VesselsValue's Head of Offshore, Robert Day, takes a look at Norway's spending over the past 12 months.

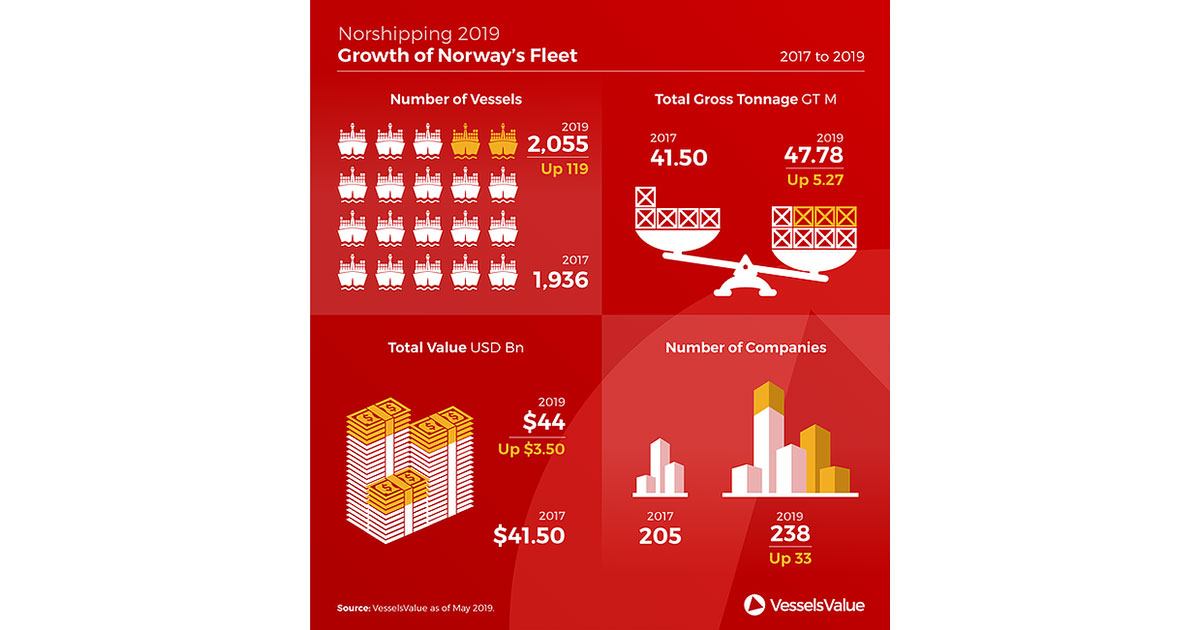

Norway 2019 is a very different place compared to a few years ago. However, many of the nation’s shipping and offshore industries have achieved sustained growth through some of the most turbulent times ever faced. Since the last Nor-Shipping in 2017, the number of Norwegian companies owning vessels has increased from 205 to 238. The Norwegian owned fleet has grown by 119 vessels, standing at 2,055 ships, and in turn the gross tonnage of the fleet has increased to 47.74 million GT. These new vessels have boosted the total fleet value of the Norwegian owned fleet by USD 3.5 billion, bringing their total fleet value to USD 44 billion, ranking fifth most valuable in the world.

Notable Norwegian companies

Notable Norwegian companies

Borr Drilling

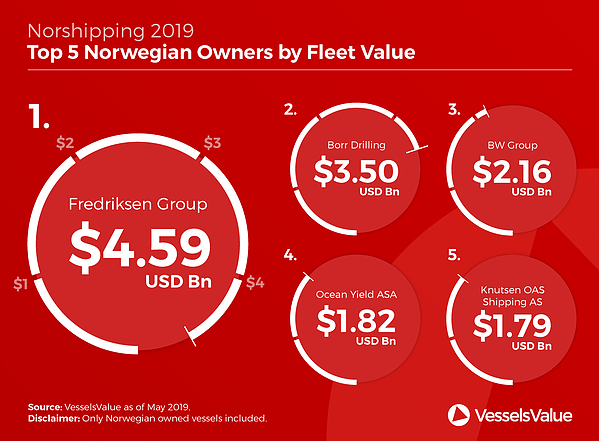

As the brainchild of John Fredriksen’s former right-hand man and poster boy of the Norwegian offshore industry, Tor Olav Troim, Borr Drilling has rocked the market since emerging in late 2016. With backing from a number of industry powerhouses (Schlumberger, Goldman Sachs and Euroclear Bank to name a few), Borr was set to flex its buying muscles. As of today, Borr has 36 high specification Jack Up rigs and is cemented as a respected player amongst the long-established owners. Borr’s current fleet value stands at USD 3.5 billion.

Solstad

Solstad

The offshore market conditions over the last few years have taken their toll on Norwegian supply boat owners, and none more so than OSV giant Solstad. In January 2019, Finanstilsynet required Solstad to revalue its entire fleet; in doing so, the total value was reduced by NOK 850m (USD 99 million). Solstad has long maintained its fleet valuation figures, so this reduction shows not only Solstad’s acceptance of the continued poor market conditions, but also the resultant asset prices which is a major step forward.

2020 Bulkers

2020 Bulkers

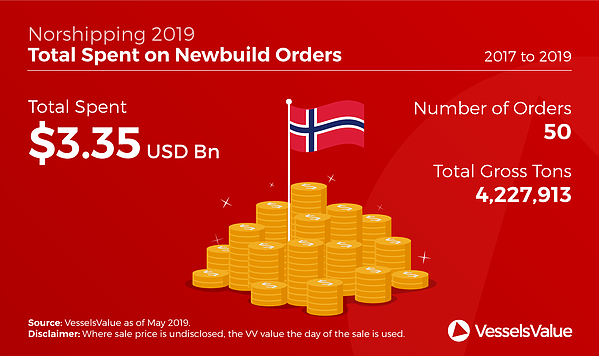

Another Troim owned company, 2020 Bulkers has ordered eight newbuild Capesize Bulkers at New Times Shipbuilding since late 2017, totaling around USD 350 million. The VV value of these vessels today is USD 453 million, which shows a significant increase in value since their order date.

The money keeps coming in for Tor Olav Troim. In January, 2020 Bulkers confirmed it had secured a long-term bank loan running to USD 240 million for its Newcastlemax newbuilding programme. As of this month, 2020 Bulkers has made the move to become listed on the Oslo stock exchange. This move will also be used to fund its newbuild orders to New Times Shipbuilding, showing its continued growth strategy plans for 2019 and beyond.

The money keeps coming in for Tor Olav Troim. In January, 2020 Bulkers confirmed it had secured a long-term bank loan running to USD 240 million for its Newcastlemax newbuilding programme. As of this month, 2020 Bulkers has made the move to become listed on the Oslo stock exchange. This move will also be used to fund its newbuild orders to New Times Shipbuilding, showing its continued growth strategy plans for 2019 and beyond.