Current Events Have Huge Impacts on Price Ranges

Oil Market:

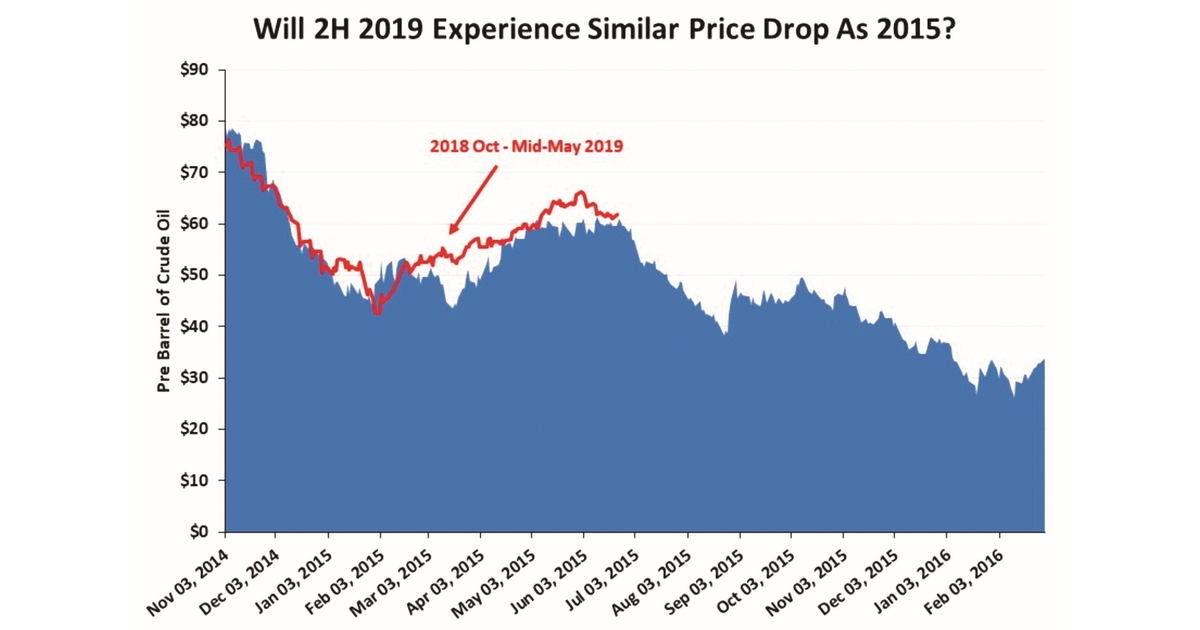

Crude oil prices are range-bound. Yes, they bob up and down like a cork in the ocean, but all that movement does little but provide traders with miniscule profit-taking opportunities. In reality, oil prices are waiting for events to unfold that will provide clarity about future oil supply and demand.

What are prices waiting for? Maybe it’s learning whether we are in a global trade skirmish or a real trade war. There are unanswered questions about the future for the current oil production cut engineered by OPEC members and its friend Russia at the end of 2018 and scheduled to end in June. These are merely two of the many unanswered questions that will determine future oil prices. News or clues about any of the issues can cause oil prices to react. Without actual resolutions, however, price moves will likely be modest.

We are in the middle of the traditionally weak second quarter for oil. Refiners are shutting down operations, as maintenance and reconfiguration work begins in preparation for stepping up gasoline output for the summer driving season. That means refiners are not aggressively buying oil, since they need less at the moment. Offsetting the buying weakness is the response to the loss of substantial heavy oil volumes given the collapse of production in Venezuela. These volumes, necessary to efficiently operate refineries, caused refiners to bid aggressively for other heavy oil supplies from Saudi Arabia, Russia and Canada. The buying initially lifted global oil prices, but now it is helping support current prices.

The other one-time refinery event is the need to step up distillate output in order to have adequate supplies for the shipping industry next January to meet the IMO 2020 low-sulfur fuel oil mandate. While the outlandish claims that the UN fuel standard would drive global oil prices to $200 per barrel have been debunked, forecasts now suggest more modest price hikes of between $2-5 per barrel, much of which may already be reflected in current oil prices.

The major uncertainties for oil prices are the duration and intensity of the growing U.S.–China trade war and its damage to economic growth, which has already shown signs of moderating. In fact, nearly every global financial organization – World Bank, International Monetary Fund, and OECD – has marked down its growth projections for 2019 issued earlier this year. This uncertainty, plus the question about the production output of troubled countries such as Venezuela and Libya, has people struggling to sense the direction of oil prices. There also remains uncertainty about how significant the impact of ending waivers from the financial sanctions leveled against the purchase of Iranian oil, awarded to a handful of countries by the United States, will be on global oil supplies this summer. These uncertainties are weighing on the discussions between OPEC members and Russia over extending their current combined 1.2 million barrels a day production cut put in place at the start of 2019, and which helped oil prices recover this year.

Also figuring into the OPEC+ negotiations is the issue of whether U.S. oil production will continue its rapid growth. The EIA recently upped its forecast for U.S. oil production this year and next, certainly muddling the global oil market outlook the OPEC+ group must fathom in order to set its future production quotas. At the present time, the likely scenario is for OPEC+ to ease back its cut – adding anywhere from 300,000 to 800,000 barrels per day to global supply starting in the second half. With global oil inventories building in 2Q 2019, rather than falling as had been predicted, OPEC+ will probably wait until July for additional data before making its final decision. When OPEC+ speaks, the oil market may take its direction, but that may be more than a month away.

Natural Gas Market:

The natural gas market has been boring. That’s because gas prices did not react to the large inventory draws early this year when Polar Vortex blasts depleted storage. As temperatures moderated heading into the spring, surging gas output, largely associated with growing crude oil production in the Permian Basin, has met all gas demands while also enabling large storage injections. As a result, gas storage has passed last year’s low levels and is on track to rebuild inventory beyond the level at the end of last season. As this rebuilding is happening without significantly lifting gas prices, expectations are for little further upside for the balance of 2019. In fact, it is not until November 2019 that natural gas futures prices climb above $2.70 per thousand cubic feet level.

In the accompanying chart, the trend in natural gas futures prices is downward for the next three years, before starting to climb. Note that it isn’t until the winter of 2023-24 that gas prices exceed $3/Mcf again, assuming they reach the January 2020 futures price of $3.02/Mcf. The most interesting point about the near-term gas price outlook is that futures prices in March 2021 and March 2022 sit at $2.50/Mcf, a threshold that prices briefly dipped below recently, but which had only been breached four times since the late 1990s.

With natural gas production remaining strong, although not setting new monthly records, demand and exports will determine how much gas can be injected into storage. With multiple weeks of triple-digit storage injections, any concern gas traders had about a potential supply shortage this coming winter disappeared. The recent uptick in gas prices from $2.50 to above $2.60/Mcf reflected views that the lack of new gas production records coupled with greater liquefied natural gas shipments and increased pipeline exports to Mexico has slightly increased pressure on the market. Will it continue or wane as we await warmer weather? Recent snowstorms in Denver are highlighting a cooling trend that is emerging, confounding the energy outlook.

The greatest challenge for natural gas producers, and derivatively for gas prices, is the output from the Marcellus and Utica regions, our largest supply source. It is facing limited export opportunities to the Northeast and Canada, so more gas is going to the Cove Point LNG export terminal in Maryland, and more gas is heading westward and to the Southeast. This latter flow is meeting increased output from the Haynesville, which is squeezing gas prices in the Southeast. The Ohio and Pennsylvania gas flowing westward has run into greater volumes coming up from the Permian Basin, which is being forced to ship more gas west and north, until new LNG export and petrochemical facilities along the Gulf Coast open. This new gas flow pattern across the United States will create new price pressures, as regional supply/demand imbalances force prices to balance markets. All this turmoil works to keep gas prices range-bound for the foreseeable future.

By G. Allen Brooks | www.energymusings.com