The Covid-19 pandemic and the price crisis it has brought upon the oil and gas sector have hit the profitability of exploration and production (E&P) companies hard. Despite the recent relative oil price recovery, dozens of US operators are still threatened by bankruptcies even at a WTI oil price of $30 per barrel. A Rystad Energy analysis shows that royalty exemptions could save the day for many of them.

To begin with, our analysis has found that even at an average WTI price of $30 this year, about 73 E&Ps in the US may have to file for Chapter 11 bankruptcy protection, with 170 more following in 2021. The number of bankruptcies could climb even more in lower price scenarios.

As many operators struggle with profitability, in the absence of aid from the federal government, almost 300,000 barrels per day of their operated production is at risk of being deemed uneconomical and permanently shut in.

By basing royalty relief on operated production, the US government could help eligible operators instead of eligible leases. As such, the relief effort would help protect US energy security in the future by enabling smaller operators to avoid bankruptcies.

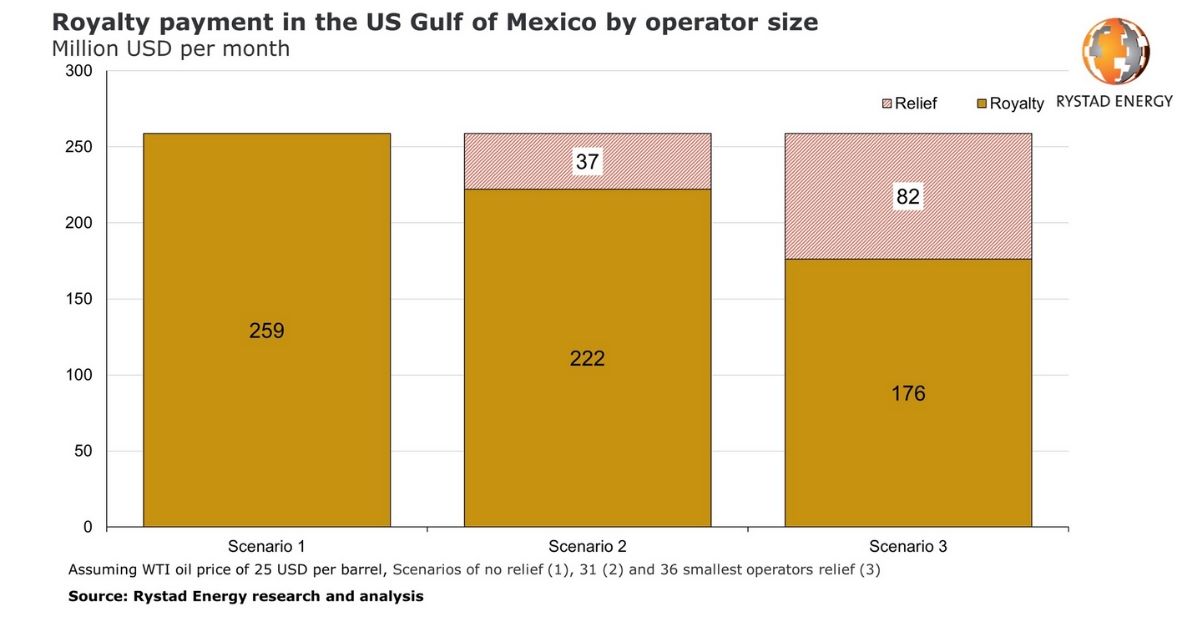

Taking the Gulf of Mexico as case study, Rystad Energy finds that at an average WTI price of $25 and without any shut-ins taken into account, the expected total royalty payment, given the production level, is equivalent to slightly more than $250 million per month.

If royalty relief targets the 31 smallest operators, which collectively operate 300,000 barrels of oil per day, the relieved royalties would amount to $37 million per month. If royalty relief targets the 36 smallest operators, which collectively produce 640,000 barrels per day, that would equal $82 million in relieved royalty payments.

“If these smaller players go bankrupt and their production is shut down, a lot more cash would be required to restart production by a potential new operator that picks up the lease. This would disincentivize operators from applying for these leases, resulting in an economically suboptimal result,“ says Rystad Energy’s Upstream analyst Joachim Milling Gregersen.

S oil and gas operators, including producers of all sizes, amount to just above 9,000. The number might seem high, but most of these operators represent small, family-owned businesses operating a single-digit number of wells. The smaller operators are also the most vulnerable in this crisis, Rystad Energy finds, as they often don’t have the cash stack to navigate the downturn and if they shut their wells, they are not likely to ever restart them again.

To avoid bankruptcies Gulf of Mexico E&Ps in late March sent a pre-emptive letter to President Donald Trump asking for initiatives to relieve the companies from their near-term obligations to the government in the Gulf of Mexico Federal Waters. The letter proposed three actions: suspension of royalties, direct suspension of appraisals and developments, and an automatic three-year extension of the primary lease terms.

Although President Trump has been quoted to be against providing a wide-ranging royalty relief for federal land, the GoM E&Ps are hoping that a relatively narrow offshore-focused royalty relief program could get approved. Operators can apply for discretionary relief under current royalty policies, but only when special circumstances render the company unable to produce from a lease while paying such royalties.

Several companies have recently applied for this provision, both in deepwater and shelf leases. Towards the end of April, even sizable operators decided to shut all or parts of their operated fields either due to loss-making production or by moving up the timeline for planned maintenance, further emphasizing the need for short-term incentives to help them maintain their production.

“Royalty relief is particularly important for the smaller operators. One of the proposals put forward to the US government is to exempt companies with less than 100,000 barrels per day production from paying royalties. If implemented, this initiative could contribute towards avoiding bankruptcies among the smaller independents and private-equity-backed players,“ Milling Gregersen concludes.

About two-thirds of the US Gulf of Mexico production is operated by Shell, BP, Anadarko and Chevron, which are the four companies with the largest operated production in the region. On the other side of the scale, the 31 smallest companies operate less than a sixth of the total production in the US GoM. With a targeted royalty relief program for the smaller players, the US government could potentially avoid bankruptcies at a lower cost than if they were to grant royalty relief to all Outer Continental Shelf (OCS) leases. For more analysis, insights and reports, clients and non-clients can apply for access to Rystad Energy’s Free Solutions