"We now have a powerful track record of safe and reliable performance, efficient execution and capital discipline. And we’re doing this while growing the business – bringing more high-quality projects online, expanding marketing in the Downstream and doing transformative deals such as BHP. Our strategy is clearly working and will serve the company and our shareholders well through the energy transition."

- More than double full-year earnings, near double returns

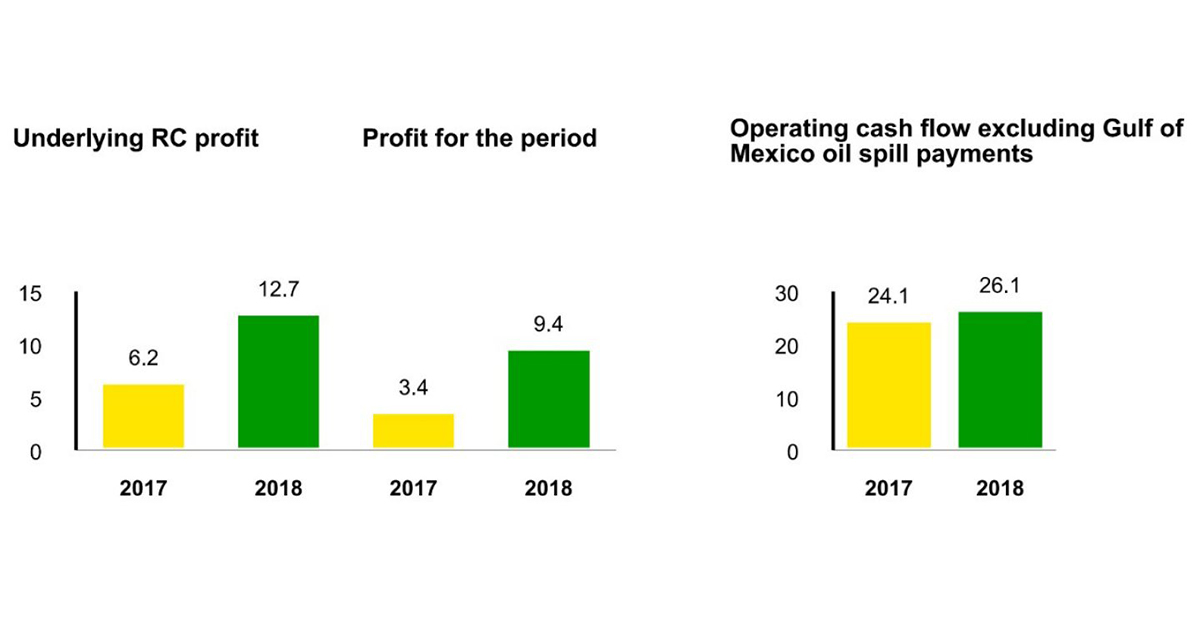

- Underlying replacement cost profit for full year 2018 was $12.7 billion, more than double that reported for 2017. The fourth quarter result was $3.5 billion, driven by the strong operating performance across all business segments.

- Return on average capital employed was 11.2% compared to 5.8% in 2017.

- Operating cash flow, excluding Gulf of Mexico oil spill payments, for full year 2018 was $26.1 billion, including a $2.6 billion working capital build (after adjusting for inventory holding losses). This compares with $24.1 billion for 2017, which included a working capital release of $2.6 billion.

- Gulf of Mexico oil spill payments in 2018 totalled $3.2 billion on a post-tax basis.

- Total divestments and other proceeds in 2018 were $3.5 billion. BP intends to complete more than $10 billion divestments over the next two years, which includes plans announced following the BHP transaction.

- Dividend of 10.25 cents a share announced for the fourth quarter, 2.5% higher than a year earlier.

- Record Upstream reliability, record refining throughput

- Operational reliability was very strong in 2018 for both main business segments.

- For the year, BP-operated Upstream plant reliability was a record 96%, and Downstream delivered refining availability of 95% and record refining throughput. o Reported oil and gas production averaged 3.7 million barrels of oil equivalent a day for 2018. Upstream underlying production, which excludes Rosneft, was 8.2% higher than 2017.

- Growing the business, advancing the energy transition

- Six Upstream major projects started up in 2018, making a total of 19 brought online since 2016.

- Reserves replacement ratio (RRR) for 2018, including Rosneft, is 100%. Including acquisitions and disposals, RRR is 209%, primarily reflecting the BHP transaction.

- Fuels marketing continued to grow, with over 25% more convenience partnership sites, as well as further retail expansion in Mexico.

- BP set out its approach to advancing the energy transition in 2018, introducing its ‘reduce-improve-create’ framework and setting clear targets for operational greenhouse gas emissions, towards which it is already making significant progress.

- BP acquired UK electric vehicle charging company Chargemaster and Lightsource BP saw important expansion internationally.

RC profit (loss), underlying RC profit, return on average capital employed, operating cash flow excluding Gulf of Mexico oil spill payments and working capital are non-GAAP measures. These measures and Upstream plant reliability, refining availability, major projects, inventory holding gains and losses, non-operating items, fair value accounting effects, underlying production and reserves replacement ratio are defined in the Glossary on page 32.