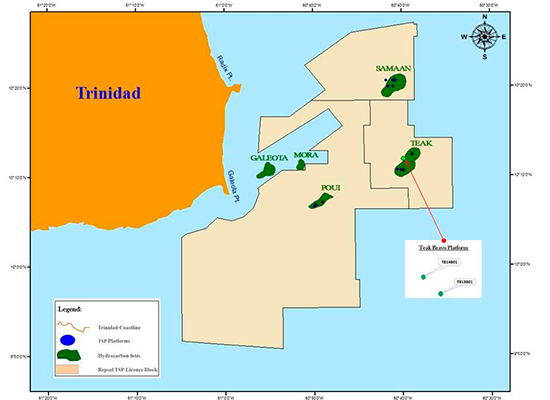

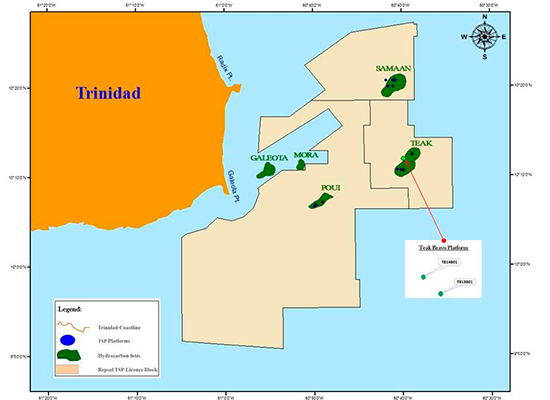

Repsol has made a new hydrocarbons discovery in the Teak field, offshore Trinidad and Tobago, in the TSP block east of the island of Trinidad.

The find in the TB14 well has upgraded the northern portion of the Teak B field that was not known to exist before.

The newly-discovered area is estimated to contain over 40 million barrels of oil in place, which increases the field's current reserves, extends its productive life and adds new output.

Repsol operates the field with a 70% interest, partnered by co-venturers Petroleum Company of Trinidad and Tobago (Petrotrin) and The National Gas Company of Trinidad and Tobago (NGC), with a 15% stake each.

Repsol and its partners are carrying out a drilling campaign to add new resources and production to the TSP block, which has been producing since the 1970s. The program includes new drilling throughout 2014.

The TB14 well, which has produced 1,200 barrels of oil a day in testing, adds to the start-up in June of the TB13 well, which added 1,384 bopd to the field's output. The new wells add 24% to the block's existing production, which averaged 10,900 bopd during 2013.

The drilling programs in Trinidad and Tobago have been benefitted by fiscal reforms implemented by the government in the last few years to incentivise exploration and production in mature fields. This has resulted in increased rig activity, additional production and new reserves.

Repsol and its partners continue to work in the area, expecting to complete at least two more wells during the current year, with further drilling scheduled for the following years.

Repsol has boosted its exploratory activity in the last few years with significant success, with more than 50 discoveries since 2008, including some of the world's largest finds in the period.

In 2013, Repsol posted the highest reserve replacement rate amongst its peers at 275%, which also beat the company's own reserve addition targets for a third consecutive year to reach a total 1.515 billion barrels of oil equivalent.

Repsol in Trinidad and Tobago

Repsol has been operating in Trinidad and Tobago since 1995. It currently holds rights over seven offshore blocks. Repsol's production in the country averaged 135,046 boepd in 2013.

At the end of 2013, Repsol has hydrocarbons reserves in Trinidad and Tobago totalling 325.3 million barrels of oil equivalent.

The Bureau of Safety and Environmental Enforcement (BSEE)

The Bureau of Safety and Environmental Enforcement (BSEE)  The Brasil Voyager, a tanker owned and operated by Chevron, was built with specific features for offloading oil from Papa-Terra.

The Brasil Voyager, a tanker owned and operated by Chevron, was built with specific features for offloading oil from Papa-Terra. The fully owned subsidiary of A.P. Møller - Maersk A/S (the Company), Maersk Olie og Gas A/S (Maersk Oil), completed the acquisition of stakes in three Brazilian blocks from SK Energy for USD 2.4 billion in July 2011.

The fully owned subsidiary of A.P. Møller - Maersk A/S (the Company), Maersk Olie og Gas A/S (Maersk Oil), completed the acquisition of stakes in three Brazilian blocks from SK Energy for USD 2.4 billion in July 2011. Roxtec UK managing director Graham O'Hare (photo) said the firm's deck seals are being used on the hull and top sides of the project and also in the living quarters.

Roxtec UK managing director Graham O'Hare (photo) said the firm's deck seals are being used on the hull and top sides of the project and also in the living quarters.

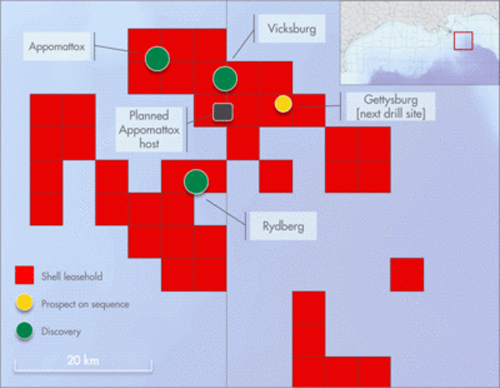

Shell

Shell GE Oil & Gas

GE Oil & Gas

Litre Meter has launched the second in its series of industry surveys on safety issues in the oil and gas sector.

Litre Meter has launched the second in its series of industry surveys on safety issues in the oil and gas sector. Leiv Eriksson

Leiv Eriksson Myanmar's Deputy Minister for the Ministry of Energy, His Excellency, U Aung Htoo, was guest of honor at the inauguration ceremony for CGG's new Myanmar subsuface imaging center.

Myanmar's Deputy Minister for the Ministry of Energy, His Excellency, U Aung Htoo, was guest of honor at the inauguration ceremony for CGG's new Myanmar subsuface imaging center. The Njord A platform in the Norwegian Seat. (Photo: Øyvind Nesvåg)

The Njord A platform in the Norwegian Seat. (Photo: Øyvind Nesvåg) Scaffolding used in the reinforcement process. (Photo: Ole-Andreas Nylund)

Scaffolding used in the reinforcement process. (Photo: Ole-Andreas Nylund) • Repsol has discovered hydrocarbons in its TB14 well in the TSP block offshore Trinidad and Tobago, east of the Island of Trinidad.

• Repsol has discovered hydrocarbons in its TB14 well in the TSP block offshore Trinidad and Tobago, east of the Island of Trinidad. Oseberg Øst. (Photo: Øyvind Hagen)

Oseberg Øst. (Photo: Øyvind Hagen)