Secretary of the Interior Sally Jewell and Acting Director of the Bureau of Ocean Energy Management (BOEM) Walter Cruickshank have announced the first step in a robust public engagement process to develop the next schedule of potential offshore oil and gas lease sales.

Secretary of the Interior Sally Jewell and Acting Director of the Bureau of Ocean Energy Management (BOEM) Walter Cruickshank have announced the first step in a robust public engagement process to develop the next schedule of potential offshore oil and gas lease sales.

The publication in the Federal Register of a Request for Information (RFI) and Comments on the Preparation of the 2017-2022 Outer Continental Shelf (OCS) Oil and Gas Leasing Program (RFI) is the initial step in the multi-year planning process and does not identify any specific course of action. Per statute and consistent with previous efforts, BOEM will evaluate all of the OCS planning areas during this first stage.

Today’s publication of a RFI begins a 45-day comment period. Substantial public involvement and extensive analysis will accompany all stages of the planning process, which will take up to three years to complete.

“The development of the next Five Year Program will be a thorough and open process that incorporates stakeholder input and uses the best available science to develop a proposed offshore oil and gas program that creates jobs and safely and responsibly meets the energy needs of the nation,” said Secretary Jewell. “Today marks the first step of engaging interested parties across the spectrum to balance the various uses and values inherent in managing the resources of federal offshore waters that belong to all Americans and future generations.”

The OCS Lands Act requires the Secretary of the Interior, through BOEM, to prepare and maintain a schedule of proposed oil and gas lease sales in federal waters, indicating the size, timing and location of auctions that would best meet national energy needs for the five-year period following its approval. In developing the Five Year Program, the Secretary is required to achieve an appropriate balance among the potential for environmental impacts, for discovery of oil and gas, and for adverse effects on the coastal zone.

“In issuing the RFI, BOEM does not propose to schedule sales in particular areas, or make any preliminary decisions on what areas will be included in the schedule,” said BOEM Acting Director Cruickshank. “Rather, the RFI provides an opportunity for interested parties to submit comments and suggestions about the potential for leasing and to identify environmental and other concerns and uses that may be affected by offshore leasing.”

BOEM seeks a wide array of input, including information on the economic, social and environmental values of all OCS resources, as well as the potential impact of oil and gas exploration and development on other resource values of the OCS and the marine, coastal and human environments.

Using the information received, BOEM will prepare a Draft Proposed Program, followed by a Proposed Program and a Proposed Final Program. Throughout the planning process, BOEM consults with all interested parties and seeks additional public comment. Concurrently, BOEM will prepare a Programmatic Environmental Impact Statement (PEIS) required by the National Environmental Policy Act to evaluate the potential environmental impacts of various OCS oil and gas leasing alternatives under the Proposed Program and to help inform decisions on the Proposed Final Program.

The current Five Year Program for 2012–2017, which expires in August 2017, schedules 15 potential lease sales in six planning areas with the greatest resource potential, including more than 75 percent of the estimated undiscovered, technically recoverable oil and gas resources in federal offshore waters. BOEM has held five sales thus far, including annual auctions in the Central and Western Gulf of Mexico and a single sale in the portion of the Eastern Gulf not subject to the Congressional moratorium.

These five auctions offered more than 60 million offshore acres and leased 4.3 million of those, generating more than $2.3 billion in high bids. The sixth lease sale in August 2014 will offer 21 million OCS acres in the Western Gulf of Mexico. Off Alaska, the current Five Year Program includes one potential sale each for the Chukchi Sea, Beaufort Sea and Cook Inlet planning areas.

BOEM currently manages about 6,200 active OCS leases, covering more than 33 million acres – the vast majority in the Gulf of Mexico. Of those, 1,064 are producing leases, covering 5.2 million producing acres – the highest acreage under production since 2008. In 2013, OCS oil and gas leases accounted for about 18 percent of domestic oil production and 5 percent of domestic natural gas production. This production generates billions of dollars in revenue for state and local governments and the U.S. taxpayer, while supporting hundreds of thousands of jobs.

Under the RFI published today, BOEM will accept comments until July 30, 2014 in either of the following ways: On BOEM’s website. Click on the “Open Comment Documents” link and follow instructions to view relevant documents and submit comments. In written form, deliver to: Ms. Kelly Hammerle, Five Year Program Manager; Bureau of Ocean Energy Management; 381 Elden Street - HM-3120; Herndon, Virginia 20170. Additional information on the process of developing the next Five-Year Program as well as on the current Five Year Program can be found here.

BP

BP The discovery in the Piri prospect is

The discovery in the Piri prospect is  owing of the first Gullfaks loading buoy.

owing of the first Gullfaks loading buoy. The new loading buoys are scheduled to come on line in June and mid-September.

The new loading buoys are scheduled to come on line in June and mid-September. New loading hose for Gullfaks.

New loading hose for Gullfaks.

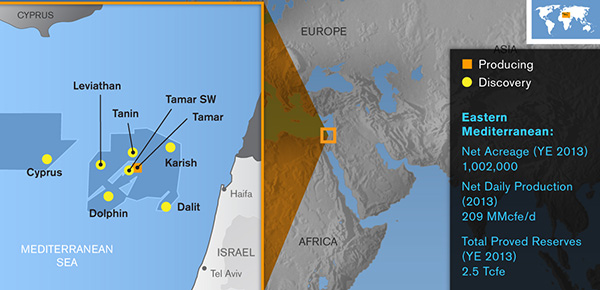

Noble Energy, Inc.

Noble Energy, Inc.  Supply Base Manager Alexander Pavlov (left) discusses planned upgrades

Supply Base Manager Alexander Pavlov (left) discusses planned upgrades Secretary of the Interior Sally Jewell and Acting Director of the Bureau of Ocean Energy Management (BOEM) Walter Cruickshank have announced the first step in a robust public engagement process to develop the next schedule of potential offshore oil and gas lease sales.

Secretary of the Interior Sally Jewell and Acting Director of the Bureau of Ocean Energy Management (BOEM) Walter Cruickshank have announced the first step in a robust public engagement process to develop the next schedule of potential offshore oil and gas lease sales. CGG

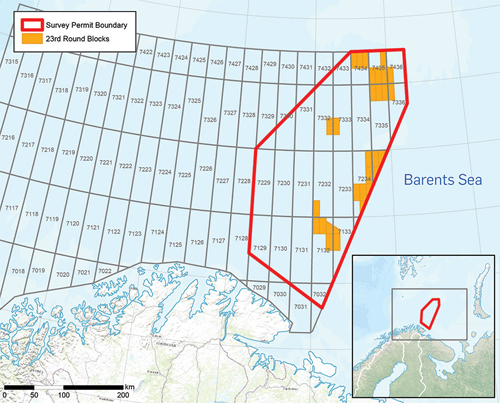

CGG In March 2011

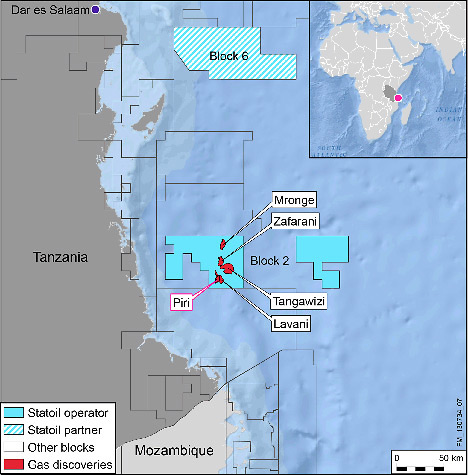

In March 2011  Statoil

Statoil Royal Dutch Shell plc

Royal Dutch Shell plc A new

A new  Production from a subsea template at the Snorre B platform was shut down on 17 May following the discovery of an abnormal erosion of mass under the template.

Production from a subsea template at the Snorre B platform was shut down on 17 May following the discovery of an abnormal erosion of mass under the template.