Crude Oil Volatile, Natural Gas Prices Could Head Lower

Crude Oil:

In recent weeks, crude oil prices have been volatile. The volatility was magnified by an attack on Saudi Arabia’s largest petroleum processing facility and a significant oil field. The drone and cruise missile attack inflicted meaningful damage, initially shutting down 50 percent of Saudi Arabia’s oil production, the equivalent of roughly five percent of the globe’s total supply. The market shock, along with uncertainty about the duration this supply would be off-line, sent oil prices soaring.

The attack occurred on a Saturday morning. By the time commodity markets opened for trading Sunday night, global oil prices were up as much as 20 percent. This was a natural response to uncertainty, as prices signal suppliers to increase their output and consumers to cut consumption. Without both responses, the globe’s supply/demand will become and remain unbalanced.

Chaos ruled the first day of oil trading. Saudi Aramco declared it would sustain its export volumes, but importantly, that full operation of the damaged facilities would be restored within days and weeks, not months. With the fires snuffed out, damage assessments began and the optimism of an early return of production caused oil traders to sell, after their panic buying had driven WTI up 15 percent. Over the next two days, WTI’s price fell nearly eight percent before stabilizing, as traders believed the optimism for an early return of supply.

Since then, oil prices have fluctuated based on commodity traders’ interpretation of the latest news from Saudi Aramco. Prices rose when news emerged that the Saudis were seeking to obtain crude oil and refined petroleum products for its own use, as it seemed Saudi’s optimism about the speed of its output return was premature. The Kingdom reaffirmed it would meet all its export obligations, however, customers were told of adjustments to the mix of grades of oil they would receive. This was necessitated by the loss of the processing facility’s capacity to upgrade oil volumes.

Where do oil prices go from here? The world is in the midst of its weak demand period. That means oil inventories will likely grow. The attack raises the possibility of future attacks, raising geopolitical tensions, yet surprisingly, the risk premium in oil prices that came with the Iranian tanker attacks, has largely disappeared. Thank the U.S. shale industry for altering that historical pattern.

For the foreseeable future, the oil market is likely to function much as it was doing before the attack. Global economic growth forecasts by the IMF were cut once again, which means reduced oil demand projections. The brief spike in oil prices will not alter producer drilling and production plans. In fact, oil price stability in the mid-$50s has prompted an increase in offshore and international activity that will bring more oil to market in 2020 and beyond. The yin-and-yang of supply and demand will control oil price moves in the near-term. It revolves around the question: Will there be a recession, or not? Sentiment on that question will drive global oil prices.

Natural Gas:

A month ago, natural gas prices were flirting with $2 per Mcf. Despite growing LNG and pipeline exports, the lack of power and industrial demand growth had the market struggling to deal with growing gas supplies. That struggle has contributed to rapidly rising storage volumes, which are now essentially at the 5-year average and likely headed higher. Last month’s conditions shifted, driving gas price higher. Today, we are at $2.50 per Mcf, significantly higher than last month.

The gas market has been impacted in recent weeks by a number of factors – some positive and others negative ‒ but the latter ones are capping prices and likely sending them lower. That view is tied to the seasonal temperature change underway - shifting from hot to cold. During the transition, the number of cooling days falls while heating days don’t grow to offset the gas demand loss.

Amazingly, gas production continues to grow, although the rate of increase is slowing, primarily due to the downturn in oil drilling and its associated gas output. Without a resumption of gas production growth, when demand peaks this winter, we could see sharply higher gas prices in response.

LNG prices are now higher than gas prices in Europe, the favorite target for spot sales. As a result, Gulf Coast LNG storage tanks are nearly full, meaning that any disruptions such as in tanker operations or finding LNG buyers, pipeline flows to the Gulf Coast could slow, backing up supplies and pushing prices down. At the same time, nuclear plant outages are lower than normal, wind speeds and hydro volumes are up helping renewables, but critically, coal prices have fallen below natural gas prices, boosting coal-to-gas switching. The cumulative impact has seen lower gas demand, which has stopped prices from rising, and potentially causing them to start sliding.

Near-term, natural gas prices are not impacted by the climate change debate. Efforts to stop gas from growing are increasing. Studies highlighting increased natural gas leaks in urban areas and from fracking activities have been published. Several studies have questionable foundations, but they help environmentalists argue for ending natural gas use in favor of more expensive wind and solar power. Once considered the bridge fuel to a cleaner world, gas is now viewed as the enemy of renewables due to its lower cost and dispatchability. Without natural gas-fired generators to back up renewable power sources, electricity grids will become less stable, increasing disruptive and expensive blackouts.

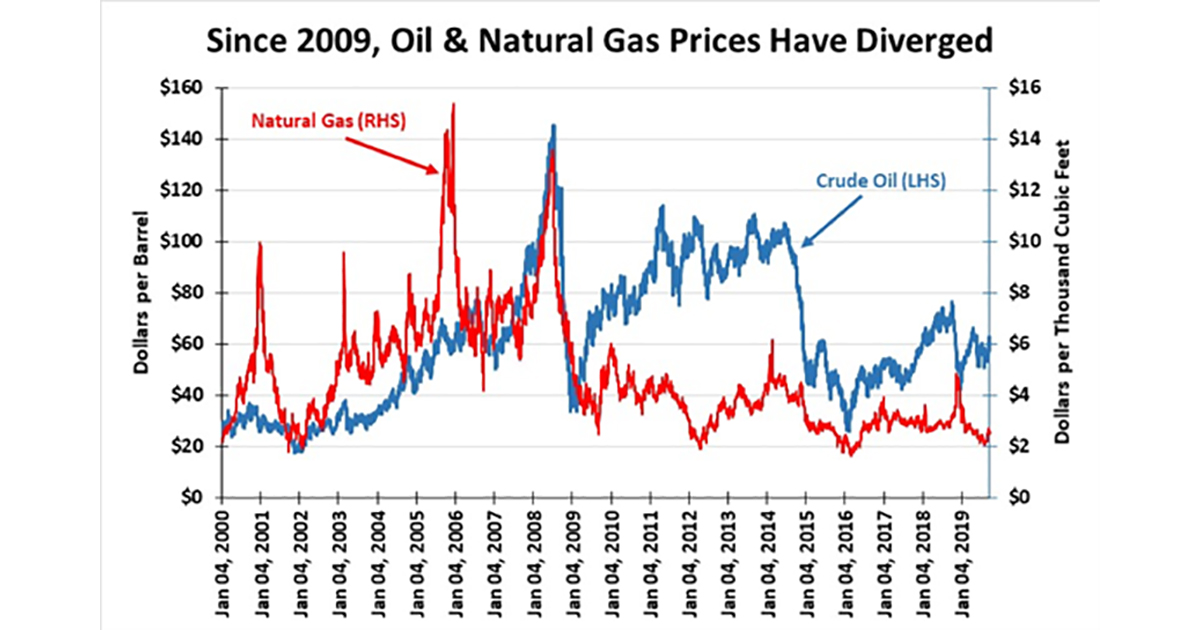

Natural gas prices are likely heading lower in the near future, which will further widen the divergence with crude oil prices. Wildcards that could alter our view of the future of gas prices include LNG storage, hurricane supply disruptions and slower supply growth. The greatest threat to, and hope for, gas prices is LNG exports, as U.S. prices must be lower to improve spot LNG sale economics. Lower prices will help consumers and LNG operators, but hurt producers. That may be the environment until the winter snows arrive.

By G. Allen Brooks | Author, Musings From the Oil Patch |