Trade tariffs, Iranian aggression and OPEC deal each having impacts on oil prices.

Oil Market

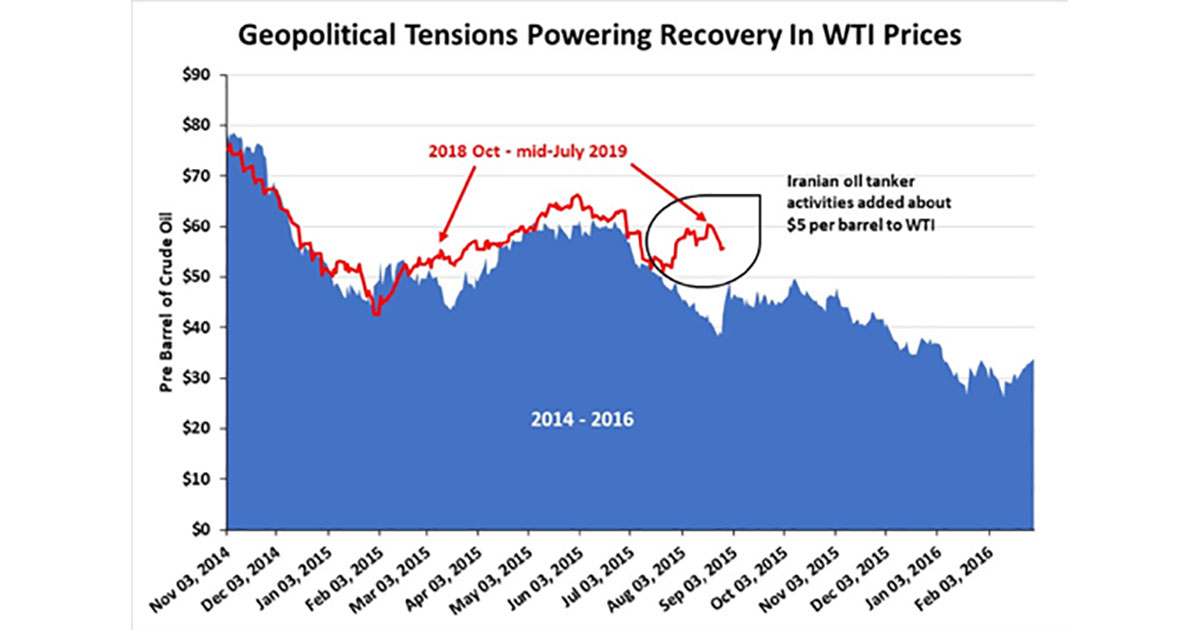

The past month saw an intriguing struggle between the forces of oil supply growth and demand, as well as those of geopolitical events. This wrestling match produced days when oil prices rose sharply and days when they fell equally as hard. In the end, the weight of geopolitical developments reversed oil price’s downward momentum, lifting prices by roughly 10% by mid-July. Thank the mullahs of Iran for higher prices.

The dominant event shaping the investment world this year has been the trade tariffs the Trump administration has levied on many of the United States’ major trading partners. Regardless of whether this negotiating strategy is appropriate or not, their implementation and threats of additional tariffs has chilled global trade, producing a slowdown in global economic activity. Concomitant with the economic slowdown has been weakening oil consumption growth. Without a corresponding reduction in global oil supply, the pendulum in the oil market is poised for lower prices as the global oil glut grows.

The tone of the oil market dramatically changed when news reports told of attacks by Iran’s Islamic Revolutionary Guard against two western oil tankers traveling in international waters in the Persian Gulf. Geopolitical tensions escalated. The drumbeats for a Middle East war grew louder and global oil prices jumped. Experienced oil forecasters and traders were surprised prices didn’t go higher. In fact, adding to the geopolitical tension was a budding Gulf of Mexico hurricane that eventually shut in one million barrels a day of U.S. oil output, while also delaying oil shipping traffic. Despite all these pressures, crude oil prices failed to reach or exceed their recent high, let alone the peak price experienced in the past 52 weeks. This event has experts wondering what message they should take away from the oil price action of the past few weeks in light of events.

The late June agreement between Russia and OPEC to extend the existing 1.2 million barrel a day production cut, this time for nine months, carries the reduction through the first quarter of 2020. A disagreement emerged among the parties over the possibility of further production cuts being required, or at least a longer extension of the current cut. The disagreement was over OPEC members needing higher oil prices to satisfy their budget needs, while Russia desires to expand its oil exports. In reality, this debate is core to the question about future oil demand and supply dynamics. Remember, output in the U.S. continues growing, adding to the current global oversupply. At the same time an oil glut exists, Iran’s exports are sanctioned so their volumes are lower, Venezuela’s output is at historical lows, and sporadic interim production outages in Nigeria and Libya continue. If demand fails to grow, and global financial institutions are already marking down their economic growth forecasts for the balance of 2019 and 2020, the oil market has a serious problem.

Natural Gas

For a brief period, the natural gas market came to life ˗ at least when measured by the rise in Henry Hub gas prices. At the end of the third week of June, natural gas prices fell from the $2.30’s per thousand cubic feet per day to $2.15. They then jumped into the $2.40s as a heat dome settled over the middle of the U.S. before spreading eastward.

Gas prices gained momentum, reaching nearly $2.50 when Hurricane Barry formed and began making its way toward the Louisiana coast. What was dramatically different this time from prior hurricanes was that gas prices barely moved. In 2005 and 2008, when hurricanes Katrina and Rita landed on the Gulf Coast, gas prices soared to $10/mcf. This different price performance says volumes about how the natural gas market has changed in the past decade due to the shale revolution.

Another example of the changed gas market was the Energy Information Administration’s report that 90% of the gas consumed in the U.S. last year was produced domestically. That trend came at the same time the U.S. was sharply growing shipments of liquefied natural gas. In January 2018, LNG exports accounted for 2.4% of daily gas production. That share increased by December 2018 to 3.7%, at the same time total gas production grew by over 13% during the year. Through April 2019 (the latest data available), LNG exports represented 3.9% of production that had increased from last December by 1.6%.

Absent growing LNG export volumes, combined with increased supplies being shipped by pipelines to Mexico and Canada, gas prices would have been weighed down even more. With the heat dome gone and temperatures more in line with traditional summer weather, people are worried gas prices may break the $2/mcf mark, an issue we had raised earlier.

As Permian Basin crude oil drilling fell throughout the last half of 2018 and so far in early 2019, associated natural gas volumes are being limited. Without sufficient pipeline capacity to move the greater gas output from the basin to market, gas flaring remains high. With new pipelines, that flared volume will become marketable, further pressuring gas prices.

With healthy gas production growth and only reasonable demand increases – both for electricity generation due to hot weather and pipeline and LNG exports – gas storage has been the beneficiary. Low gas prices are encouraging producers to stuff more of it into storage, hoping for increased profitability in the upcoming winter. Given these market trends, gas storage is coming closer to the 5-year average, suggesting we will end the injection season with greater gas volumes in storage than last year. While “boring” may continue to characterize the natural gas market, many will be watching to see if the $2/mcf barrier is breeched.

By G. Allen Brooks | Author, Musings From the Oil Patch