Aligned With the Paris Agreement and Approved by the Science Based Targets Initiative (SBTi), JetBlue Commits to Reduce Jet Fuel Emissions 50% Per Revenue Tonne Kilometer by 2035 From 2019 Levels

JetBlue’s Most Aggressive Near-term Emissions Target Will Require an Increased Focus on Lower-carbon Solutions Within Its Operation and Can Only Be Successful with Industry and Policy Support

NEW YORK--(BUSINESS WIRE)--JetBlue (Nasdaq: JBLU) today announces a science-based target approved by the Science Based Targets initiative (SBTi), a coalition that defines and promotes best practices in emissions reduction targets. With this target, JetBlue commits to reducing well-to-wake (lifecycle) scope 1 and 3 greenhouse gas (GHG) emissions related to jet fuel by 50% per revenue tonne kilometer (RTK) by 2035 from a 2019 base year1. JetBlue’s most aggressive near-term emissions reduction target to-date, this science-based target aligns with the goals of the Paris Agreement and the growing airline’s own goal to reach net zero carbon emissions by 2040 – 10 years ahead of broader airline industry targets. Aligned with SBTi requirements, JetBlue will also regularly review and update this target following any significant change to JetBlue's business or structure.

To meet this aggressive near-term target, the airline will increase its investments in lower-carbon solutions within its operation and will evaluate future sustainability investments with its science-based target in mind. JetBlue also recognizes how critical external partners are to decarbonizing the aviation industry and is committed to encouraging and supporting efforts by aircraft and engine manufacturers, governments, regulatory agencies, and fuel suppliers to realize their own GHG emission reduction goals.

“Effectively cutting our per-seat emissions in half will require substantial change to the way we run our business today,” said Robin Hayes chief executive officer, JetBlue, “Our team is fully committed to hitting the goal, but we can’t do it alone. We are calling on governments, aircraft and engine manufacturers, and fuel producers to support the development of the products and solutions that airlines need to achieve our ambitious goals.”

Charting a path to net zero

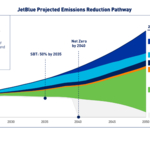

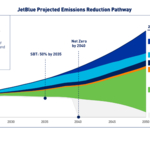

JetBlue further illustrates its path to achieving its 2035 and net zero goals and contributing factors with its JetBlue Projected Emissions Reduction Pathway (graphic attached). Sustainable aviation fuel (SAF) is expected to be the key contributor to large-scale lifecycle emissions reduction, which is highly dependent on availability and costs of supply. Advancements in aircraft technology and fuel efficiency represent the second-most significant opportunity for emissions reduction. This includes efficiencies from the airline’s transition to newer and more advanced aircraft, the incremental improvements for aircraft delivered in subsequent years, as well as the potential for broader efficiency improvements for next generation aircraft yet to be developed, but anticipated to be commercially available by the late 2030s or early 2040s. Procedural optimization via Air Traffic Control (ATC) modernization led by the Federal Aviation Administration (FAA) and fine-tuning of the airline’s own operations will also significantly contribute to further emissions reductions. Finally, investing in high-quality carbon removals and offsets is expected to play a role in addressing emissions the airline is unable to avoid. JetBlue is committed to prioritizing the lower-carbon solutions within its operation first, to drive down the need for carbon credits as much as possible.

“The aviation industry is at a critical time in our push towards net zero. Many of these lower carbon solutions are proven, but still haven’t achieved the scale needed to make a meaningful impact,” said Sara Bogdan, director of sustainability and environmental social governance, JetBlue. “Encouragement of these maturing technologies is needed and the investments we make today will help shape the trajectory of these solutions as they grow to realize their fullest potential.”

Since 2020 when the airline first outlined its net zero goal, JetBlue has made significant headway in its own sustainability efforts.

Reducing Fuel Burn

JetBlue operates a robust fuel savings strategy that starts with a young, fuel-efficient fleet that reduces emissions from fuel burn, from the outset. Its growing fleet of Airbus A321neo aircraft are improving fuel economy by approximately 20%. Further, JetBlue continues to take delivery of Airbus A220s, reducing emissions by up to 35% per seat compared to the aircraft they are replacing. To support fuel efficiency and cost goals, JetBlue is accelerating the retirement of its E190 fleet, with the final E190 aircraft scheduled to exit the fleet in 2025. And to ensure all aircraft are flown efficiently, JetBlue also operates a cross functional Fuel Optimization Team targeting a range of procedural and technology shifts that maximize the efficiency of its flight operations. Due to JetBlue’s fleet and fuel optimization initiatives, the airline is on pace to achieve a 6% improvement in emissions per available seat mile (ASM) in 2022 versus 2019 flying.

Further emissions reductions can be achieved by looking at operational airspace and JetBlue continues to advocate for air traffic control modernization (NextGen) efforts. Current Air Traffic Control inefficiencies account for as much as 12% of fuel burn and resulting emissions. One of the most impactful ways to help reduce airline emissions across the industry is transitioning the United States’ aging radar technology with GPS based technology, which would allow for greater efficiency, more consistent flight planning, and as an added benefit, improved on-time performance for all travelers.

To reduce the impact on the ground, JetBlue set a public goal to convert 40% of its three most common ground service vehicle types to electric by 2025 and 50% to electric by 2030. In 2019, JetBlue rolled out the largest electric fleet of any carrier at John F. Kennedy International Airport with 118 electric vehicles and continues to roll out electric ground service equipment at other airports including Boston Logan, the airline’s second largest city, and Newark Liberty International Airport.

Transitioning to Sustainable Aviation Fuel (SAF)

JetBlue views SAF as the most promising avenue for addressing aviation emissions in a meaningful and rapid way – once cost-effective SAF is made available commercially at scale. SAF is a type of renewable fuel that exists today that drops directly into existing aircraft and infrastructure with no impact to safety or performance. SAF can be produced from a wide array of renewable sources such as agricultural wastes and used cooking oils—not fossil fuels—and can lower lifecycle greenhouse gas emissions by roughly 80% compared to traditional petroleum-based fuels.

Supporting and growing SAF availability is critical to reaching larger industry goals and JetBlue continues to do its part to encourage a diverse and competitive SAF market. The shared focus is necessary to build the economies of scale needed to compete with traditional fuel sources. Since 2020, JetBlue has continued to secure immediate as well as future supplies of SAF on its path to convert 10% of the airline’s total fuel to be SAF by 2030.

Since 2020, JetBlue has been flying regularly using SAF from its California airports in Los Angeles and San Francisco, partnering with both currently available SAF suppliers in the U.S., Neste and World Energy. To further encourage a vibrant and competitive market, in 2022 alone, JetBlue has signed agreements with three additional SAF producers for future supply: Aemetis, AIR COMPANY, and Fidelis New Energy. While its 2021 agreement with SG Preston has been terminated, JetBlue will continue to look at future SAF partnerships to grow its SAF portfolio, with a particular interest in encouraging SAF in its Northeast focus cities.

Through these existing and future SAF offtake agreements, JetBlue seeks to build a diversified portfolio of future SAF suppliers and feedstocks while continuing to send the message that strong demand for SAF exists.

Advancing the Future of Flight

The airline’s subsidiary, JetBlue Ventures (JBV), continues to invest in and partner with early-stage startups improving travel and hospitality, including those in the sustainable travel space. Referred to as, “the most active startup investor across all airlines in green aviation technologies,” JBV has invested in seven direct and three adjacent sustainability companies to date. The team explores advanced methods of measuring and reducing emissions, technologies that improve environmental protections and encourage sustainable tourism, and game-changing transportation powered by alternative propulsion systems like electric or hydrogen powered commercial aircraft. Most recently, JBV announced an investment in Rubicon Carbon, a next generation carbon solutions provider also backed by TPG Rise Climate.

Refreshed Carbon Offsetting Strategy

Since first setting the airline’s path to net zero, JetBlue has maintained its stance that carbon offsetting is a bridge solution toward greater sustainability efforts that directly reduce air travel emissions. JetBlue is proud to have voluntarily offset more than 11M metric tons of CO2 emissions to date (EOY 2022), including providing domestic and transatlantic carbon neutral flights for all customers from June 2020 to 2022. As lower-carbon solutions within the airline’s operations are made more readily available, the use of carbon offsets was always intended to decrease.

While JetBlue still strongly believes there is a role for high-quality carbon offsetting solutions, the airline has elected to not continue its voluntary carbon offsetting of domestic flights into 2023. In place, it will reallocate its offsetting spending into operational investments that align with its science-based target, as well as evolve its offsetting strategy to support a curated list of primarily nature-based projects in and around the destinations the airline serves.

JetBlue continues to see value in supporting high-quality projects that truly remove or avoid CO2 and deliver community benefits such as improving local air quality, introducing employment opportunities, and improving biodiversity of local habitats. JetBlue recently joined Rubicon Carbon as a launch partner for their innovative platform that delivers trusted, enterprise-grade solutions for carbon credit purchases. Rubicon Carbon was developed to deliver greater scale, confidence, and innovation across all facets of the carbon markets and meet the growing demand for high-integrity emissions reduction solutions.

To further high-quality, high-integrity carbon credit availability in the voluntary carbon market, JetBlue will continue to collaborate with other like-minded organizations and recently joined the Business Alliance to Scale Climate Solutions (BASCS) as the first airline member to open opportunities for investment, policy influence, and discussions with other corporations and NGOS/IGOS in aligned messaging around scaling climate solutions. With the BASCS partnership JetBlue will specifically focus on workstreams seeking to encourage conservation and restoration projects for coastal and oceanic carbon ecosystems – referred to as blue carbon projects – as well as promote learning sessions offering transparency into the standards, methodologies, and corporate guidance initiatives that go into these carbon credit markets.

JetBlue’s Focus on the Environment

JetBlue depends on natural resources and a healthy environment to keep its business running smoothly. Not only do we all rely on those natural resources, but tourism also relies on having beautiful, natural and preserved destinations for customers to visit. The airline focuses on issues that have the potential to impact its business. Customers, crewmembers and community are key to JetBlue's sustainability strategy. Demand from these groups for responsible service is one of the motivations behind changes that help reduce the airline’s carbon output and overall environmental impact. For more on JetBlue’s sustainability initiatives, visit www.jetblue.com/sustainability.

About JetBlue Airways

JetBlue is New York's Hometown Airline®, and a leading carrier in Boston, Fort Lauderdale-Hollywood, Los Angeles, Orlando and San Juan. JetBlue carries customers to more than 100 destinations throughout the United States, Latin America, Caribbean, Canada and United Kingdom. For more information and the best fares, visit jetblue.com.

____________________________

1 The full commitment to SBTi reads: “JetBlue Airways commits to reduce well-to-wake scope 1 and 3 GHG emissions related to jet fuel 50% per revenue tonne kilometer by 2035 from a 2019 base year. Non- CO2e effects which may also contribute to aviation induced warming are not included in this target. JetBlue Airways commits to publicly report on non- CO2e impacts of aviation over its target timeframe.”

|

Contacts

Media Contact

JetBlue Corporate Communications

This email address is being protected from spambots. You need JavaScript enabled to view it.